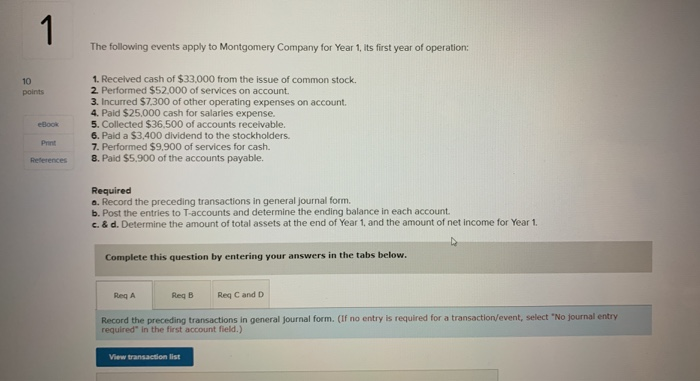

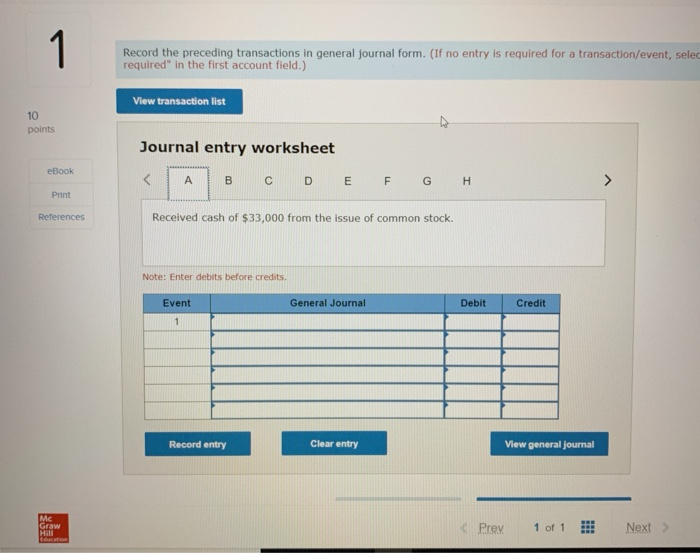

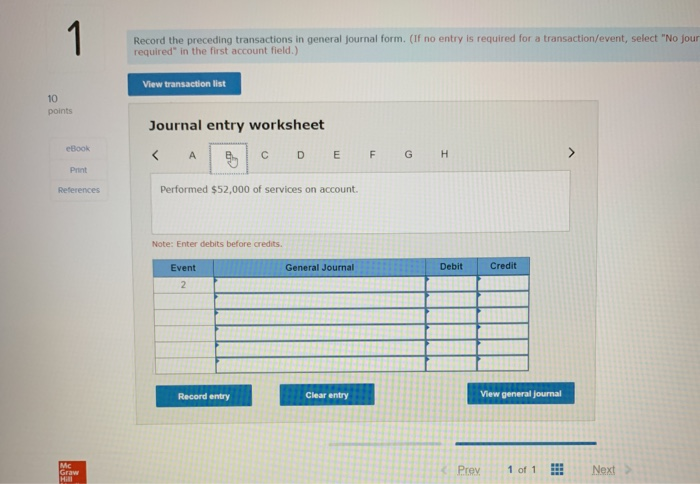

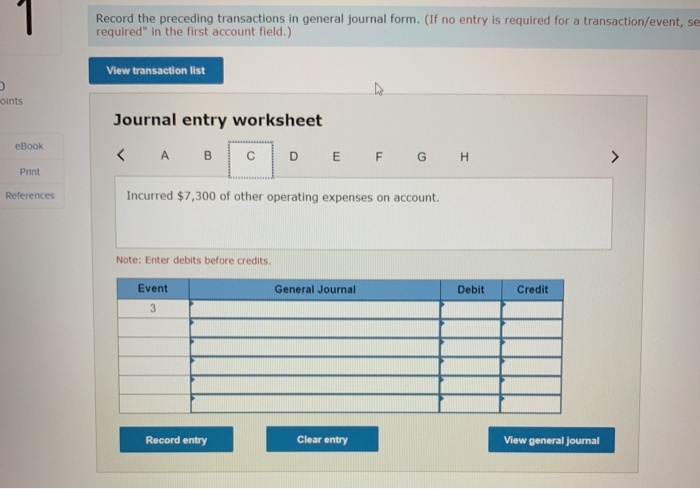

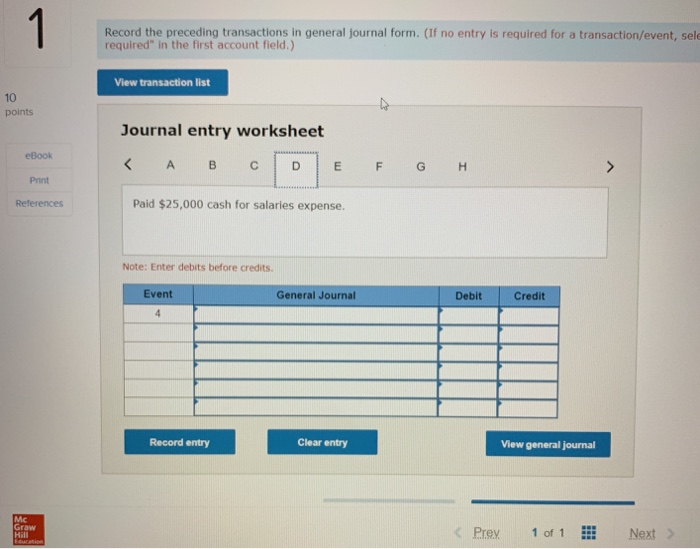

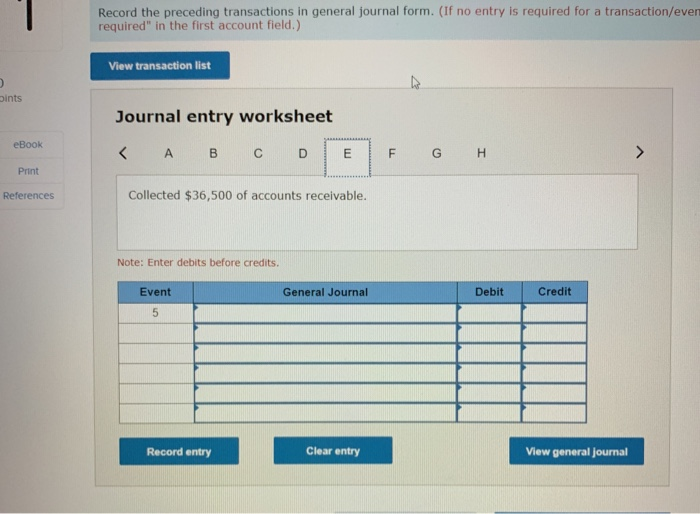

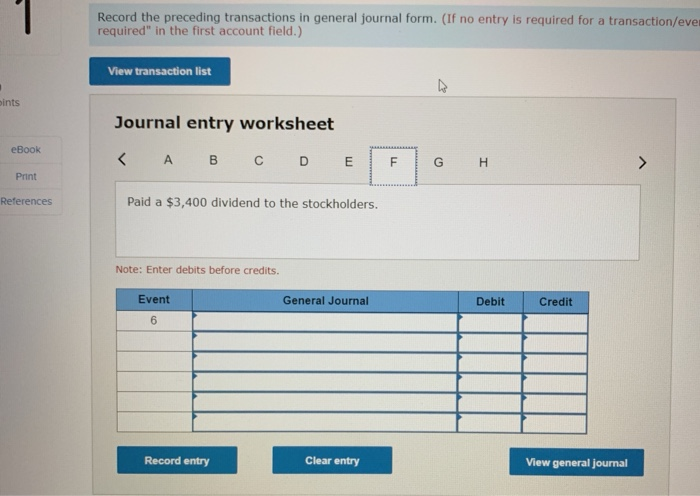

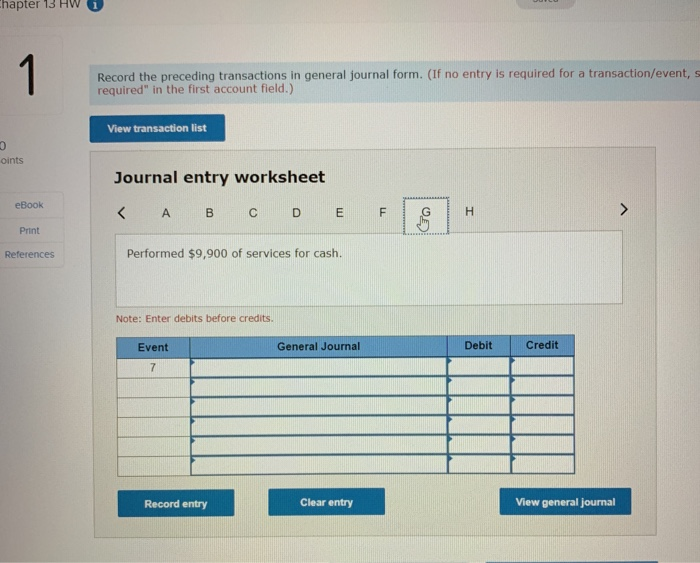

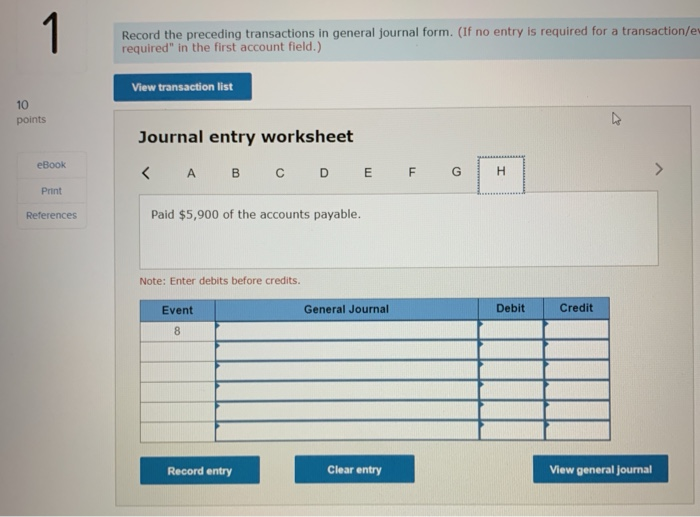

The following events apply to Montgomery Company for Year 1, its first year of operation: 1. Recelved cash of $33,000 from the issue of common stock 2. Performed $52.000 of services on account. 3. Incurred $7,300 of other operating expenses on account. 4. Paid $25,000 cash for salaries expense 5. Collected $36,500 of accounts receivable. 6. Paid a $3,400 dividend to the stockholders 7. Performed $9,900 of services for cash 10 points Print References 8.Paid $5,900 of the accounts payable. Required a. Record the preceding transactions in general journal form. b. Post the entries to T-accounts and determine the ending balance in each account. c. & d. Determine the amount of total assets