Question

The following facts are known: The total pounds needed for production are 2 times the units to be produced. The desired ending direct materials

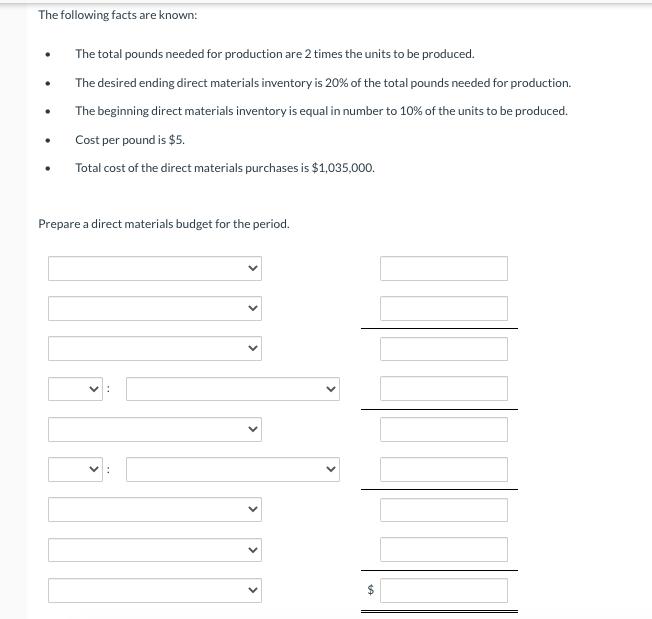

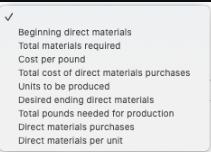

The following facts are known: The total pounds needed for production are 2 times the units to be produced. The desired ending direct materials inventory is 20% of the total pounds needed for production. The beginning direct materials inventory is equal in number to 10% of the units to be produced. Cost per pound is $5. Total cost of the direct materials purchases is $1,035,000. Prepare a direct materials budget for the period. > > > > Beginning direct materials Total materials required Cost per pound Total cost of direct materials purchases Units to be produced Desired ending direct materiais Total pounds needed for production Direct materials purchases Direct materiais per unit

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The Total cost of direct Material is 90000 Direct Materi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Tools for business decision making

Authors: kimmel, weygandt, kieso

4th Edition

978-0470117262, 9780470534786, 470117265, 470534788, 978-0470095461

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App