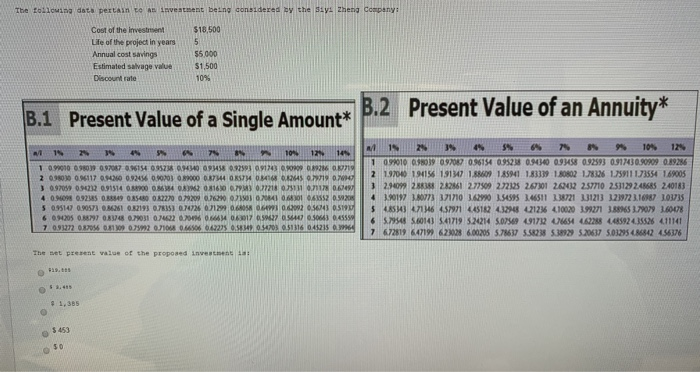

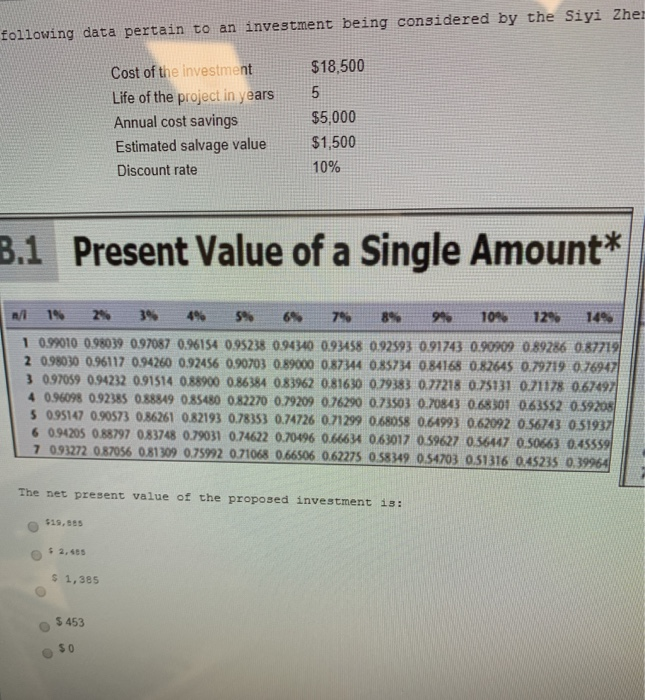

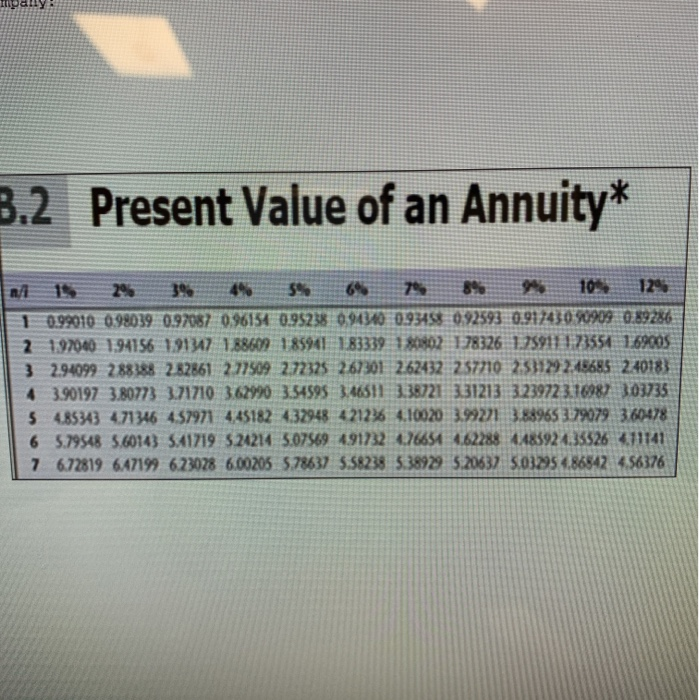

The following dats pertain C An investment being considered by the Siy: Zheng Company $18.500 Cost of the investment Life of the project in years Annual cost savings Estimated salvage value Discount rate 55.000 $1,500 109 B.2 Present Value of an Annuity* B.1 Present Value of a Single Amount* 1 2 3 4 5 6 7 8 104 125 1 099010 0.98039 097087 096154095296 0.94340 09458 0.92593 091243 0. 9 0.89286 0.79 2 098030 0.96117 0 2 0.92444 0.90703 089000 0.87344 OBS734 0.84165 0.025 0.7919 0.70947 3 0.92099 0.94212 091514 OYO 4 OM 00160P) 0.18 051117117009497 4 0.90098 0.92085 349 050 0R220 0 0 0 1 0 1 0 5 095147 0.90573 OM 02193 8153 OM 0 19 OGOS OKWI 06.2002 05043 05190 6 094205 0 97 0.8378 29031 2 0 0 617 27 1 .5064) 0.45550 7 091272 08096 0.81 0. 7 2 .10 O 42235 0,58 034703 $1316 045215 396 15 25 3% 4% 5% 6% 10% 12% 1 099010 0.98039 097087 096154 095238 0.94340 0.93458 0.92593 0.9130.90909 0.89286 2 1.97040 194156 1917 1. D 185941 1.83319 1.SO802 178326 1.7591117355 169005 3 2.94099 286388 282861 272509 2.72125 2.67301 2042 2.57710 2.53129 2.48685 2.40183 4 3.90197 3.80773 371710 3.62990 3.54595 3.46511 238721 131213 1.239723.16987 203735 $ 485443 471346 457971 445182432945 21236 4.10020 3.99271 3.88965 3.79079 3.60478 6 5.79548 5.60143 5.41719 522214 5.02509491712 6654 462258 448592435526 411141 7 672819 647199 623028 6.00205 5.78637 5.58238 5.38929 5.20637 5.012954.86842 4.56376 The wet present value of the proposed investment : FEST Eollowing data pertain to an investment