Question

The following data refer to the partnership of POE and GO POE-GO CO. Adjusted Trial Balance December 31, 2020 Cash P 462,800 Accounts receivable 912,200

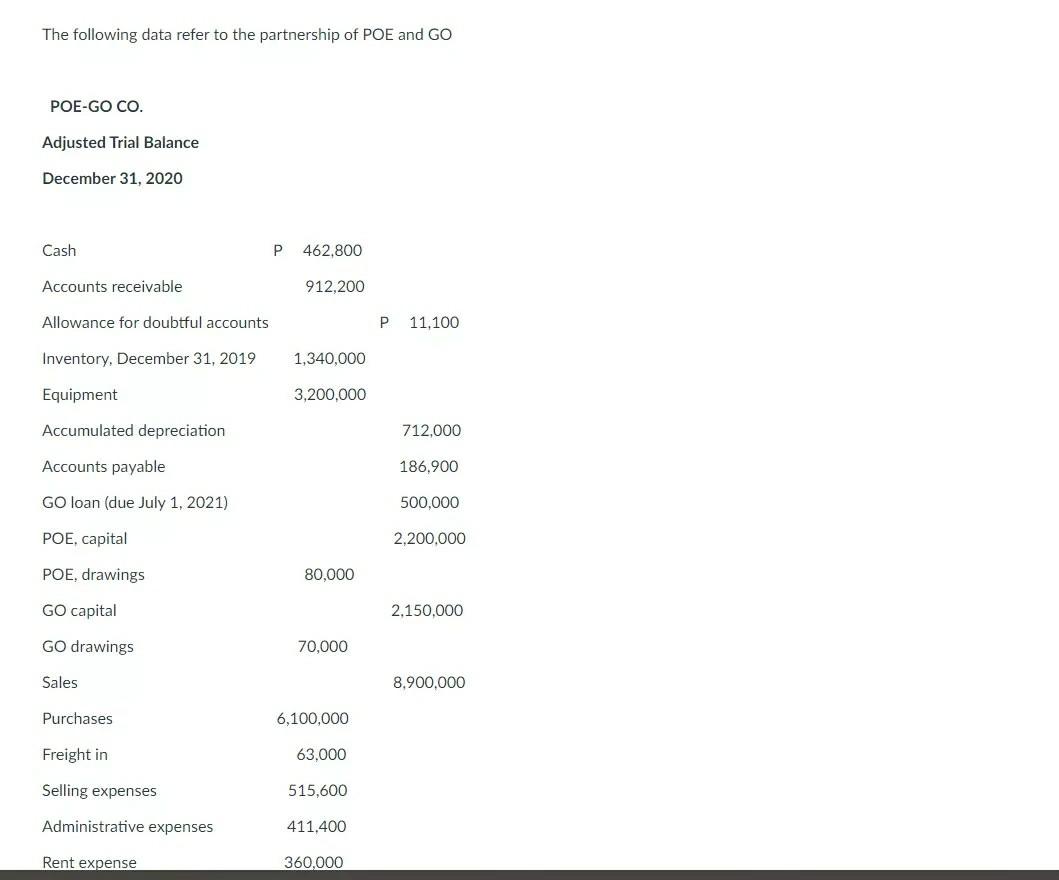

The following data refer to the partnership of POE and GO

POE-GO CO.

Adjusted Trial Balance

December 31, 2020

Cash P 462,800

Accounts receivable 912,200

Allowance for doubtful accounts P 11,100

Inventory, December 31, 2019 1,340,000

Equipment 3,200,000

Accumulated depreciation 712,000

Accounts payable 186,900

GO loan (due July 1, 2021) 500,000

POE, capital 2,200,000

POE, drawings 80,000

GO capital 2,150,000

GO drawings 70,000

Sales 8,900,000

Purchases 6,100,000

Freight in 63,000

Selling expenses 515,600

Administrative expenses 411,400

Rent expense 360,000

Depreciation expense 180,000

POE, salary 400,000

GO salary 550,000

Interest on partners loan 15,000 -

P14,660,000 P14,660,000

Inventory, December 31, 2020 P 1,270,000

The partnership agreement provides for the division of earnings (and losses) as follows:

Interest on beginning of the year capitals: 4%

Salaries, POE, P500,000; GO P600,000

Remainder: POE, 40%; GO 60%

REQUIRED:

Prepare an income statement and division of profit and loss. Prepare statement of changes in partners equity. Prepare journal entries to close all nominal accounts. Prepare statement of financial position.

The following data refer to the partnership of POE and GO POE-GO CO. Adjusted Trial Balance December 31, 2020 Cash 462,800 Accounts receivable 912,200 Allowance for doubtful accounts 11.100 Inventory, December 31, 2019 1,340,000 Equipment 3,200,000 Accumulated depreciation 712,000 Accounts payable 186.900 GO loan (due July 1, 2021) 500,000 POE, capital 2,200.000 POE, drawings 80,000 GO capital 2,150,000 GO drawings 70,000 Sales 8.900.000 Purchases 6,100,000 Freight in 63.000 Selling expenses 515,600 Administrative expenses 411,400 Rent expense 360,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started