Answered step by step

Verified Expert Solution

Question

1 Approved Answer

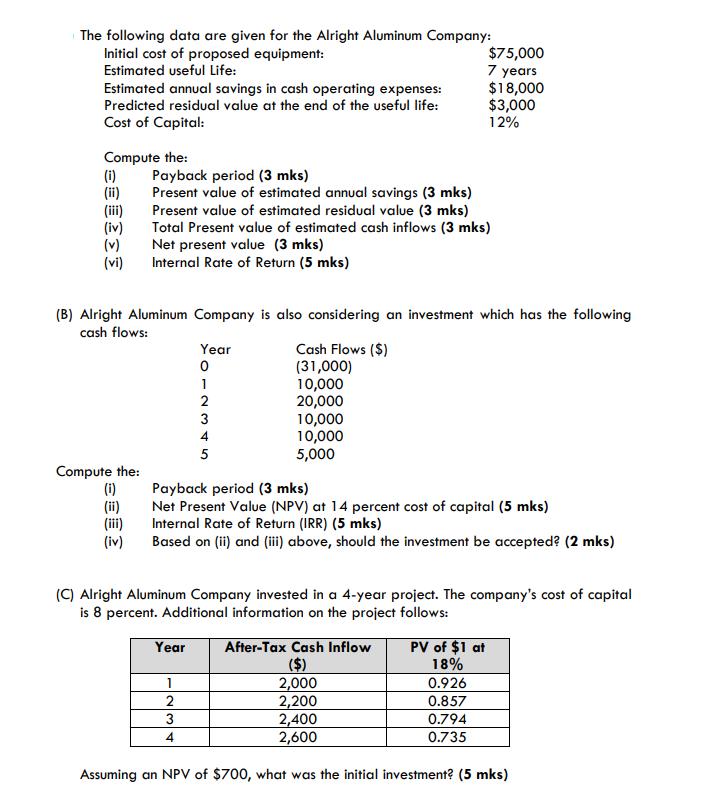

The following data are given for the Alright Aluminum Company: Initial cost of proposed equipment: Estimated useful Life: Estimated annual savings in cash operating

The following data are given for the Alright Aluminum Company: Initial cost of proposed equipment: Estimated useful Life: Estimated annual savings in cash operating expenses: Predicted residual value at the end of the useful life: Cost of Capital: Compute the: (i) (ii) (iii) (iv) (v) (vi) Compute the: (i) (B) Alright Aluminum Company is also considering an investment which has the following cash flows: (iii) (iv) Payback period (3 mks) Present value of estimated annual savings (3 mks) Present value of estimated residual value (3 mks) Total Present value of estimated cash inflows (3 mks) Net present value (3 mks) Internal Rate of Return (5 mks) Year 0 Year 12345 5 1 2 3 4 $75,000 7 years $18,000 $3,000 12% Cash Flows ($) (31,000) 10,000 20,000 10,000 10,000 5,000 Payback period (3 mks) Net Present Value (NPV) at 14 percent cost of capital (5 mks) Internal Rate of Return (IRR) (5 mks) Based on (ii) and (iii) above, should the investment be accepted? (2 mks) (C) Alright Aluminum Company invested in a 4-year project. The company's cost of capital is 8 percent. Additional information on the project follows: After-Tax Cash Inflow ($) 2,000 2,200 2,400 2,600 Assuming an NPV of $700, what was the initial investment? (5 mks) PV of $1 at 18% 0.926 0.857 0.794 0.735

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started