being considered by the Siyi Zhe: $18,500 Cost of the investment Life of the project in years Annual cost savings Estimated salvage value Discount rate $5,000 $1,500 10% B.1 Present Value of a Single Amount* m 19 2 3% 9% 10% 12% 14% 1 0.99010 0.98039 097087 0.96154 0.95238 094340 093458 0.92593 0.91743 0.90909 0.89286 0.87719 2 0.98030 0.96117 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 0.84168 0.82645 0.79719 0.76947| 3 097059 0.94232 091514 0.88900 0.86384 0.83962 0.81630 0.79383 0.77218 0.75131 0.71178 0.67497 4 0.96093 092385 0.88849 085480 0.82270 0.79209 0.76290 0.73503 0.70843 0.68301 0.63552 0.59208 5 095147 0.90573 0.86261 0.82193 0.78353 0.74726 0.71299 0.68058 0.64993 0.62092 0.56743 0.51937 6 0.94205 0.88797 0.83748 0.79031 0.74622 0.70496 0.66634 0.63017 0.59627 0.56447 0.50663 0.45559 7 093272 087056 0.81309 0.75992 0.71068 0.66506 0.62275 0.58349 0.54703 0.51316 0.45235 0.39964 The net present value of the proposed investment is: fists $1,385 5453 LY 3.2 Present Value of an Annuity* 152% 3% 4% 5% 6% 75 % 100% 1 0.99010 0.98039 0.92087 0.96154 0.95238 09490 0.93458 0.92593 0.91743090909 0.89286 2 197040 194156 19137 1.88609 185941 183339 180802 178326 1.75911 1 23554 169005 3 294099 288388 282861 2.77509 2.72375 267301 262432 257710 233179245685 240183 4 3.90197 3.80773 171710 3.62990 3.54595 346511 238721 331213 3.23972 3.1098) 303735 5 485343 471346 457971445182 432948 4212% 4.10020 3.99221388965379079 3.60478 6 5.79548 5.60143 541719 524214 3.07569 491732 6651 462288 1485924.35526 211141 7 672819 647199 623028 6.00205 578637 558238 5.38929 5.20532 503295486842 4.56376