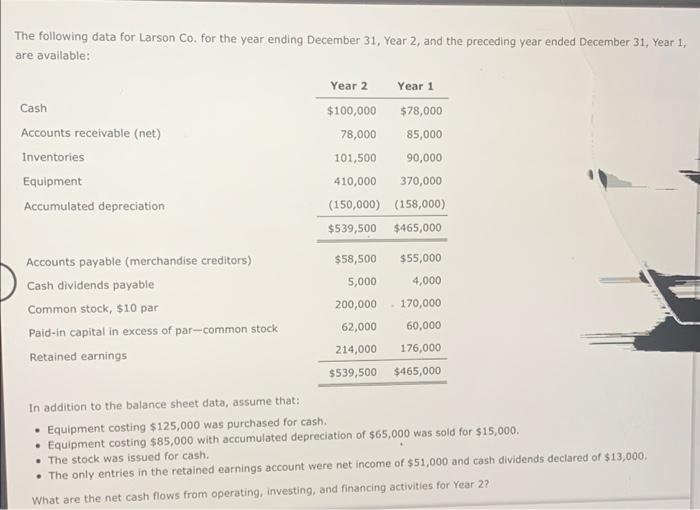

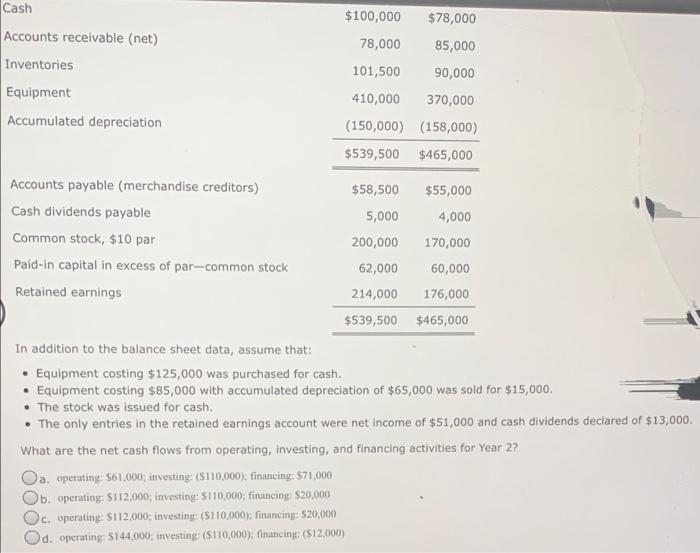

The following data for Larson Co. for the year ending December 31, Year 2, and the preceding year ended December 31, Year 1, are available: Year 2 Year 1 Cash $100,000 $78,000 Accounts receivable (net) 78,000 85,000 Inventories 101,500 90,000 Equipment 410,000 370,000 Accumulated depreciation (150,000) (158,000) $539,500 $465,000 Accounts payable (merchandise creditors) $58,500 $55,000 Cash dividends payable 5,000 4,000 Common stock, $10 par 200,000 170,000 Paid-in capital in excess of par-common stock 62,000 60,000 Retained earnings 214,000 176,000 $539,500 $465,000 In addition to the balance sheet data, assume that: Equipment costing $125,000 was purchased for cash. Equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000 . The stock was issued for cash. The only entries in the retained earnings account were net income of $51,000 and cash dividends declared of $13,000 What are the net cash flows from operating, investing, and financing activities for Year 2? Cash $100,000 $78,000 Accounts receivable (net) 78,000 85,000 Inventories 101,500 90,000 Equipment 410,000 370,000 Accumulated depreciation (150,000) (158,000) $539,500 $465,000 Accounts payable (merchandise creditors) $58,500 $55,000 Cash dividends payable 5,000 4,000 Common stock, $10 par 200,000 170,000 Paid-in capital in excess of par-common stock 62,000 60,000 Retained earnings 214,000 176,000 $539,500 $465,000 In addition to the balance sheet data, assume that: Equipment costing $125,000 was purchased for cash. Equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000. The stock was issued for cash. The only entries in the retained earnings account were net income of $51,000 and cash dividends declared of $13,000. What are the net cash flows from operating, investing, and financing activities for Year 2? Oa opetuting: 561,000; investing: (S110,000); financing: $71,000 Ob operating: $112.000; investing: S110,000; financing: $20,000 Oc. operating: $112,000, investing ($110,000), financing: $20,000 Od operating S144,000; investing: ($110,000); financing ($12,000)