Answered step by step

Verified Expert Solution

Question

1 Approved Answer

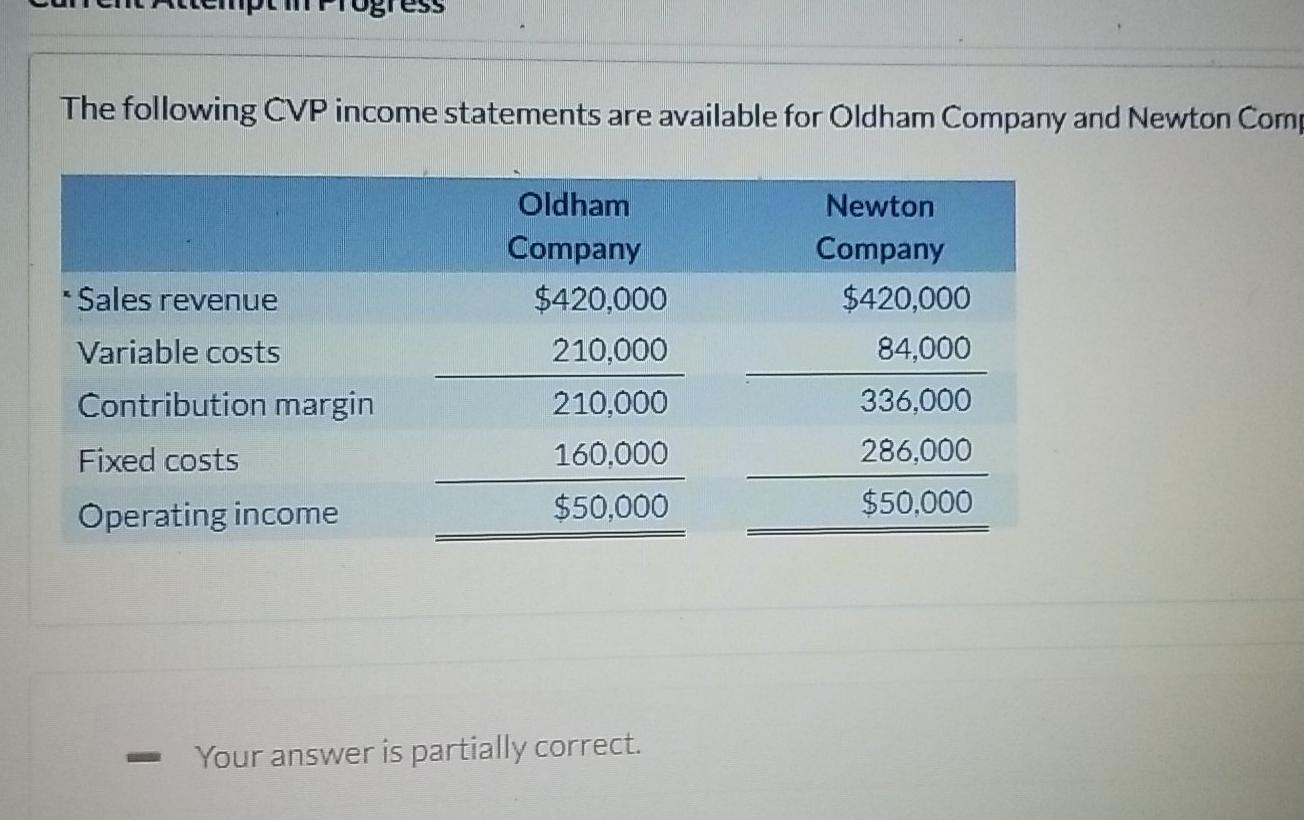

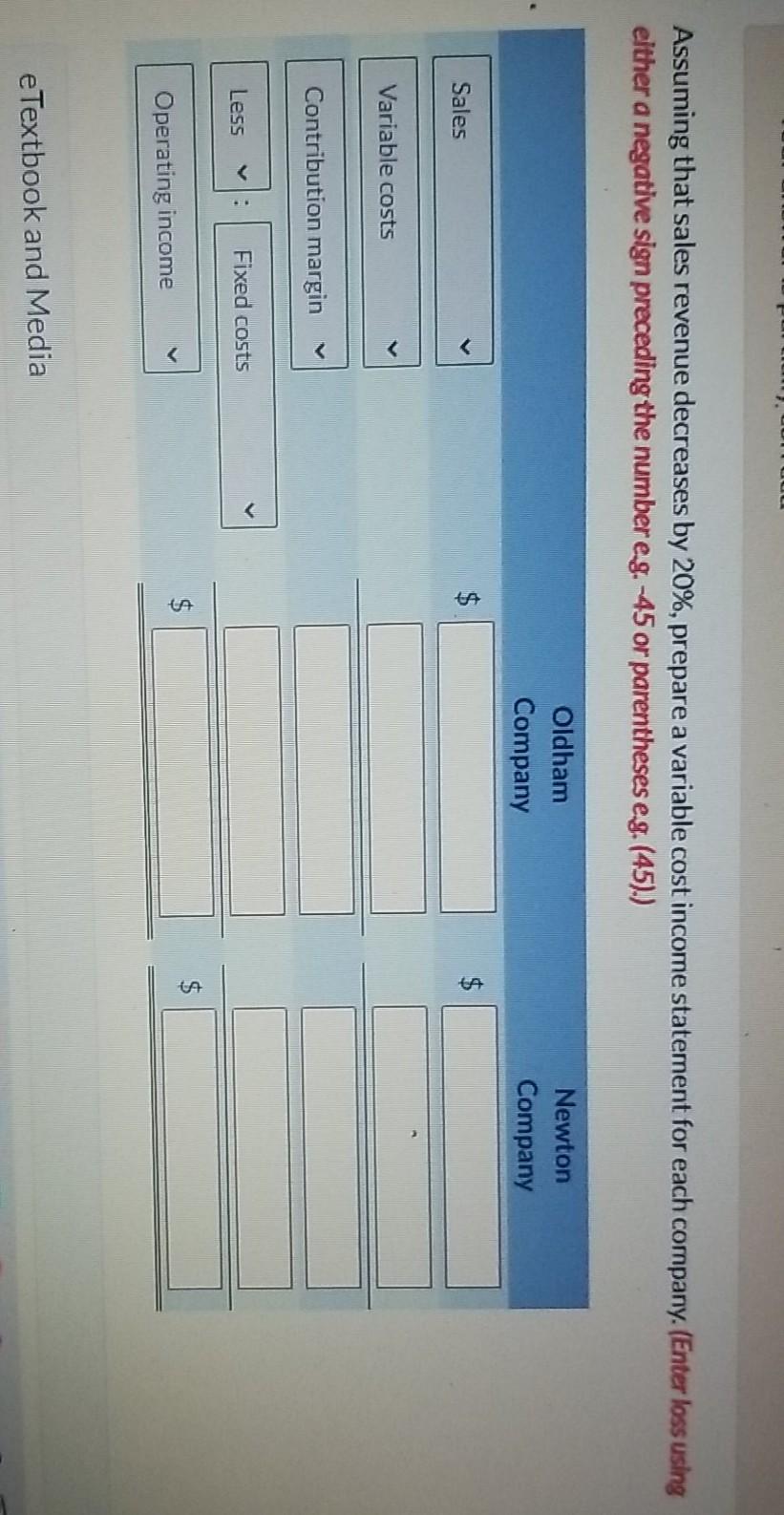

The following CVP income statements are available for Oldham Company and Newton Comp Sales revenue Variable costs Contribution margin Fixed costs Operating income Oldham Company

