Answered step by step

Verified Expert Solution

Question

1 Approved Answer

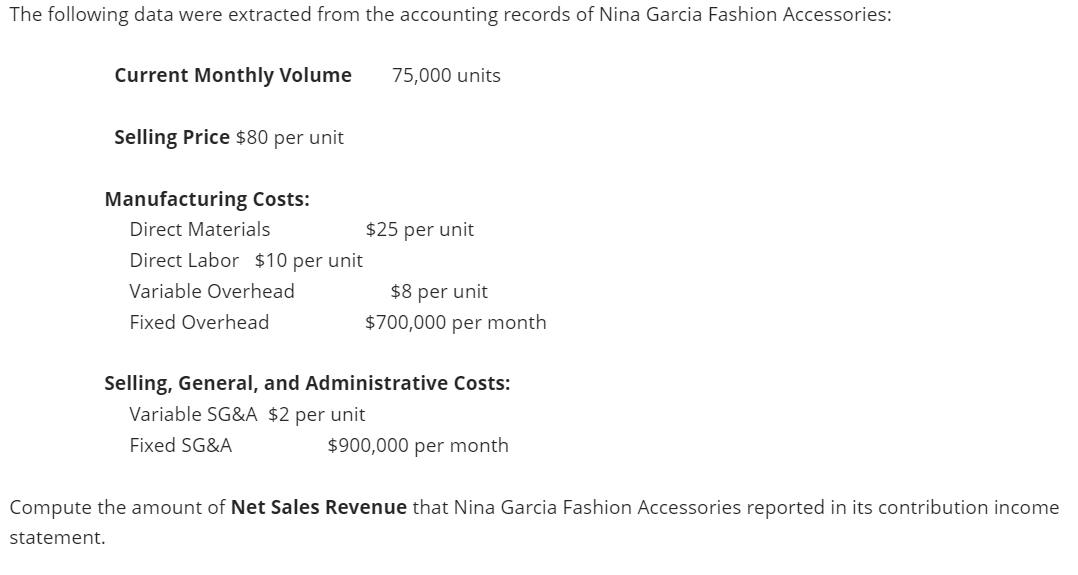

The following data were extracted from the accounting records of Nina Garcia Fashion Accessories: Current Monthly Volume Selling Price $80 per unit Manufacturing Costs:

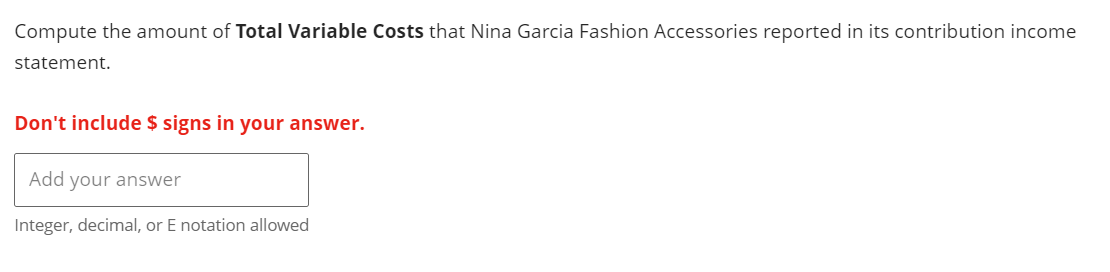

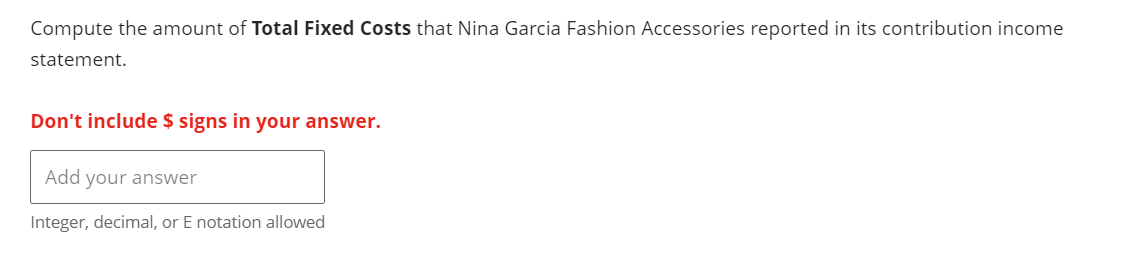

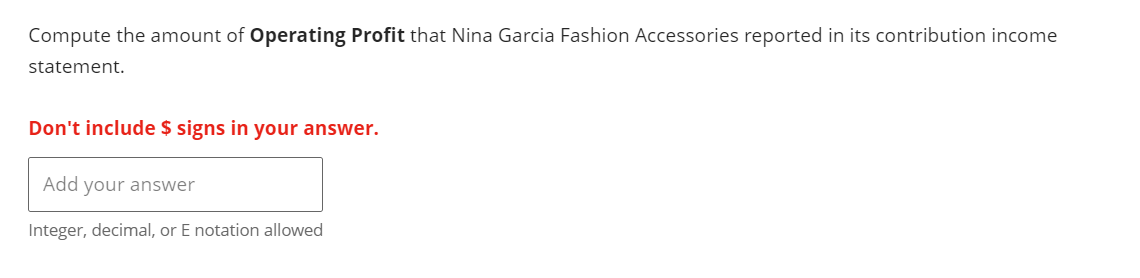

The following data were extracted from the accounting records of Nina Garcia Fashion Accessories: Current Monthly Volume Selling Price $80 per unit Manufacturing Costs: Direct Materials Direct Labor $10 per unit Variable Overhead Fixed Overhead 75,000 units $25 per unit $8 per unit $700,000 per month Selling, General, and Administrative Costs: Variable SG&A $2 per unit Fixed SG&A $900,000 per month Compute the amount of Net Sales Revenue that Nina Garcia Fashion Accessories reported in its contribution income statement. Compute the amount of Total Variable Costs that Nina Garcia Fashion Accessories reported in its contribution income statement. Don't include $ signs in your answer. Add your answer Integer, decimal, or E notation allowed Compute the amount of Total Contribution Margin that Nina Garcia Fashion Accessories reported in its contribution income statement. Don't include $ signs in your answer. Add your answer Integer, decimal, or E notation allowed Compute the amount of Total Fixed Costs that Nina Garcia Fashion Accessories reported in its contribution income statement. Don't include $ signs in your answer. Add your answer Integer, decimal, or E notation allowed Compute the amount of Operating Profit that Nina Garcia Fashion Accessories reported in its contribution income statement. Don't include $ signs in your answer. Add your answer Integer, decimal, or E notation allowed

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Nina Garcia Fashion Accessories Contribution Income Statement Calculations Net S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started