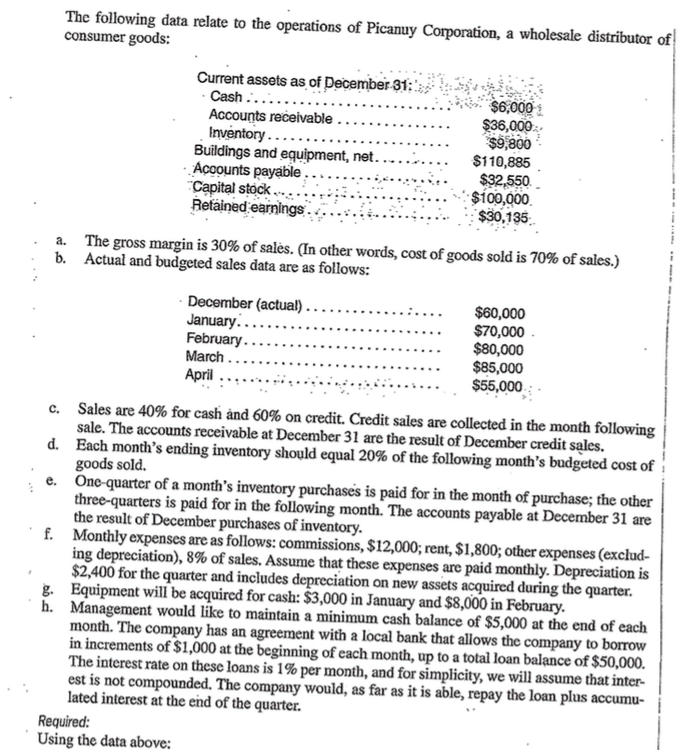

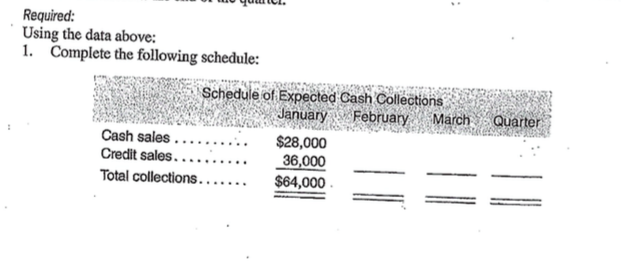

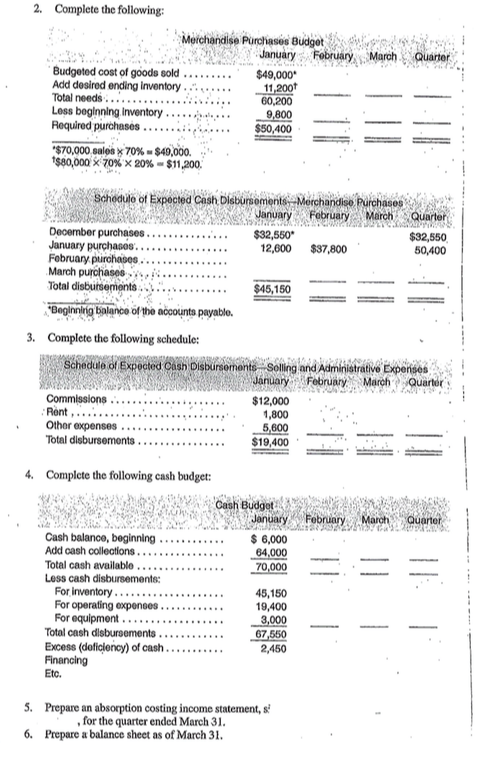

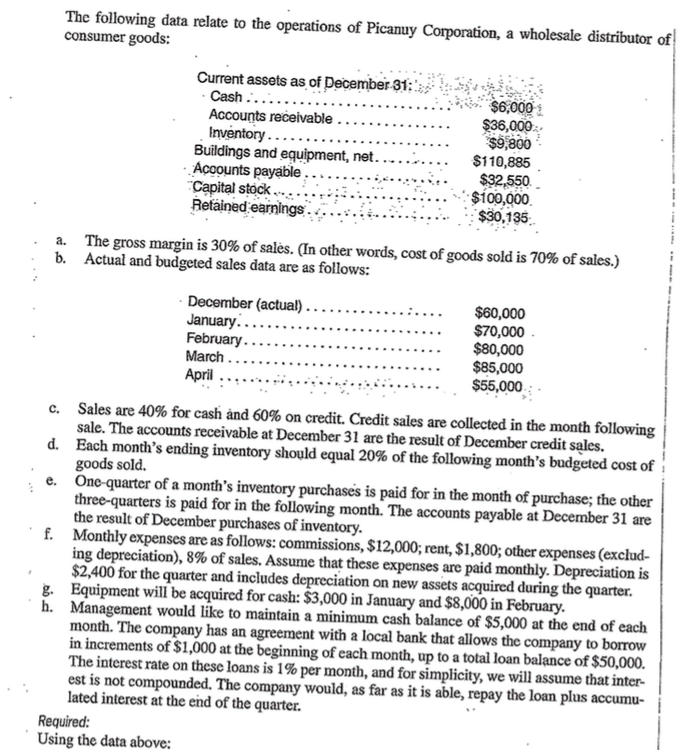

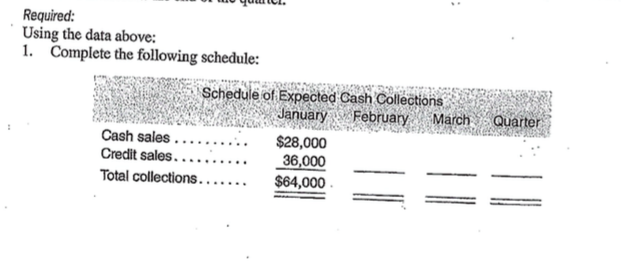

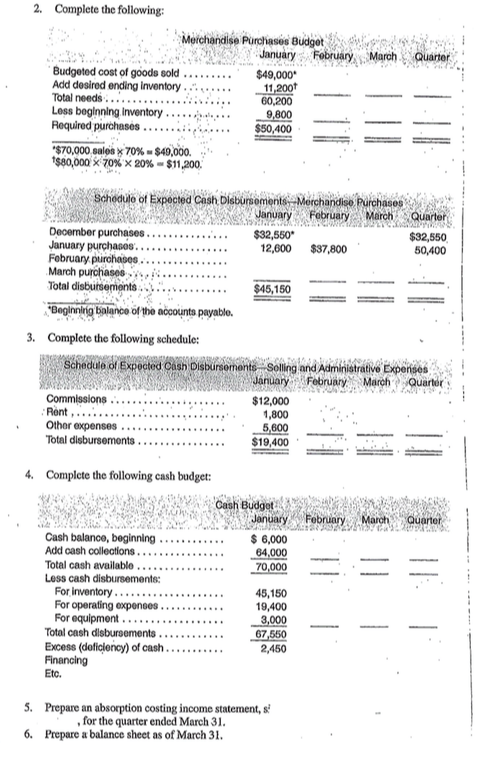

The following data relate to the operations of Picanuy Corporation, a wholesale distributor of consumer goods: assels as of Deoember 31: .$9,800 Capital stock.. -::.... $100,000 a. b. The gross margin is 30% of sales. (In other words, cost of goods sold is 70% of sales.) Actual and budgeted sales data are as follows: $80,000 $85,000 ....$55,000 Sales are 40% for cash and 60% on credit. Credit sales are collected in the month following ! sale. The accounts receivable at December 31 are the result of Deccmber credit sales Each month's ending inventory should equal 20% of the following month's budgeted cost of : c. d. One-quarter of a month's inventory purchases is paid for in the month of purchase; the other three-quarters is paid for in the following month. The accounts payable at December 31 are the result of December purchases of inventory Monthly expenses are as follows: commissions, $12,000, rent, $1,800; other expenses (exclud- ing depreciation), 8% of sales. Assume that these expenses are paid monthly. Depreciation is $2,400 for the quarter and includes depreciation on new assets acquired during the quarter. Equipment will be acquired for cash: $3,000 in January and $8,000 in February Management would like to maintain a minimum cash balance of $5,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $50,000. The interest rate on these loans is 1% per month, and for simplicity, we will assume that inter- est is not compounded. The company would, as far as it is able, repay the loan plus accumu-| lated interest at the end of the quarter. e. f. g. h. Using the data above: Required: Using the data above: 1. Complete the following schedule: schedule of Expected Cash Collections Cash sales $28,000 64,000 . 