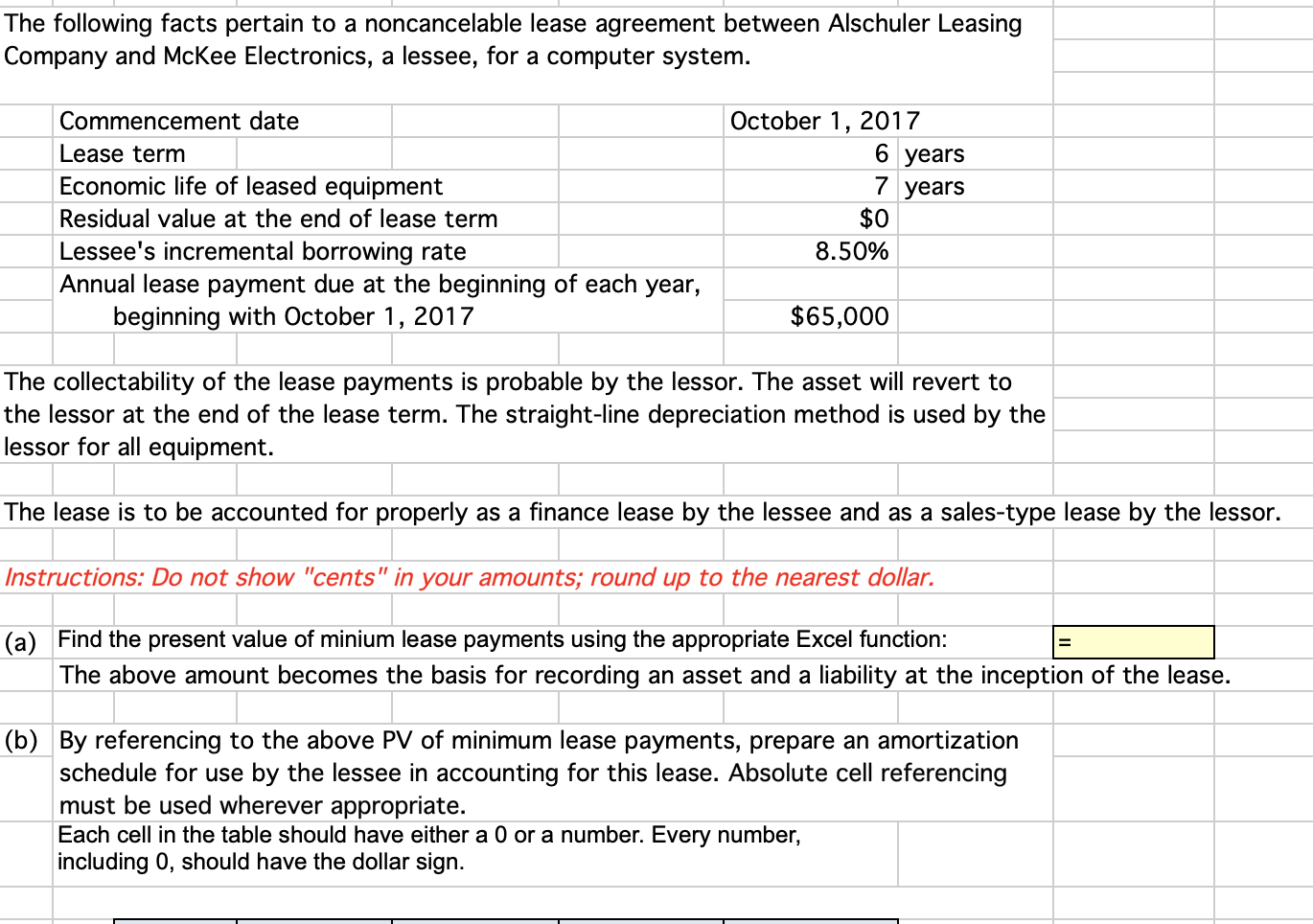

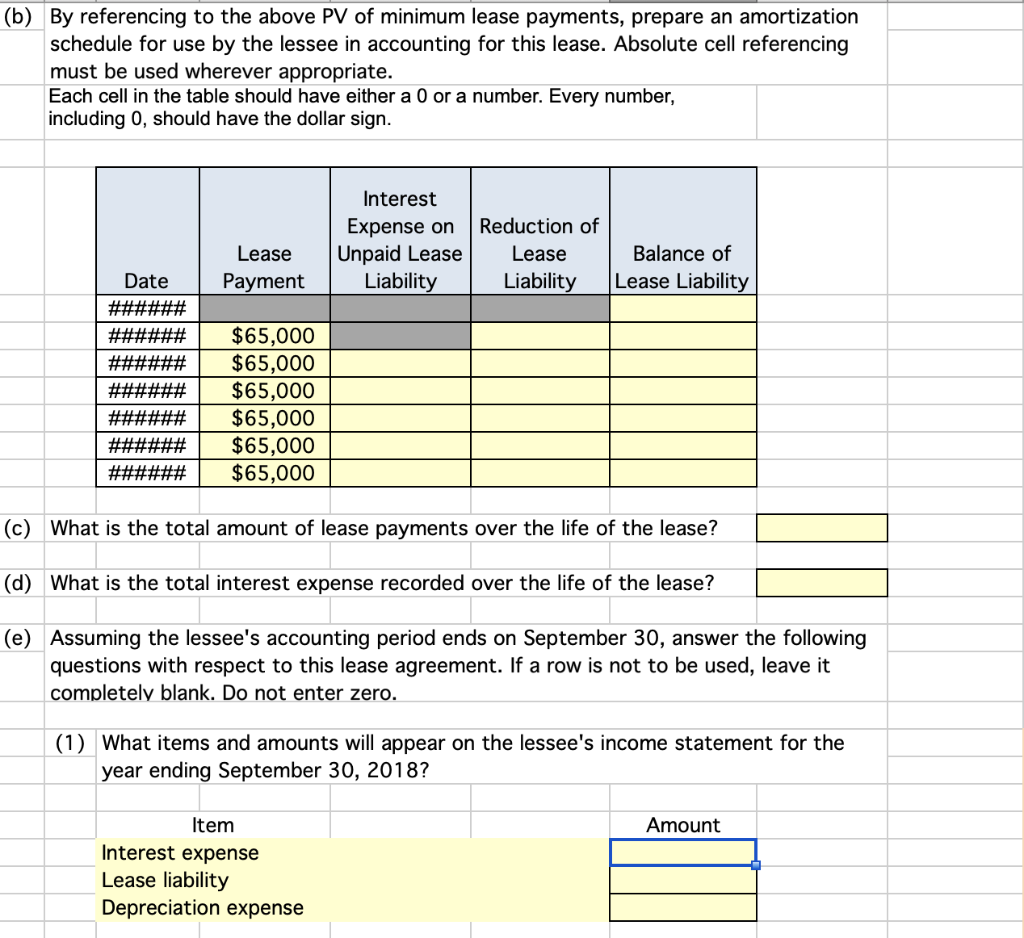

