Answered step by step

Verified Expert Solution

Question

1 Approved Answer

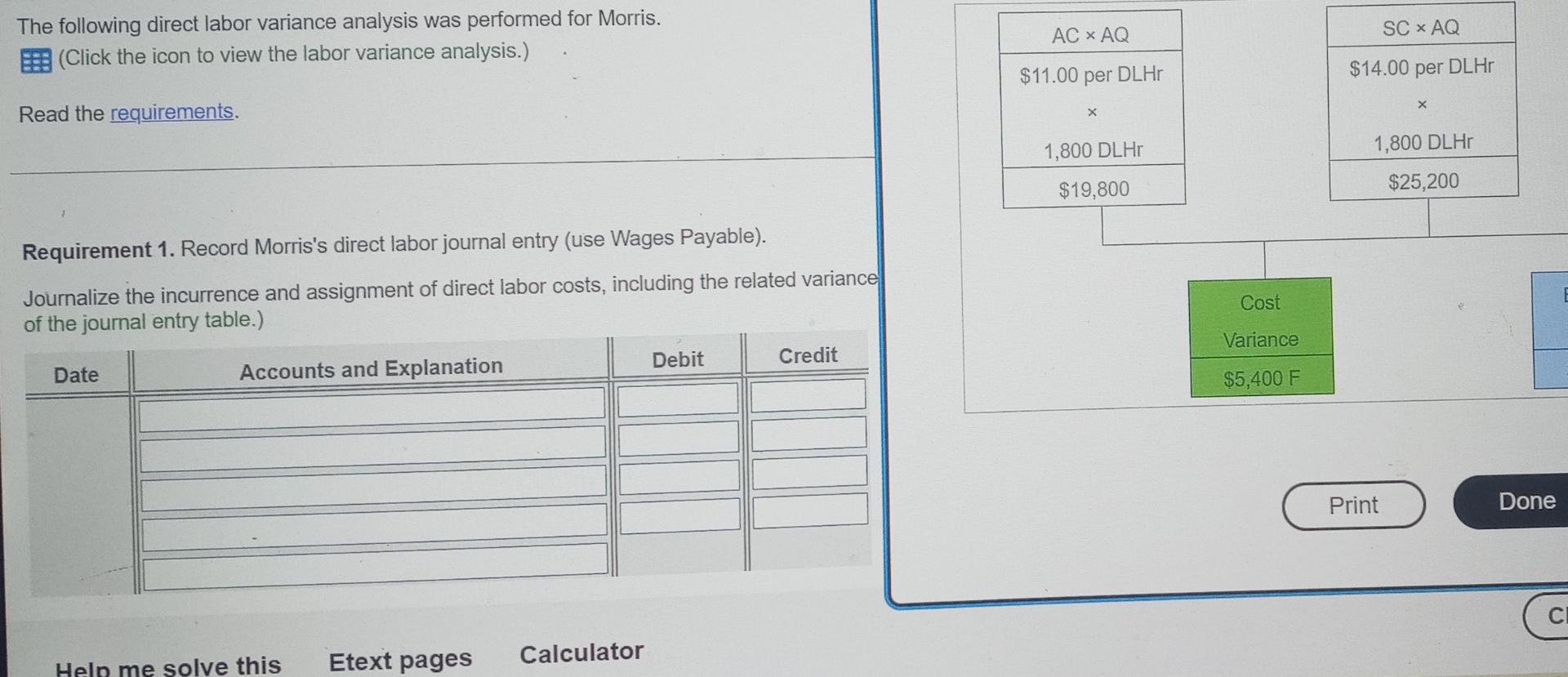

The following direct labor variance analysis was performed for Morris. (Click the icon to view the labor variance analysis.) AC ~ AQ SC XAQ $11.00

