Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following details are included in the rate sensitivity report for Gotbucks Bank, Inc. ($ millions). Assets Cash 1-month T-bills Liabilities and Equity $10

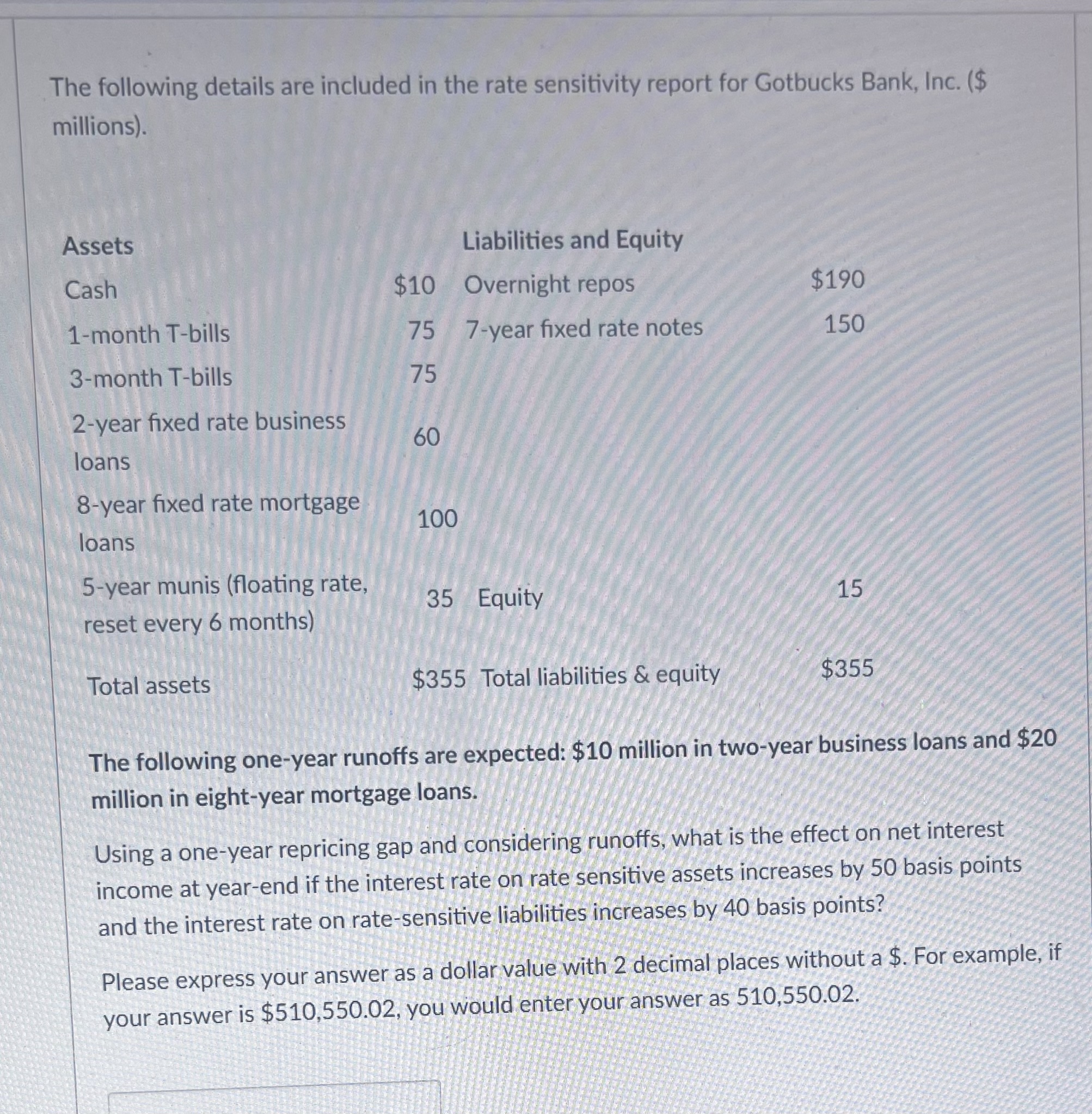

The following details are included in the rate sensitivity report for Gotbucks Bank, Inc. ($ millions). Assets Cash 1-month T-bills Liabilities and Equity $10 Overnight repos $190 75 7-year fixed rate notes 150 3-month T-bills 4 75 75 2-year fixed rate business 60 60 loans 8-year fixed rate mortgage 100 loans 5-year munis (floating rate, reset every 6 months) Total assets 35 Equity 15 55 $355 Total liabilities & equity $355 The following one-year runoffs are expected: $10 million in two-year business loans and $20 million in eight-year mortgage loans. Using a one-year repricing gap and considering runoffs, what is the effect on net interest income at year-end if the interest rate on rate sensitive assets increases by 50 basis points and the interest rate on rate-sensitive liabilities increases by 40 basis points? Please express your answer as a dollar value with 2 decimal places without a $. For example, if your answer is $510,550.02, you would enter your answer as 510,550.02.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started