2 Complete the following: Total needs. Required purcheses....i.... .$70,000 sales 70%-$49,000. , ..$49,000 60,200 9,800 $50,400 80,000 x 70% 20%-$11,200. anuaryFobruary archuarter 32,550 50,400 32,550 12,600 $37,800 Bogining blance of the accoimts payable. 3. Complete the following schedule: ule of Expected Cash Disbrs g and Administrative Expees JanuaryFebruaryMarch Quarter ....1,000 1,800 Other expenses.. 400 5,600 4. Complcte the following cash budget: Add cash clledtlons...64000_ Total cash available..70,000-. i Less cash disbursements: For operating expenees Total cash disbureements.. Financing 19,400 3,000 67,550 2,450 Etc. 5. Prepare an absorption costing income statement,s for the quarter ended March 31 Prepare a balance sheet as of March 31 6. The following data relate to the operations of Picanuy Corporation, a wholesale distributor of consumer goods: assels as of Deoember 31: .$9,800 Capital stock.. -::.... $100,000 a. b. The gross margin is 30% of sales. (In other words, cost of goods sold is 70% of sales.) Actual and budgeted sales data are as follows: $80,000 $85,000 ....$55,000 Sales are 40% for cash and 60% on credit. Credit sales are collected in the month following ! sale. The accounts receivable at December 31 are the result of Deccmber credit sales Each month's ending inventory should equal 20% of the following month's budgeted cost of : c. d. One-quarter of a month's inventory purchases is paid for in the month of purchase; the other three-quarters is paid for in