Answered step by step

Verified Expert Solution

Question

1 Approved Answer

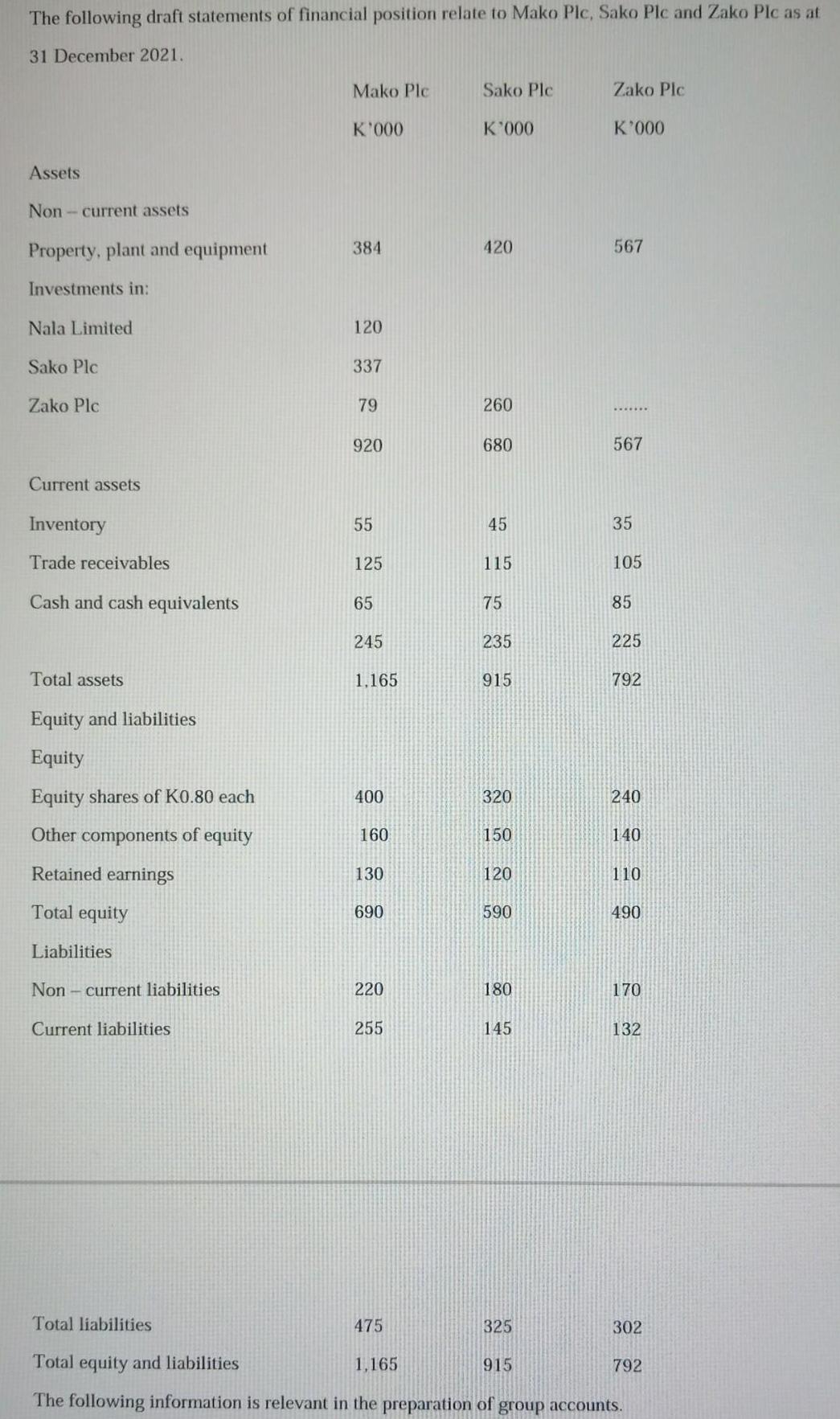

The following draft statements of financial position relate to Mako Plc, Sako Plc and Zako Plc as at 31 December 2021. Assets Non-current assets

