Question

The following events apply to Paradise Vacationss first year of operations: 1. Acquired $24,000 cash from the issue of common stock on January 1, Year

The following events apply to Paradise Vacationss first year of operations:

1. Acquired $24,000 cash from the issue of common stock on January 1, Year 1.

2. Purchased $1,000 of supplies on account.

3. Paid $4,680 cash in advance for a one-year lease on office space.

4. Earned $32,350 of revenue on account.

5. Incurred $13,100 of other operating expenses on account.

6. Collected $26,000 cash from accounts receivable.

7. Paid $9,200 cash on accounts payable.

8. Paid a $3,400 cash dividend to the stockholders.

Information for Adjusting Entries

9. There was $190 of supplies on hand at the end of the accounting period.

10. The lease on the office space covered a one-year period beginning November 1.

11. There was $4,000 of accrued salaries at the end of the period.

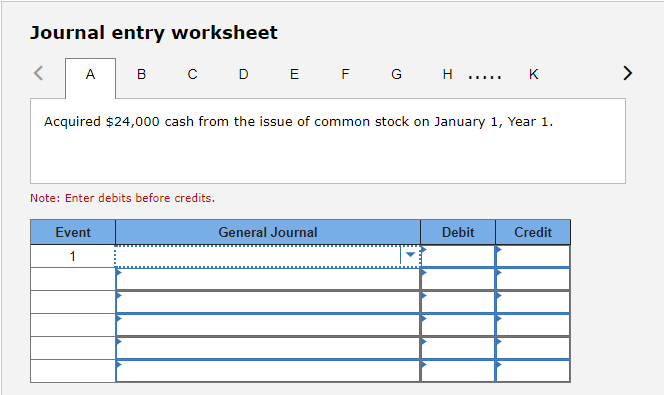

Required A A. Record these transactions in general journal form.

Complete this question by entering your answers in the tabs below.

Record these transactions in general journal form. (If no entry is required for a event, select "No journal entry required" in the first account field.)

"General Journal" Column Answer Options:

- No journal entry required

- Accounts payable

- Accounts receivable

- Cash

- Common stock

- Dividends

- Land

- Other operating expense

- Prepaid rent

- Rent expense

- Salaries expense

- Salaries payable

- Service revenue

- Supplies

- Supplies expense

- Unearned revenue

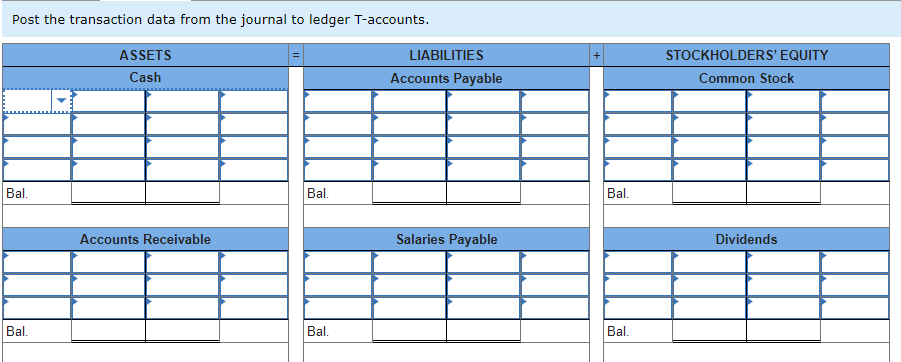

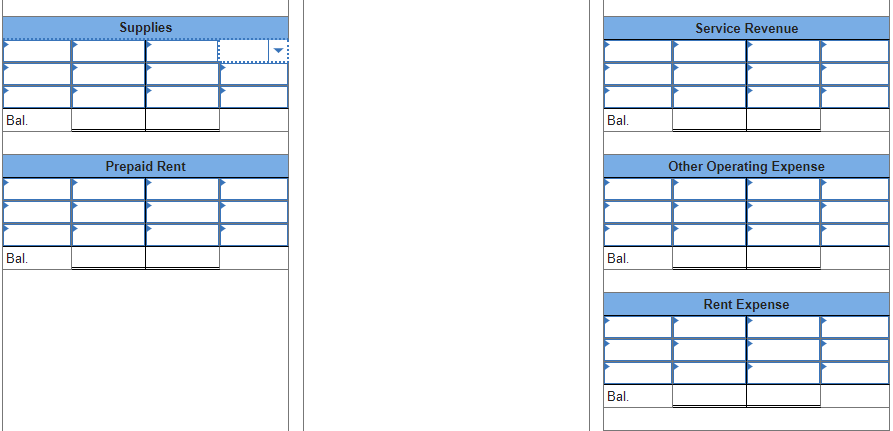

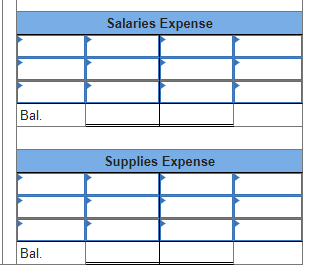

Required B

B. Post the transaction data from the journal to ledger T-accounts.

Complete this question by entering your answers in the tabs below.

