Question

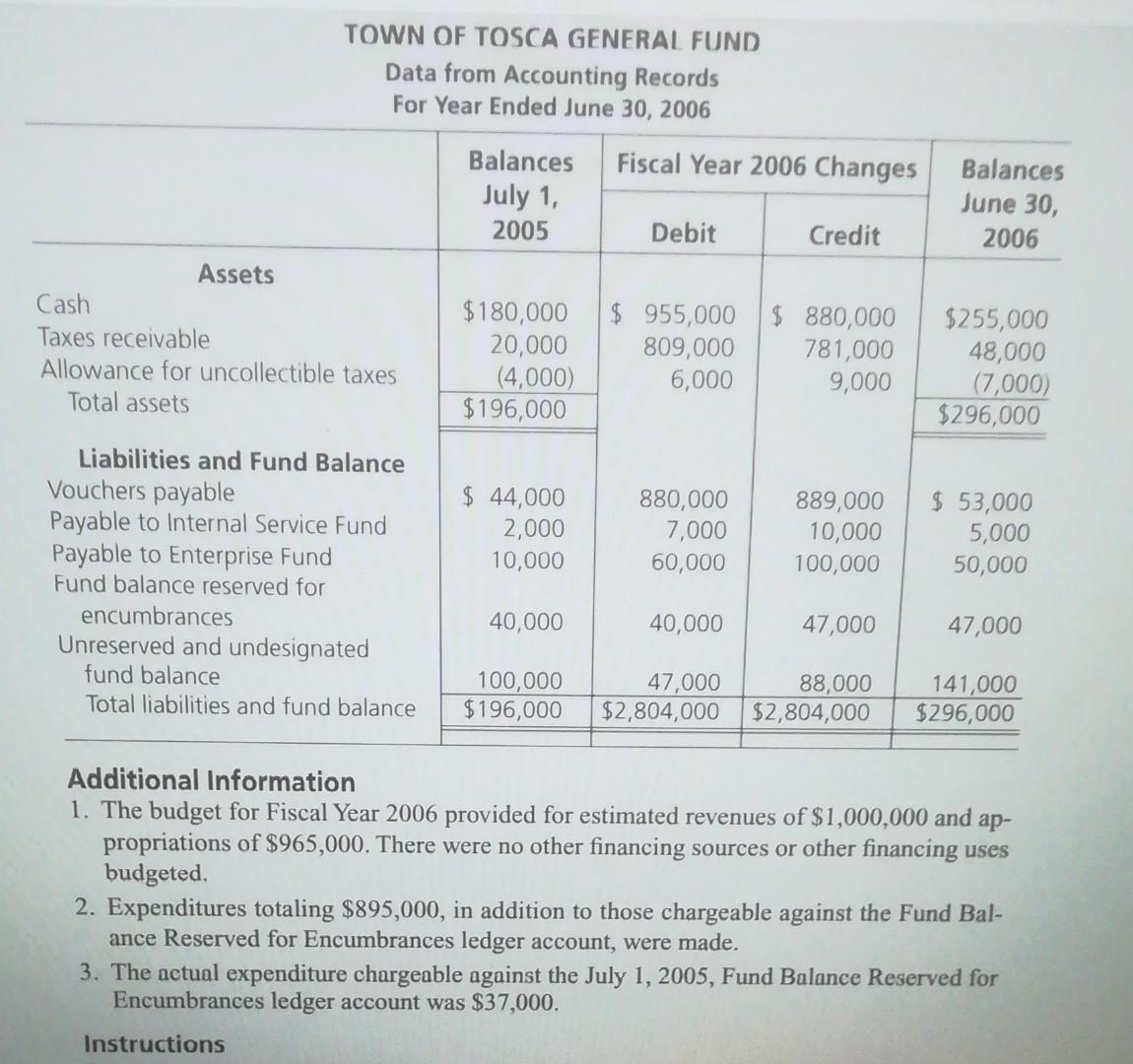

The following data were taken from the accounting records of the Town of Tosca General Fund after the ledger accounts had been closed for the

