Answered step by step

Verified Expert Solution

Question

1 Approved Answer

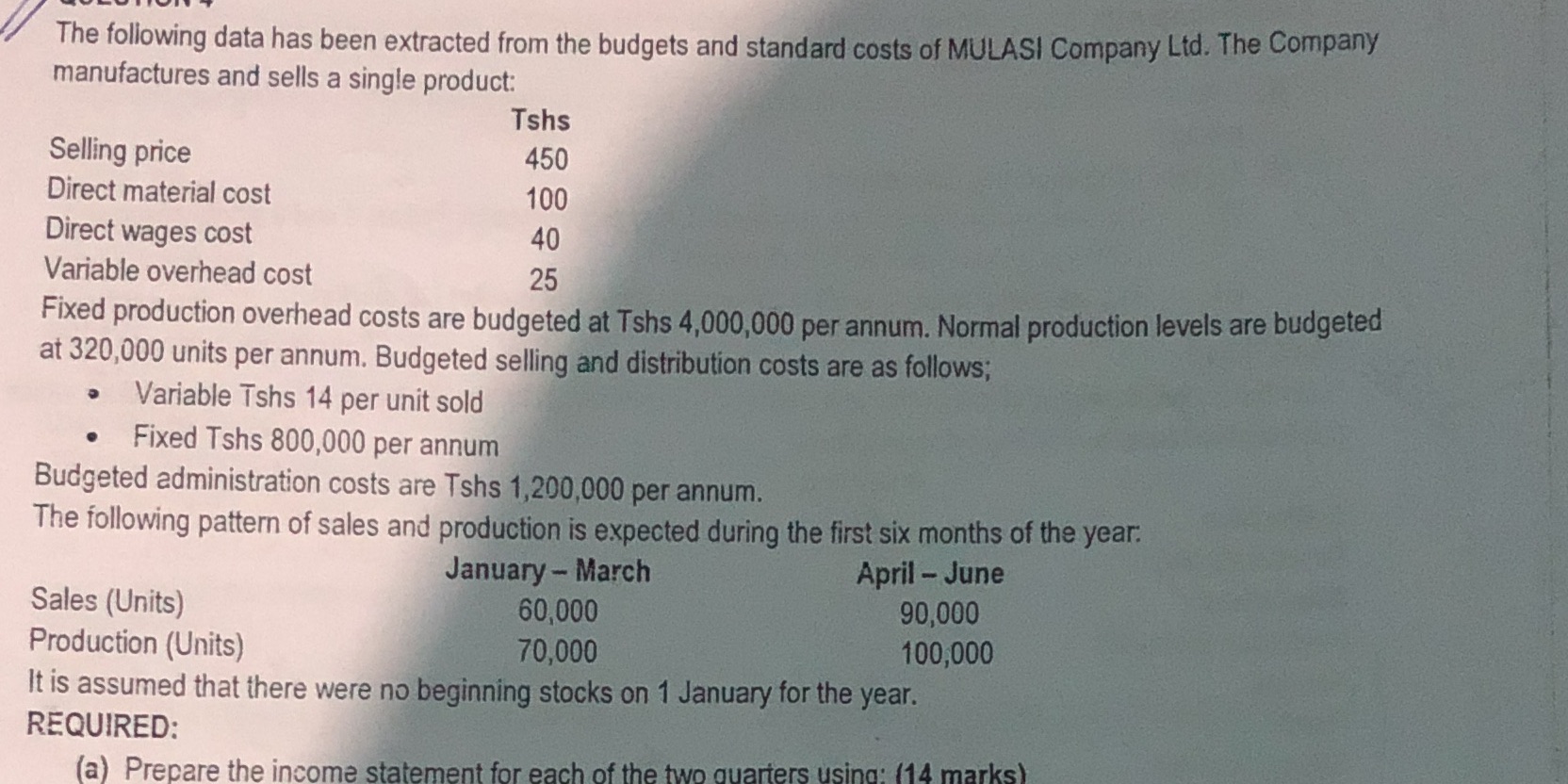

The following data has been extracted from the budgets and standard costs of MULASI Company Ltd. The Company manufactures and sells a single product:

The following data has been extracted from the budgets and standard costs of MULASI Company Ltd. The Company manufactures and sells a single product: Selling price Direct material cost Direct wages cost Tshs 450 100 40 Variable overhead cost 25 Fixed production overhead costs are budgeted at Tshs 4,000,000 per annum. Normal production levels are budgeted at 320,000 units per annum. Budgeted selling and distribution costs are as follows; Variable Tshs 14 per unit sold Fixed Tshs 800,000 per annum Budgeted administration costs are Tshs 1,200,000 per annum. The following pattern of sales and production is expected during the first six months of the year: Sales (Units) Production (Units) January-March 60,000 70,000 April-June 90,000 100,000 It is assumed that there were no beginning stocks on 1 January for the year. REQUIRED: (a) Prepare the income statement for each of the two quarters using: (14 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the income statement for each of the two quarters using absorption costing and variable costing we need to calculate the relevant costs and revenues based on the given data Absorption Costi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started