Question

The following data are available relating to the performance of Wildcat Fund and the market portfolio: Wildcat 18% 25% 1.25 2% Market Portfolio 15%

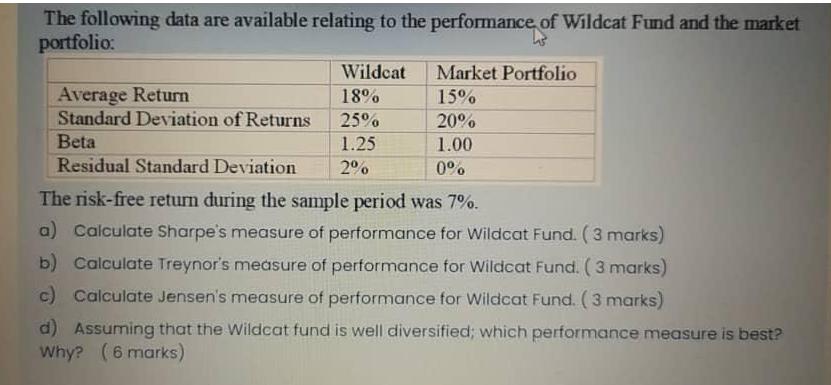

The following data are available relating to the performance of Wildcat Fund and the market portfolio: Wildcat 18% 25% 1.25 2% Market Portfolio 15% 20% 1.00 0% Average Return Standard Deviation of Returns Beta Residual Standard Deviation The risk-free return during the sample period was 7%. a) Calculate Sharpe's measure of performance for Wildcat Fund. (3 marks) b) Calculate Treynor's measure of performance for Wildcat Fund. (3 marks) c) Calculate Jensen's measure of performance for Wildcat Fund. (3 marks) d) Assuming that the Wildcat fund is well diversified; which performance measure is best? Why? (6 marks)

Step by Step Solution

3.40 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Sharpes measure of performance for Wildcat Sharpes Ratio of Wildcat Wildcat Average R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

An Introduction To Statistical Methods And Data Analysis

Authors: R. Lyman Ott, Micheal T. Longnecker

7th Edition

1305269470, 978-1305465527, 1305465520, 978-1305269477

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App