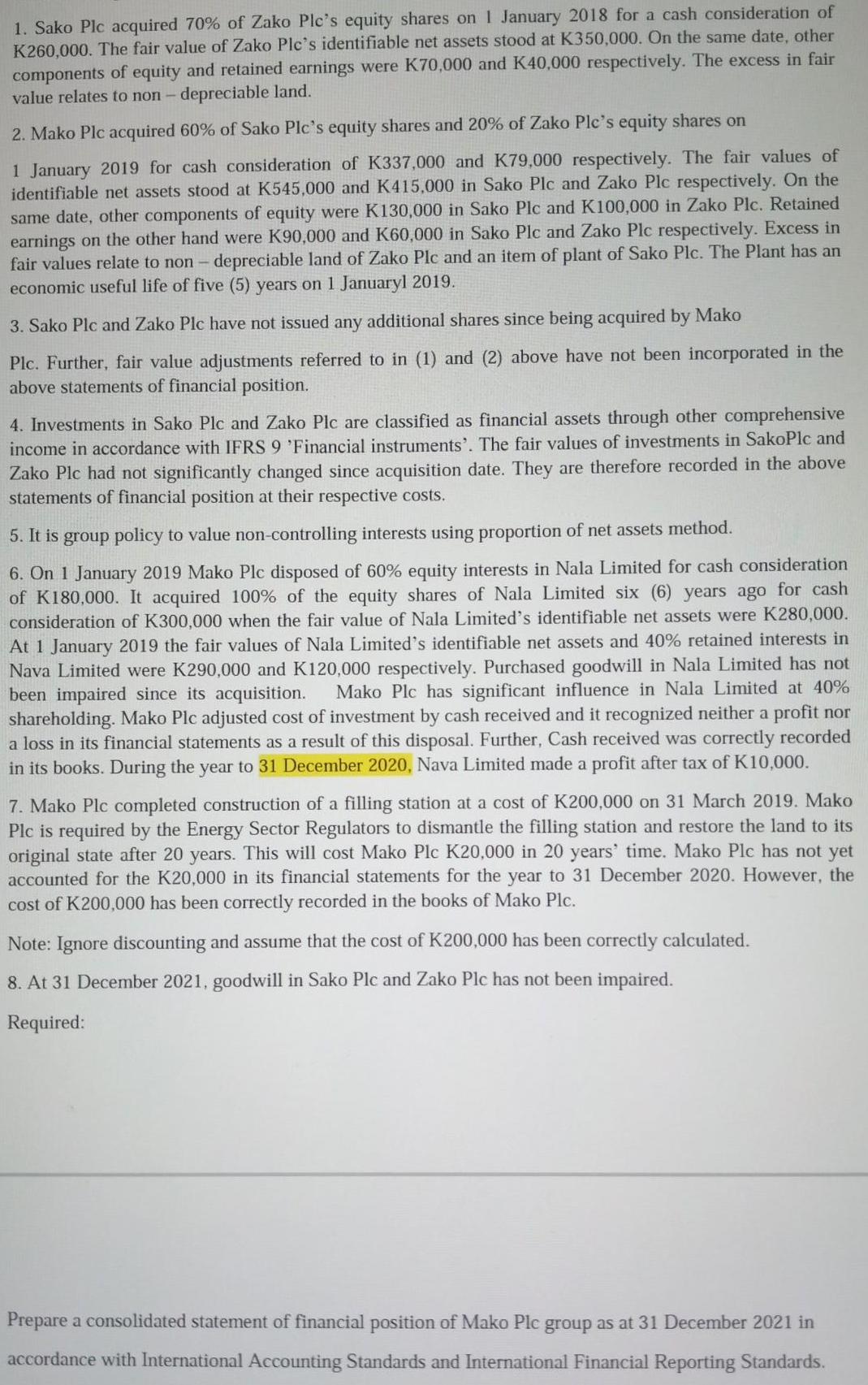

The following draft statements of financial position relate to Mako Plc, Sako Plc and Zako Plc as at 31 December 2021. Assets Non-current assets Property, plant and equipment Investments in: Nala Limited Sako Plc Zako Plc Current assets Inventory Trade receivables Cash and cash equivalents Total assets Equity and liabilities Equity Equity shares of K0.80 each Other components of equity Retained earnings Total equity Liabilities Non current liabilities Current liabilities Mako Plc K'000 384 120 337 79 920 55 125 65 245 1,165 400 160 130 690 220 255 Sako Ple K'000 420 260 680 45 115 75 235 915 320 150 120 590 180 145 Zako Plc K'000 567 567 35 105 85 225 792 240 140 110 490 170 132 Total liabilities 475 325 Total equity and liabilities 1,165 915 The following information is relevant in the preparation of group accounts. 302 792 1. Sako Plc acquired 70% of Zako Plc's equity shares on 1 January 2018 for a cash consideration of K260,000. The fair value of Zako Plc's identifiable net assets stood at K350,000. On the same date, other components of equity and retained earnings were K70,000 and K40,000 respectively. The excess in fair value relates to non- depreciable land. 2. Mako Plc acquired 60% of Sako Plc's equity shares and 20% of Zako Plc's equity shares on 1 January 2019 for cash consideration of K337,000 and K79,000 respectively. The fair values of identifiable net assets stood at K545,000 and K415,000 in Sako Plc and Zako Plc respectively. On the same date, other components of equity were K130,000 in Sako Plc and K100,000 in Zako Plc. Retained earnings on the other hand were K90,000 and K60,000 in Sako Plc and Zako Plc respectively. Excess in fair values relate to non- depreciable land of Zako Plc and an item of plant of Sako Plc. The Plant has an economic useful life of five (5) years on 1 Januaryl 2019. 3. Sako Plc and Zako Plc have not issued any additional shares since being acquired by Mako Plc. Further, fair value adjustments referred to in (1) and (2) above have not been incorporated in the above statements of financial position. 4. Investments in Sako Plc and Zako Plc are classified as financial assets through other comprehensive income in accordance with IFRS 9 'Financial instruments'. The fair values of investments in SakoPlc and Zako Plc had not significantly changed since acquisition date. They are therefore recorded in the above statements of financial position at their respective costs. 