Answered step by step

Verified Expert Solution

Question

1 Approved Answer

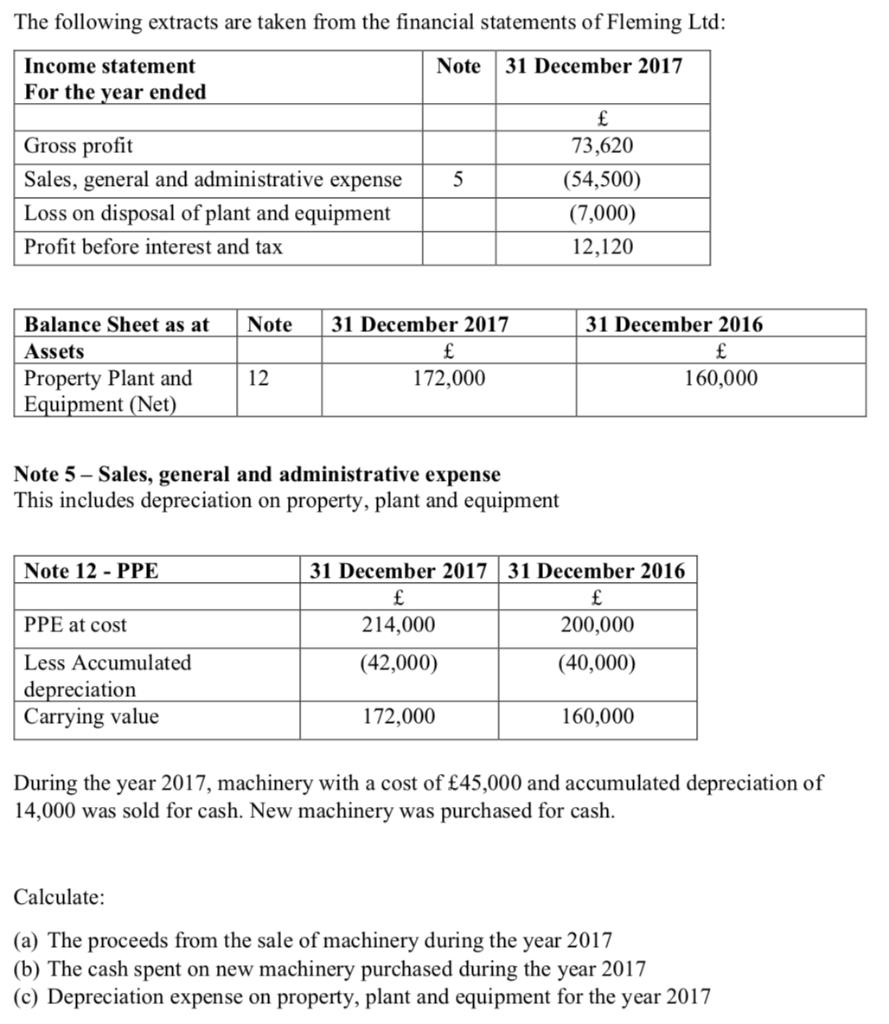

The following extracts are taken from the financial statements of Fleming Ltd: Note 31 December 2017 Income statement For the year ended Gross profit

The following extracts are taken from the financial statements of Fleming Ltd: Note 31 December 2017 Income statement For the year ended Gross profit Sales, general and administrative expense 5 Loss on disposal of plant and equipment Profit before interest and tax Balance Sheet as at Assets Property Plant and Equipment (Net) Note 12 PPE PPE at cost Less Accumulated Note depreciation Carrying value 12 Note 5 Sales, general and administrative expense This includes depreciation on property, plant and equipment 31 December 2017 172,000 73,620 172,000 (54,500) (7,000) 12,120 31 December 2016 160,000 31 December 2017 31 December 2016 214,000 200,000 (42,000) (40,000) 160,000 During the year 2017, machinery with a cost of 45,000 and accumulated depreciation of 14,000 was sold for cash. New machinery was purchased for cash. Calculate: (a) The proceeds from the sale of machinery during the year 2017 (b) The cash spent on new machinery purchased during the year 2017 (c) Depreciation expense on property, plant and equipment for the year 2017

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Proceeds from the sale of machinery Carrying value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started