Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following debt investments were held by BSA Fighters Corp. during the period under audit: Debt investment - CAF Company On January 1, 2021,

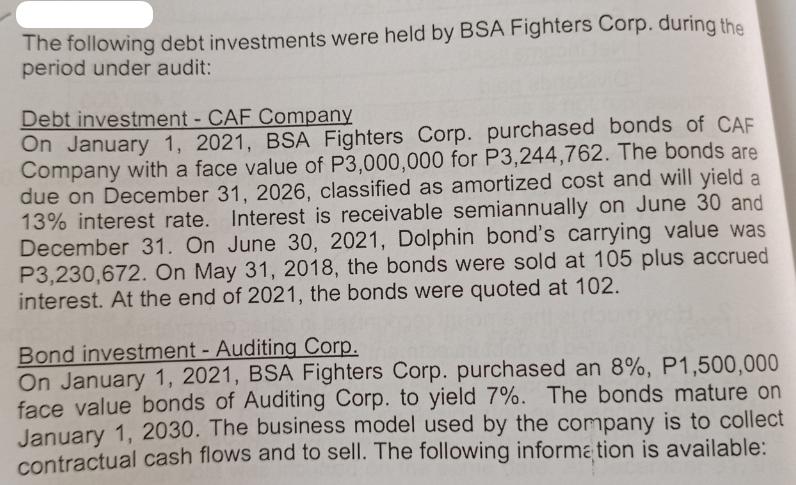

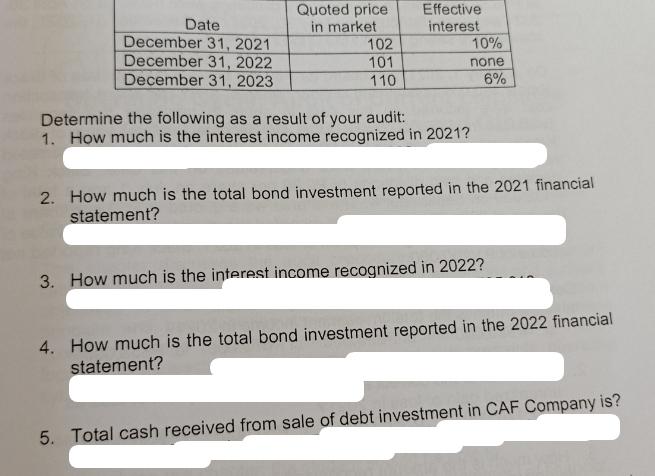

The following debt investments were held by BSA Fighters Corp. during the period under audit: Debt investment - CAF Company On January 1, 2021, BSA Fighters Corp. purchased bonds of CAF Company with a face value of P3,000,000 for P3,244,762. The bonds are due on December 31, 2026, classified as amortized cost and will yield a 13% interest rate. Interest is receivable semiannually on June 30 and December 31. On June 30, 2021, Dolphin bond's carrying value was P3,230,672. On May 31, 2018, the bonds were sold at 105 plus accrued interest. At the end of 2021, the bonds were quoted at 102. Bond investment - Auditing Corp. On January 1, 2021, BSA Fighters Corp. purchased an 8%, P1,500,000 face value bonds of Auditing Corp. to yield 7%. The bonds mature on January 1, 2030. The business model used by the company is to collect contractual cash flows and to sell. The following information is available: Date December 31, 2021 December 31, 2022 December 31, 2023 Quoted price in market 102 101 110 Effective interest 10% none 6% Determine the following as a result of your audit: 1. How much is the interest income recognized in 2021? 2. How much is the total bond investment reported in the 2021 financial statement? 3. How much is the interest income recognized in 2022? 4. How much is the total bond investment reported in the 2022 financial statement? 5. Total cash received from sale of debt investment in CAF Company is?

Step by Step Solution

★★★★★

3.30 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Determine the interest income recognized and the total bond investment reported in the financial sta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started