Answered step by step

Verified Expert Solution

Question

1 Approved Answer

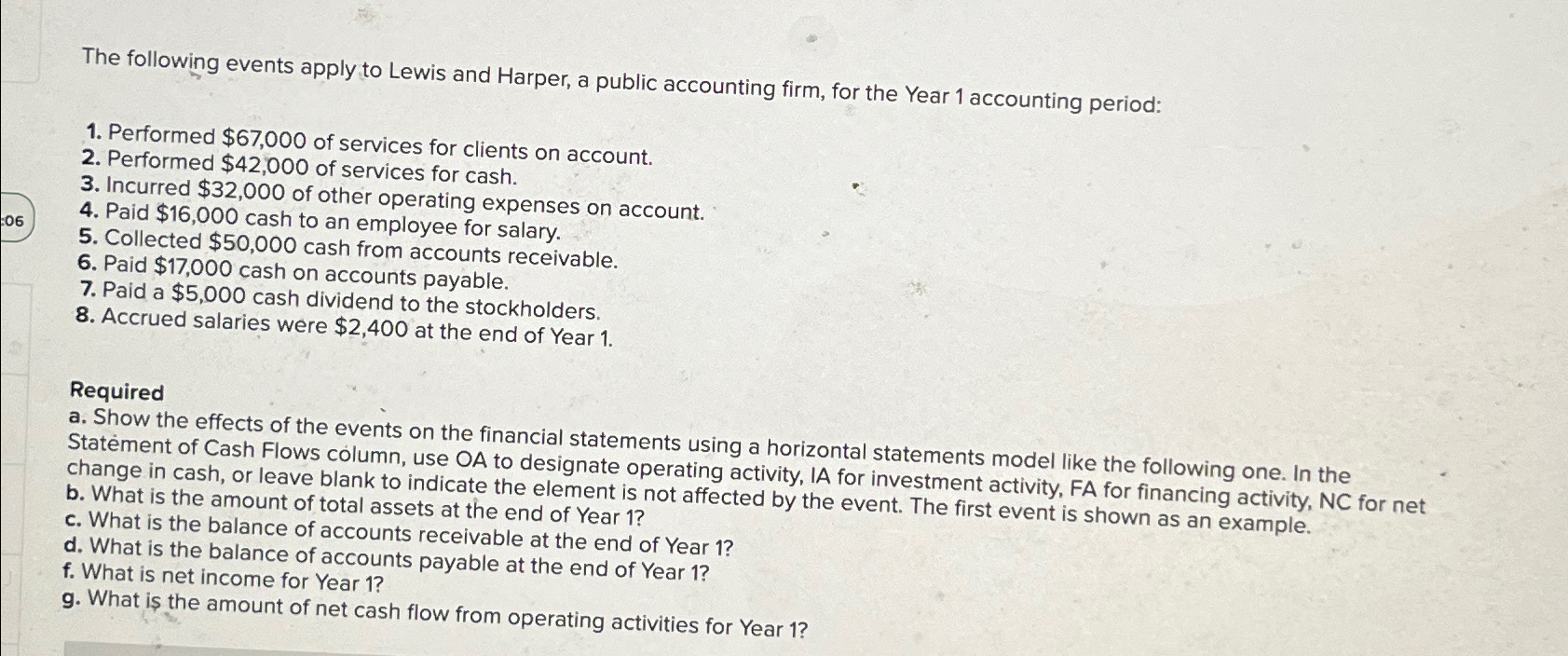

The following events apply to Lewis and Harper, a public accounting firm, for the Year 1 accounting period: Performed $ 6 7 , 0 0

The following events apply to Lewis and Harper, a public accounting firm, for the Year accounting period:

Performed $ of services for clients on account.

Performed $ of services for cash.

Incurred $ of other operating expenses on account.

Paid $ cash to an employee for salary.

Collected $ cash from accounts receivable.

Paid $ cash on accounts payable.

Paid a $ cash dividend to the stockholders.

Accrued salaries were $ at the end of Year

Required

a Show the effects of the events on the financial statements using a horizontal statements model like the following one. In the Statement of Cash Flows column, use OA to designate operating activity, IA for investment activity, FA for financing activity, NC for net b What is the or leave blank to indicate the element is not affected by the event. The first event is shown as an example.

c What is the balance of accounts receivable at the end of Year

d What is the balance of accounts payable at the end of Year

f What is net income for Year

g What is the amount of net cash flow from operating activities for Year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started