Question

The following detail of transactions and balances were extracted from the records of Wasp Manufacturers a company manufacturing gas lights. The company make use of

The following detail of transactions and balances were extracted from the records of Wasp Manufacturers a company manufacturing gas lights. The company make use of the periodic inventory system. During the year 20 400 units were completed.

The company are registered for VAT and the VAT rate is 15%.

Additional information:

1 Salaries and wages can be divided as follows:

factory supervisors: R126 100

office staff - administrative: R85 650

factory security guards: R42 000

machine operators: R198 300

factory cleaners: R44 250

office cleaner: R28 900

2. Wasp Manufacturers donated 120 finished products with a total selling price (including VAT) of R17 477 to charity. No entry was made of this transaction.

3. During the year raw materials costing R4 140 were damaged in a thunderstorm. The insurance company paid the replacement cost of R4 370.

4. Rent paid and electricity and water are allocated according to floor space used. The total area of the buildings rented is 900 m2 of which 630 m2 are occupied by factory buildings and the rest by the administration offices.

5. No entry was made for the following amounts owing on 30 June 20.20:

Wages for machine operators on leave: R2 700

Rent (including VAT): R16 100

Telephone (including VAT): R6 670

6. Insurance is paid monthly in advance. On 30 June 20.20 the insurance for July

20.20 was paid R4 025 (including VAT). 75% of the insurance was paid in respect of the factory. The rest was for the administration department.

7. The telephone expenses of the factory amounts a 1/4 of that of the office.

8. The depreciation rate on factory equipment is R5,50 per unit produced on all factory equipment. During the year equipment with a cost of R150 800 and accumulated depreciation on 1 July 20.19 of R62 800 were sold at a loss of R4 800. This equipment produced 1 700 units during the current financial year until it was sold. These units are included in the total number of units given above. New factory equipment was purchased on the 1 September 20.19.

REQUIRED:

1. Calculate the number of units on hand at 30 June 20.20.

2. Prepare the following ledger accounts for the year ended 30 June 20.20:

• Raw materials

• Indirect materials

• Work in Progress

• Number of Units of the Finished Products

3. Calculate the cost to manufacture one unit.

NB Do your workings to the nearest R1

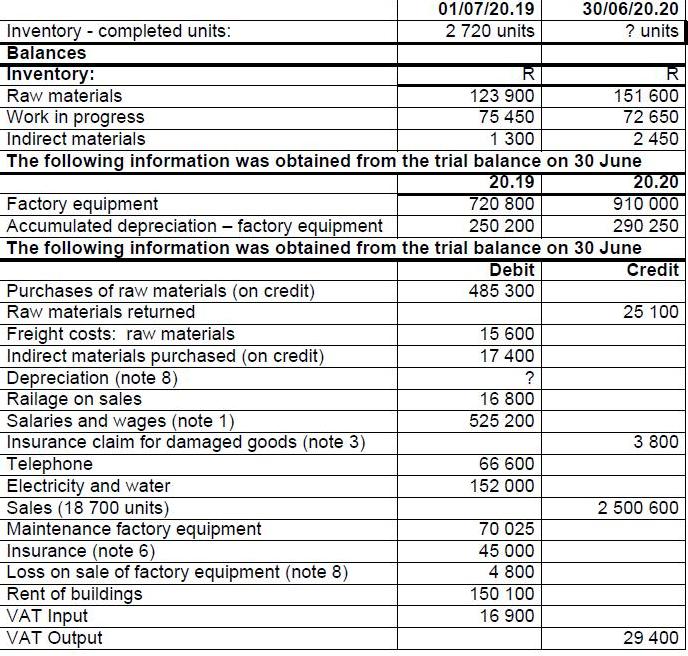

Inventory - completed units: Balances Inventory: Raw materials Work in progress Indirect materials 01/07/20.19 2 720 units R 123 900 75 450 1 300 Purchases of raw materials (on credit) Raw materials returned Freight costs: raw materials Indirect materials purchased (on credit) Depreciation (note 8) Railage on sales Salaries and wages (note 1) Insurance claim for damaged goods (note 3) Telephone Electricity and water Sales (18 700 units) Maintenance factory equipment Insurance (note 6) Loss on sale of factory equipment (note 8) Rent of buildings VAT Input VAT Output The following information was obtained from the trial balance on 30 June 20.19 720 800 250 200 Factory equipment Accumulated depreciation factory equipment The following information was obtained from the trial balance on 30 June Debit Credit 485 300 15 600 17 400 ? 16 800 525 200 66 600 152 000 30/06/20.20 ? units 70 025 45 000 4 800 R 151 600 72 650 2 450 150 100 16 900 20.20 910 000 290 250 25 100 3 800 2 500 600 29 400

Step by Step Solution

3.59 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started