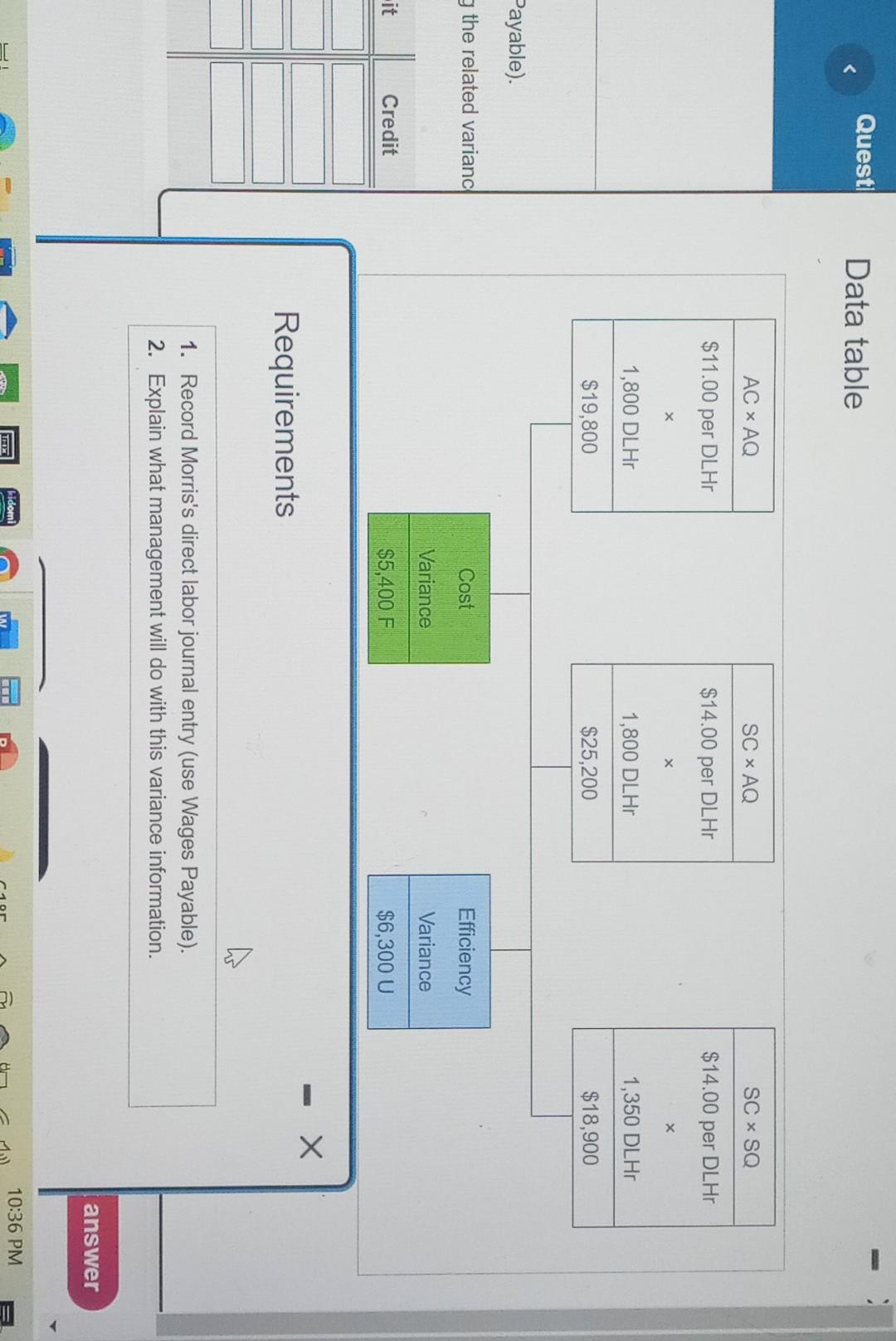

The following direct labor variance analysis was performed for Morris. (Click the icon to view the labor variance analysis.) AC ~ AQ SC XAQ $11.00 per DLHO $14.00 per DLHr Read the requirements. X 1,800 DLHO 1,800 DLHT $19,800 $25,200 Requirement 1. Record Morris's direct labor journal entry (use Wages Payable). Cost Journalize the incurrence and assignment of direct labor costs, including the related variance of the journal entry table.) Variance Debit Credit Date Accounts and Explanation $5,400 F Print Done Calculator Help me solve this Etext pages Quest Data table x AQ SC X AQ SC X SQ $11.00 per DLHO $14.00 per DLHO $14.00 per DLHO x 1,800 DLHO 1,800 DLHO 1,350 DLHO $19,800 $25,200 $18,900 Payable). g the related varianc Cost Efficiency Variance Variance it Credit $5,400 F $6,300 U - X Requirements 1. Record Morris's direct labor journal entry (use Wages Payable). 2. Explain what management will do with this variance information. answer Lidomi 1 10:36 PM 2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started