Answer Options for first and last columns of each account:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

Required C

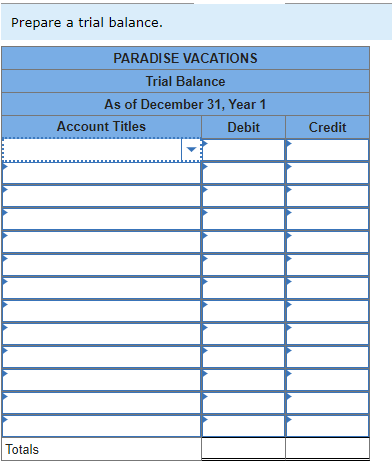

C. Prepare a trial balance.

Complete this question by entering your answers in the tabs below.

"Account Titles" Column answer options:

- Accounts payable

- Accounts receivable

- Cash

- Common stock

- Dividends

- Land

- Other operating expense

- Prepaid rent

- Rent expense

- Salaries expense

- Salaries payable

- Service revenue

- Supplies

- Supplies expense

- Unearned revenue

Required D

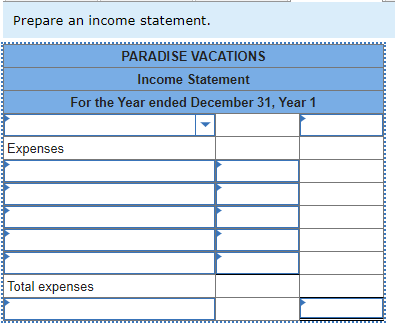

D-1. Prepare an income statement.

Complete this question by entering your answers in the tabs below.

First Column, Rows 1 - 6 Answer Options:

- Inventory

- Other operating expense

- Purchase

- Rent expense

- Retained earnings

- Salaries expense

- Service revenue

- Supplies expense

First Column, Row 7 Answer Options:

- Net income

- Net loss

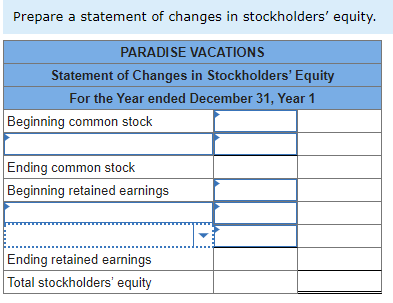

D-2. Prepare a statement of changes in stockholders equity.

Complete this question by entering your answers in the tabs below.

First Column, Row 2 Answer Options:

- Add: Stock issued

- Less: Stock issued

First Column, Row 5 Answer Options:

- Add: Net income

- Less: Net income

First Column, Row 6 Answer Options:

- Add: Dividends

- Less: Dividends

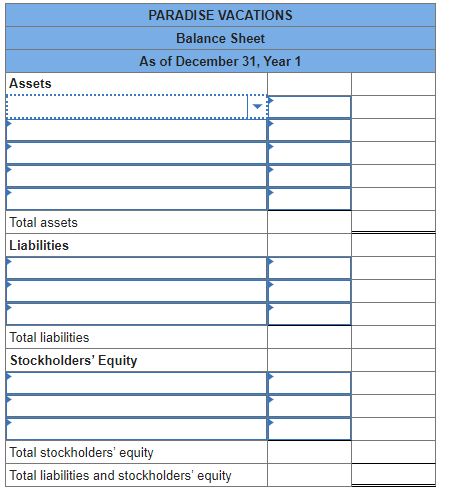

D-3. Prepare a balance sheet.

Complete this question by entering your answers in the tabs below.

First Column Answer Options:

- Accounts payable

- Accounts receivable

- Cash

- Common stock

- Notes payable

- Notes receivable

- Prepaid rent

- Retained earnings

- Salaries payable

- Supplies

Prepare a balance sheet.

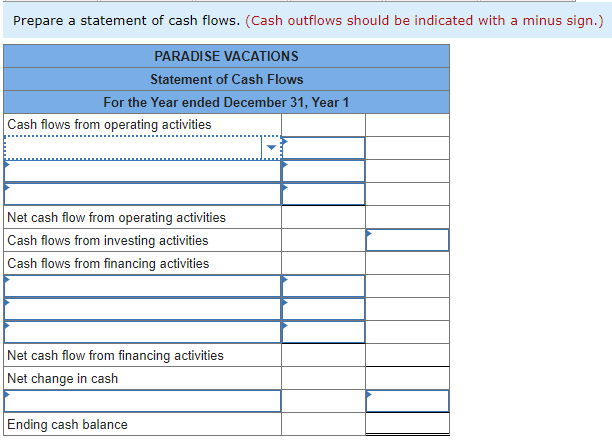

D-4. Prepare a statement of cash flows

Complete this question by entering your answers in the tabs below.

First Column, Rows 2-4 & 8-10 Answer Options:

- Inflow from customers

- Inflow from stock issue

- Outflow for dividends

- Outflow for expenses

- Outflow for inventory

First Column, Row 13 Answer Options:

- Add: Beginning cash balance

- Less: Beginning cash balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started