The following data were taken from the accounting records of the Town of Tosca General Fund after the ledger accounts had been closed for the scal year ended June 30, 2006: (Problem 17.8)Balances July 1, 2005 Fiscal Year 2006 Changes Balances June 30, 2006 Debit Credit Assets Cash Taxes receivable Allowance for uncollectible taxes Total assets Liabilities and Fund Balance Vouchers payable Payable to Internal Service Fund Payable to Enterprise Fund Fund balance reserved for encumbrances Unreserved and undesignated fund balance Total liabilities and fund balance $180,000 20,000 (4,000) $ 955,000 809,000 6,000 880,000 7,000 60,000 40,000 47,000 $ 880,000 781,000 9,000 889,000 10,000 100,000 47,000 88,000 $255,000 48,000 (7,000) $196,000 $296,000 $ 44,000 2,000 10,000 40,000 100,000 $ 53,000 5,000 50,000 47,000 141,000 $196,000 $2,804,000 $2,804,000 $296,000 746 Part Five Accounting for Nonbusiness Organizations TOWN OF TOSCA GENERAL FUND Data from Accounting Records For Year Ended June 30, 2006 Additional Information 1. The budget for Fiscal Year 2006 provided for estimated revenues of $1,000,000 and ap- propriations of $965,000. There were no other nancing sources or other nancing uses budgeted. 2. Expenditures totaling $895,000, in addition to those chargeable against the Fund Bal- ance Reserved for Encumbrances ledger account, were made. 3. The actual expenditure chargeable against the July 1, 2005, Fund Balance Reserved for Encumbrances ledger account was $37,000. Instructions Reconstruct the journal entries, including closing entries, for the Town of Tosca General Fund indicated by the foregoing data for the year ended June 30, 2006. Do not attempt to differentiate between current and delinquent taxes receivable.

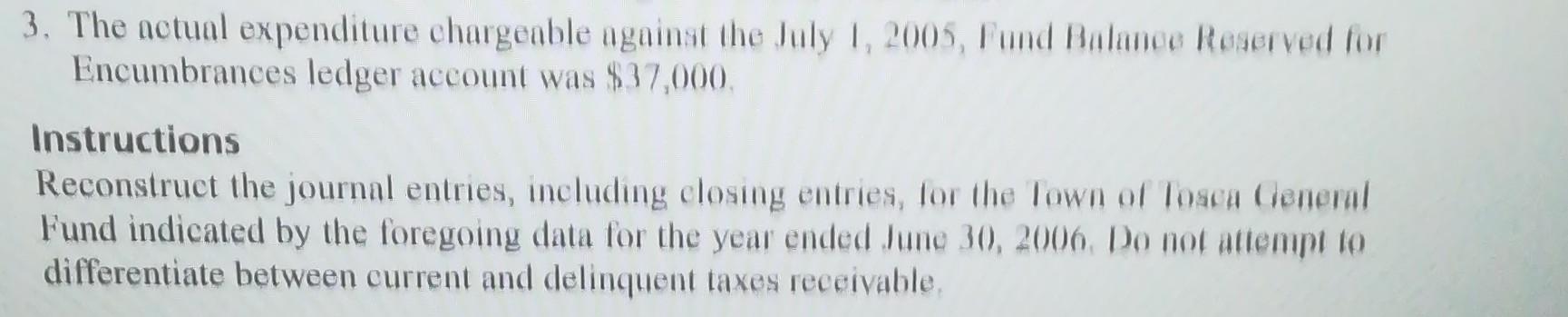

Additional Information 1. The budget for Fiscal Year 2006 provided for estimated revenues of $1,000,000 and appropriations of $965,000. There were no other financing sources or other financing uses budgeted. 2. Expenditures totaling $895,000, in addition to those chargeable against the Fund Balance Reserved for Encumbrances ledger account, were made. 3. The actual expenditure chargeable against the July 1, 2005, Fund Balance Reserved for Encumbrances ledger account was $37,000. Instructions 3. The actual expenditure chargeable against the July 1, 2005, Fund Balanee Reaerved for Encumbrances ledger account was $37,000. Instructions Reconstruct the journal entries, including closing entries, for the Town of losea Cieneral Fund indicated by the foregoing data for the year ended June 30, 2006, Do not attempt to differentiate between current and delinquent taxes receivable. Additional Information 1. The budget for Fiscal Year 2006 provided for estimated revenues of $1,000,000 and appropriations of $965,000. There were no other financing sources or other financing uses budgeted. 2. Expenditures totaling $895,000, in addition to those chargeable against the Fund Balance Reserved for Encumbrances ledger account, were made. 3. The actual expenditure chargeable against the July 1, 2005, Fund Balance Reserved for Encumbrances ledger account was $37,000. Instructions 3. The actual expenditure chargeable against the July 1, 2005, Fund Balanee Reaerved for Encumbrances ledger account was $37,000. Instructions Reconstruct the journal entries, including closing entries, for the Town of losea Cieneral Fund indicated by the foregoing data for the year ended June 30, 2006, Do not attempt to differentiate between current and delinquent taxes receivable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started