Answered step by step

Verified Expert Solution

Question

1 Approved Answer

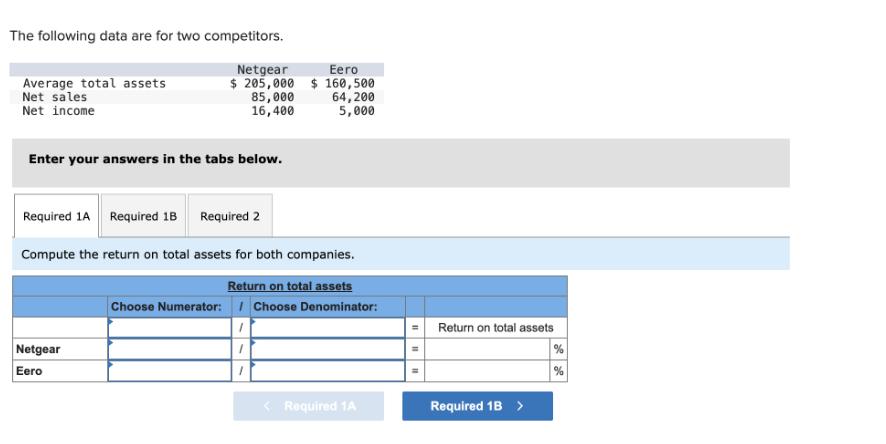

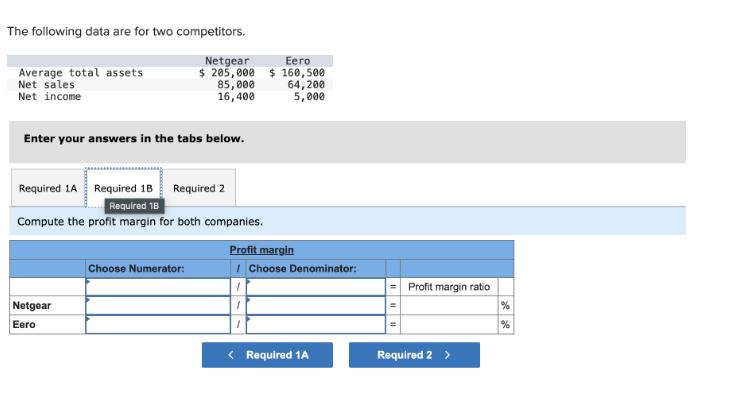

The following data are for two competitors. Average total assets Net sales Net income Eero Netgear $ 205,000 $ 160,500 85,000 16,400 64,200 5,000

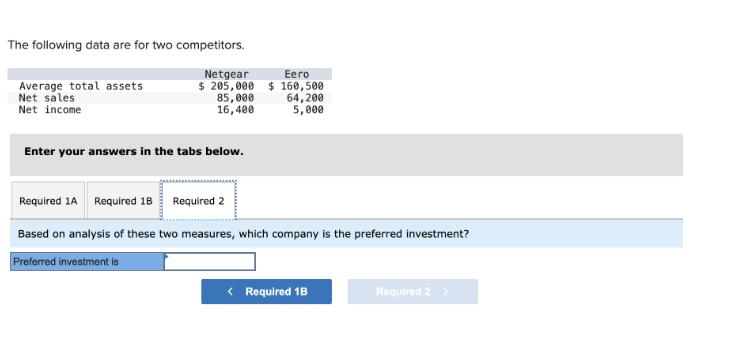

The following data are for two competitors. Average total assets Net sales Net income Eero Netgear $ 205,000 $ 160,500 85,000 16,400 64,200 5,000 Enter your answers in the tabs below. Required 1A Required 1B Required 2 Compute the return on total assets for both companies. Return on total assets Choose Numerator: Choose Denominator: Netgear Eero 1 1 1 < Required 1A 11 Return on total assets Required 1B > de de % % The following data are for two competitors. Average total assets Net sales Net income Netgear Eero $ 205,000 $ 160,500 64,200 5,000 Enter your answers in the tabs below. Netgear Eero 85,000 16,400 Required 1A Required 1B Required 2 Required 18 Compute the profit margin for both companies. Choose Numerator: Profit margin Choose Denominator: < Required 1A 11 Profit margin ratio Required 2 > % % The following data are for two competitors. Average total assets Net sales Net income Netgear Eero $ 205,000 $ 160,500 85,000 16,400 Enter your answers in the tabs below. Required 1A Required 1B Required 2 64,200 5,000 Based on analysis of these two measures, which company is the preferred investment? Preferred investment is < Required 1B Required 22

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Based on the given financial data Netgear Eero has higher net income 16400 vs 5000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started