5. It is group policy to value non-controlling interests using proportion of net assets method. 6. On 1 January 2019 Mako Plc disposed of 60% equity interests in Nala Limited for cash consideration of K180,000. It acquired 100% of the equity shares of Nala Limited six (6) years ago for cash consideration of K300,000 when the fair value of Nala Limited's identifiable net assets were K280,000. At 1 January 2019 the fair values of Nala Limited's identifiable net assets and 40% retained interests in Nava Limited were K290,000 and K120,000 respectively. Purchased goodwill in Nala Limited has not been impaired since its acquisition. Mako Plc has significant influence in Nala Limited at 40% shareholding. Mako Plc adjusted cost of investment by cash received and it recognized neither a profit nor a loss in its financial statements as a result of this disposal. Further, Cash received was correctly recorded in its books. During the year to 31 December 2020, Nava Limited made a profit after tax of K10,000. 7. Mako Plc completed construction of a filling station at a cost of K200,000 on 31 March 2019. Mako Plc is required by the Energy Sector Regulators to dismantle the filling station and restore the land to its original state after 20 years. This will cost Mako Plc K20,000 in 20 years' time. Mako Plc has not yet accounted for the K20,000 in its financial statements for the year to 31 December 2020. However, the cost of K200,000 has been correctly recorded in the books of Mako Plc. Note: Ignore discounting and assume that the cost of K200,000 has been correctly calculated. 8. At 31 December 2021, goodwill in Sako Plc and Zako Plc has not been impaired. Required: Prepare a consolidated statement of financial position of Mako Plc group as at 31 December 2021 in accordance with International Accounting Standards and International Financial Reporting Standards.

Step by Step Solution

★★★★★

3.50 Rating (183 Votes )

There are 3 Steps involved in it

Step: 1

To prepare a consolidated statement of financial position for Mako Plc group as at 31 December 2021 we need to consolidate the financial positions of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started