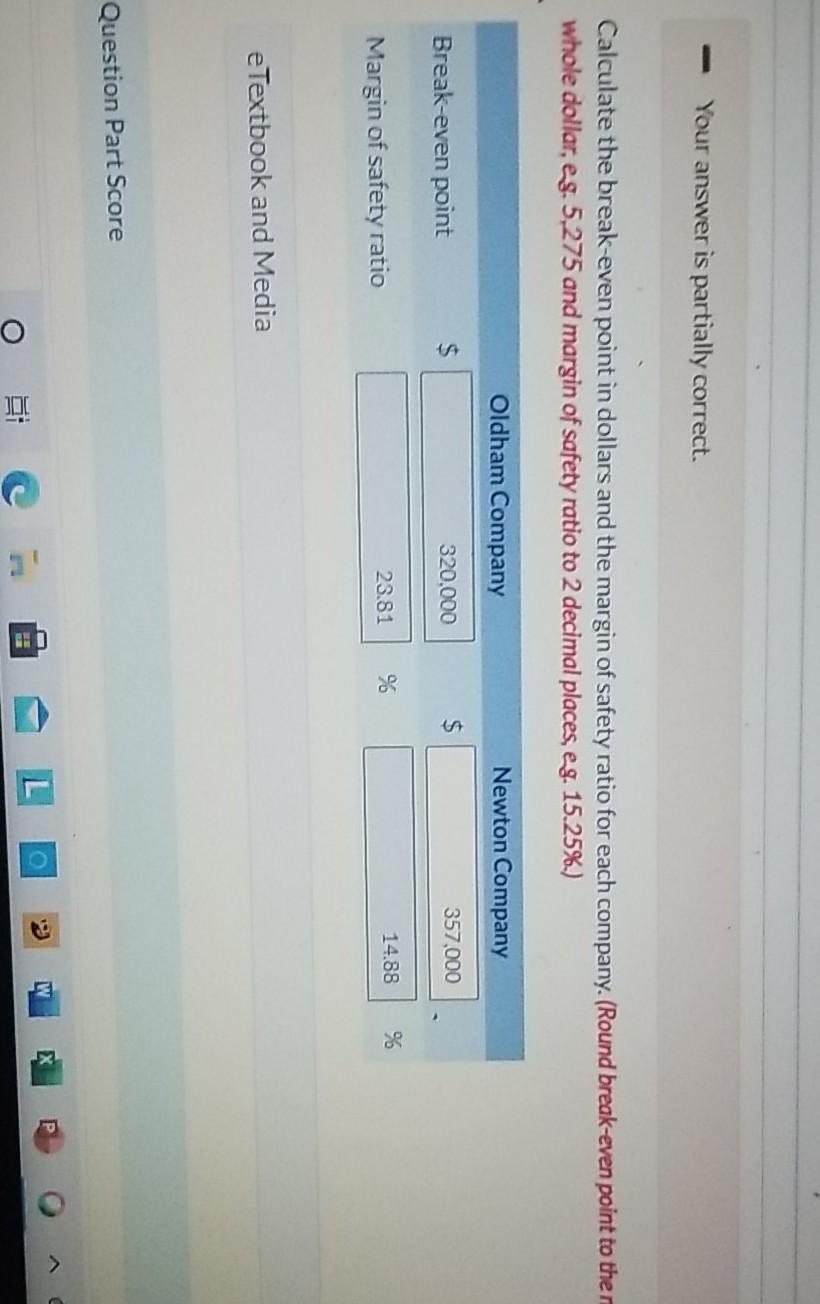

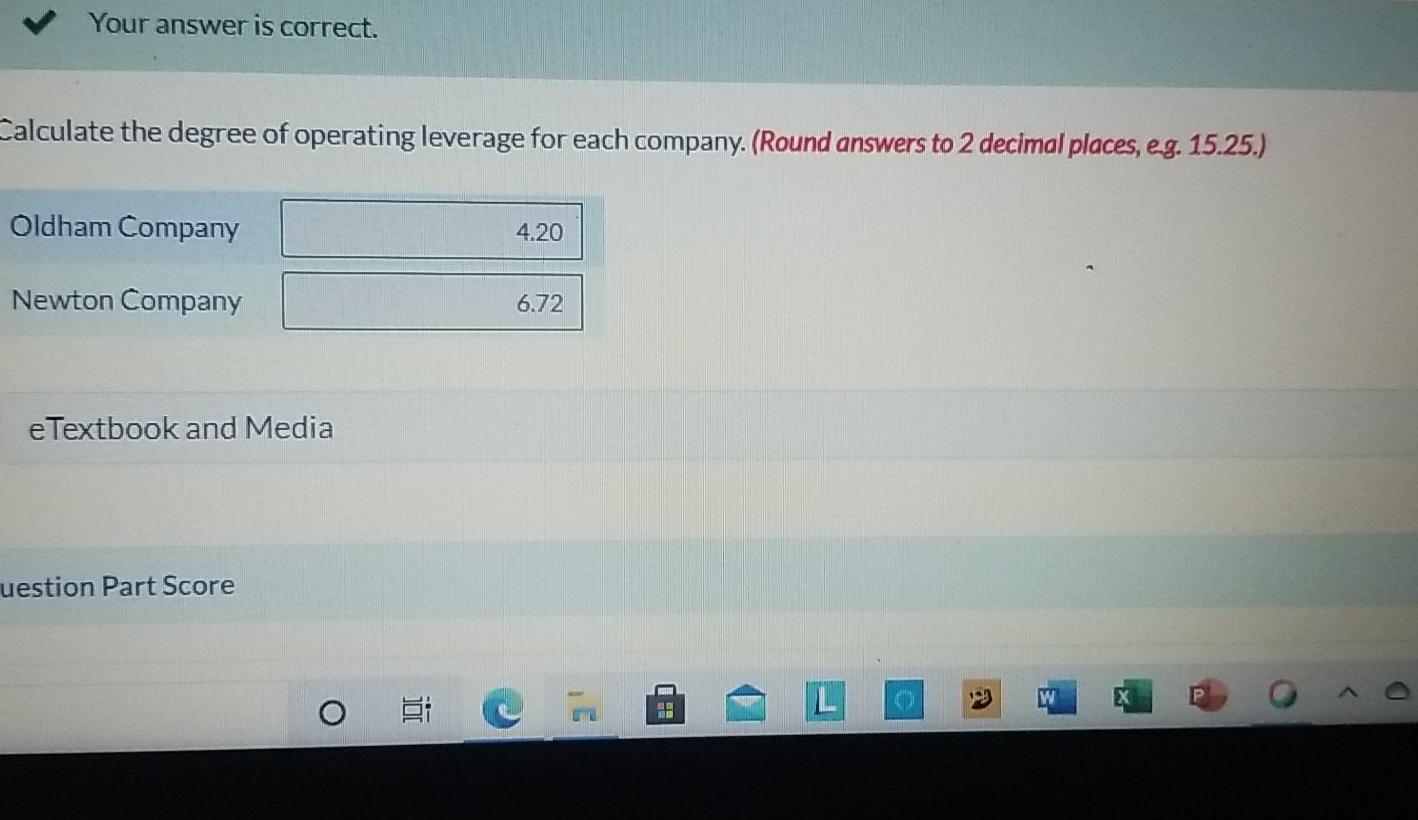

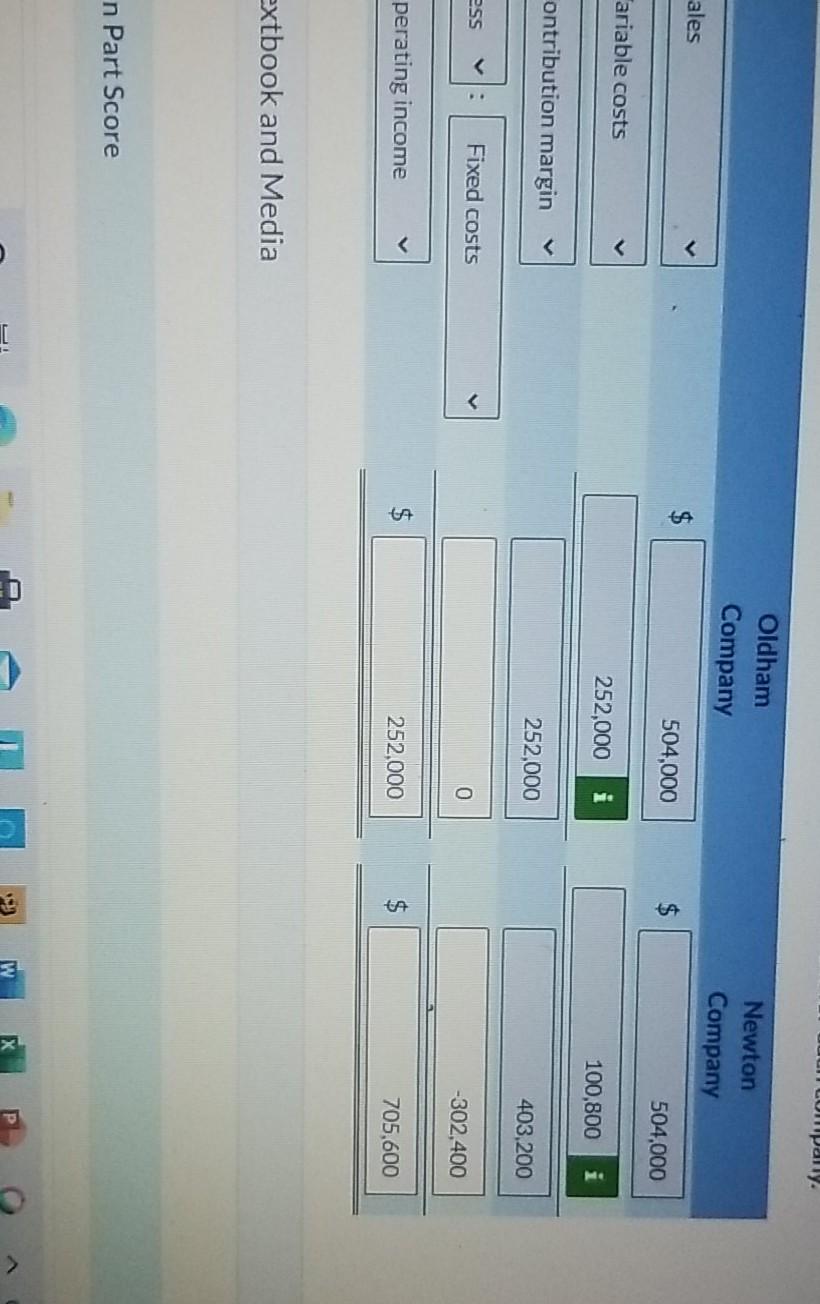

The following CVP income statements are available for Oldham Company and Newton Comp Sales revenue Variable costs Contribution margin Fixed costs Operating income Oldham Company $420,000 210,000 210,000 160.000 $50,000 Newton Company $420,000 84,000 336,000 286,000 $50.000 Your answer is partially correct. Your answer is partially correct. Calculate the break-even point in dollars and the margin of safety ratio for each company. (Round break-even point to the whole dollar, es 5,275 and margin of safety ratio to 2 decimal places, eg. 15.25%.) Oldham Company Newton Company $ 320.000 357.000 Break-even point 23.61 % 14.88 % Margin of safety ratio e Textbook and Media Question Part Score es O o Your answer is correct. Calculate the degree of operating leverage for each company. (Round answers to 2 decimal places, eg. 15.25.) Oldham Company 4.20 Newton Company 6.72 e Textbook and Media uestion Part Score W P u . company Oldham Company Newton Company ales 504,000 TA 504,000 ariable costs 252,000 100,800 ontribution margin 252,000 403,200 ess Fixed costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started