Question

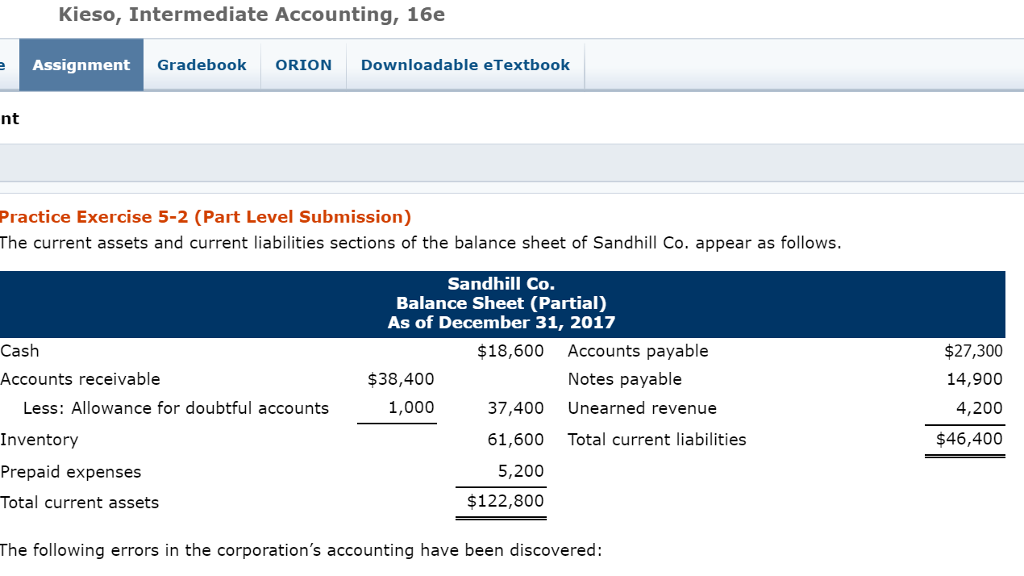

The following errors in the corporations accounting have been discovered: 1. Keane collected $4,000 on December 20, 2017 as a down payment for services to

The following errors in the corporations accounting have been discovered:

The following errors in the corporations accounting have been discovered:

| 1. | Keane collected $4,000 on December 20, 2017 as a down payment for services to be performed in January, 2018. The companys controller recorded the amount as revenue. | |

| 2. | The inventory amount reported included $3,800 of merchandise that had been received on December 31, 2017 but for which no purchase invoices had been received or entered. Of this amount, $2,000 had been received on consignment; the remainder was purchased f.o.b. destination, terms 2/10, n/30. | |

| 3. | Sales for the first day in January 2018 in the amount of $10,200 were entered in the sales journal as of December 31, 2017. Of these, $5,800 were sales on account and the remainder were cash sales. | |

| 4. | Cash, collected in December 2017, but entered as received in January 2018 totaled $4,100. Of this amount, $1,568 was received on account after cash discounts of 2% had been deducted; the remainder was collected for cash sales. | |

| 5. | Cash of $4,400 received in January 2018 was entered as received in December 2017. This cash represented the proceeds of a bank loan that matures in July 2018. | |

| 6. | January 2018 cash disbursements entered as of December 2017 included payments of accounts payable in the amount of $5,700, on which a cash discount of 1% was taken. |

1.

Cash: $ ________ Accounts Receivable: $ ________ Inventory: $ ________ Accounts Payable: $ ________ Notes Payable: $ ________ Unearned Revenue: $ ________

2. What is the future value of 22 periodic payments of $5,920 each made at the beginning of each period and compounded at 8%? 3. What is the present value of $3,640 to be received at the beginning of each of 30 periods, discounted at 5% compound interest? 4. What is the future value of 15 deposits of $3,080 each made at the beginning of each period and compounded at 10%? (Future value as of the end of the 15th period.) Thank you very much for your help :)

Kieso, Intermediate Accounting, 16e Assignment Gradebook ORIONDownloadable eTextbook nt Practice Exercise 5-2 (Part Level Submission) The current assets and current liabilities sections of the balance sheet of Sandhill Co. appear as follows. Sandhill Co. Balance Sheet (Partial) As of December 31, 2017 $27,300 14,900 4,200 $46,400 Cash $18,600 Accounts payable Accounts receivable $38,400 Notes payable 1,000 37,400 Unearned revenue Less: Allowance for doubtful accounts Inventory Prepaid expenses Total current assets Total current liabilities 61,600 5,200 $122,800 The following errors in the corporation's accounting have been discoveredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started