Answered step by step

Verified Expert Solution

Question

1 Approved Answer

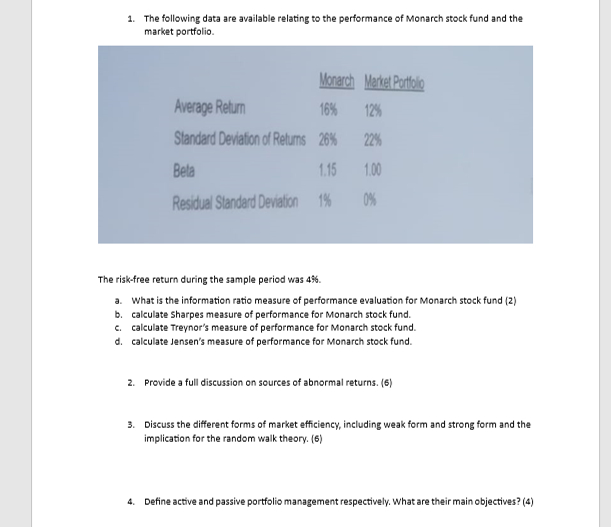

The following data are available relating to the performance of Monarch stock fund and the market portfolio. Monarch Market Portiolo Average Retum 1 6 %

The following data are available relating to the performance of Monarch stock fund and the

market portfolio.

Monarch Market Portiolo

Average Retum

Standard Deviation ot Relums

Bela

Residual Slandard Deviation

N

The riskfree return during the sample period was

a What is the information ratio measure of performance evaluation for Monarch stock fund

b calculate Sharpes measure of performance for Monarch stock fund.

c calculate Treynor's measure of performance for Monarch stock fund.

d calculate Jensen's measure of performance for Monarch stock fund.

Provide a full discussion on sourses of abnormal returns.

Discuss the different forms of market efficiency, including weak form and strong form and the

implication for the random walk theory.

Define active and passive portfolio management respectively. What are their main objectives?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started