at the end of Year 1, and the amount of net income for Year 1. Complete this question by entering your answers in the tabs below Req C and D Req A Req B Record the preceding transactions in general journal form. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Record the preceding transactions in general journal form. (If no entry is required for a transaction/event, seled required" in the first account field.) View transaction list 10 points Journal entry worksheet eBook Print Received cash of $33,000 from the issue of common stock. References Note: Enter debits before credits. Event General Journal Debit Credit Clear entry View general journal Record entry Mc Graw Prey 10f 1 Next Record the preceding transactions in general journal form. (If no entry is required for a transaction/event, select "No jour required" in the first account field.) View transaction list 10 points Journal entry worksheet eBook Print References A1,|C D E F G H Performed $52,000 of services on account. Note: Enter debits before credits. Debit Credit Event General Journal View general journal Clear entry Record entry Prey 10t 11 Next Record the preceding transactions in general journal form. (If no entry is required for a transaction/event, se required" in the first account field.) View transaction list oints Journal entry worksheet eBook Print References Incurred $7,300 of other operating expenses on account. Note: Enter debits before credits. Debit Event General Journal Credit Record entry Clear entry View general journal Record the preceding transactions in general journal form. (If no entry is required for a transaction/event, sel required" in the first account field.) View transaction list 10 points Journal entry worksheet eBook Print Paid $25,000 cash for salaries expense. References Note: Enter debits before credits. Event General Journal Debit Credit Record entry Clear entry View general journal Mc Graw Prey 1 of1E Next Record the preceding transactions in general journal form. (If no entry is required for a transaction/even required" in the first account field.) View transaction list ints Journal entry worksheet eBook