Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering an investment in an apartment complex that has a purchase price of $10,000,000. The potential gross income (PGI) in year 1

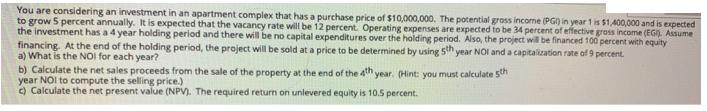

You are considering an investment in an apartment complex that has a purchase price of $10,000,000. The potential gross income (PGI) in year 1 is $1,400,000 and is expected to grow 5 percent annually. It is expected that the vacancy rate will be 12 percent. Operating expenses are expected to be 34 percent of effective gross income (EG). Assume the investment has a 4 year holding period and there will be no capital expenditures over the holding period. Also, the project will be financed 100 percent with equity financing. At the end of the holding period, the project will be sold at a price to be determined by using 5th year NOI and a capitalization rate of 9 percent. a) What is the NOI for each year? b) Calculate the net sales proceeds from the sale of the property at the end of the 4th year. (Hint: you must calculate 5th year NOI to compute the selling price.) c) Calculate the net present value (NPV). The required return on unlevered equity is 10.5 percent.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To answer these questions you will need to calculate the net operating income NOI for each year of the holding period the net sales proceeds from the sale of the property at the end of the holding per...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started