the following month. The accounts payable at December 31 are the result of December purchases of inventory Monthly expenses are as follows: commissions, $12,000, rent, $1,800; other expenses (exclud- ing depreciation), 8% of sales. Assume that these expenses are paid monthly. Depreciation is $2,400 for the quarter and includes depreciation on new assets acquired during the quarter. Equipment will be acquired for cash: $3,000 in January and $8,000 in February Management would like to maintain a minimum cash balance of $5,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $50,000. The interest rate on these loans is 1% per month, and for simplicity, we will assume that inter- est is not compounded. The company would, as far as it is able, repay the loan plus accumu-| lated interest at the end of the quarter. e. f. g. h. Using the data above: Required: Using the data above: 1. Complete the following schedule: schedule of Expected Cash Collections Cash sales $28,000 64,000 . 2 Complete the following: Total needs. Required purcheses....i.... .$70,000 sales 70%-$49,000. , ..$49,000 60,200 9,800 $50,400 80,000 x 70% 20%-$11,200. anuaryFobruary archuarter 32,550 50,400 32,550 12,600 $37,800 Bogining blance of the accoimts payable. 3. Complete the following schedule: ule of Expected Cash Disbrs g and Administrative Expees JanuaryFebruaryMarch Quarter ....1,000 1,800 Other expenses.. 400 5,600 4. Complcte the following cash budget: Add cash clledtlons...64000_ Total cash available..70,000-. i Less cash disbursements: For operating expenees Total cash disbureements.. Financing 19,400 3,000 67,550 2,450 Etc. 5. Prepare an absorption costing income statement,s for the quarter ended March 31 Prepare a balance sheet as of March 31 6