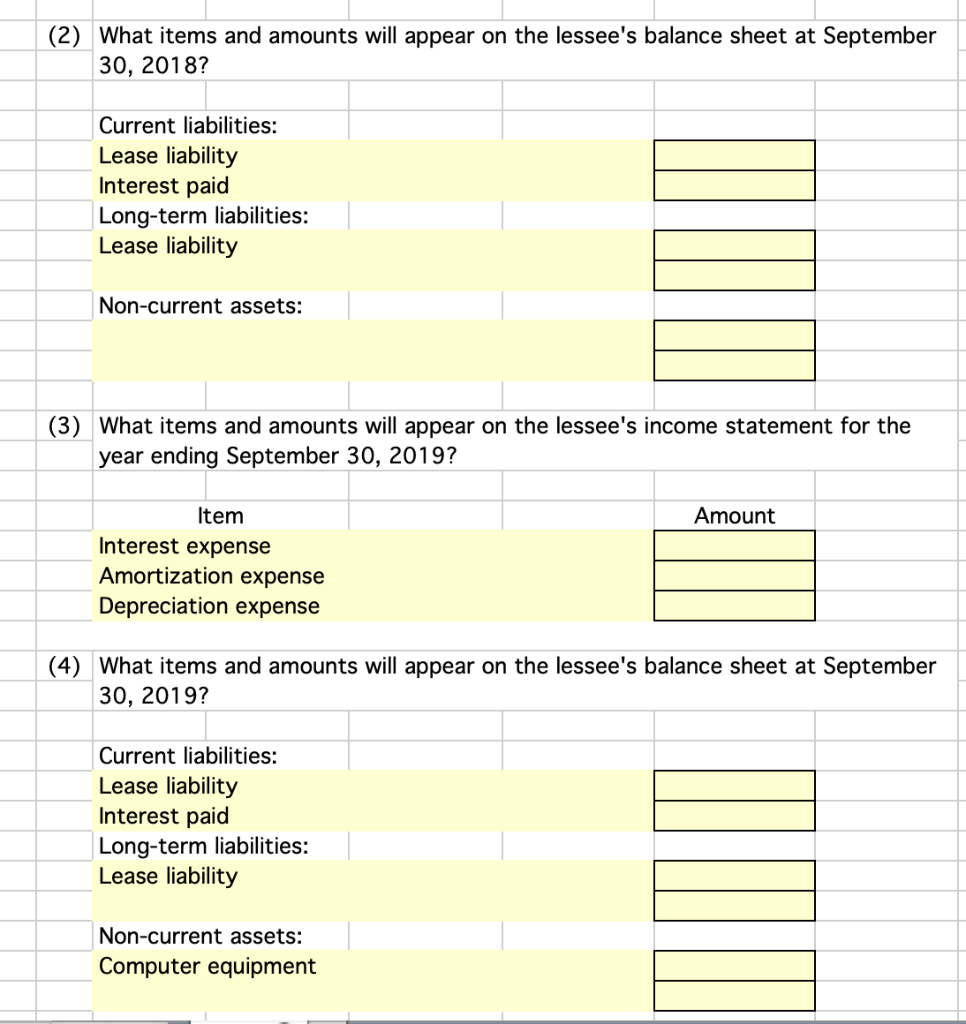

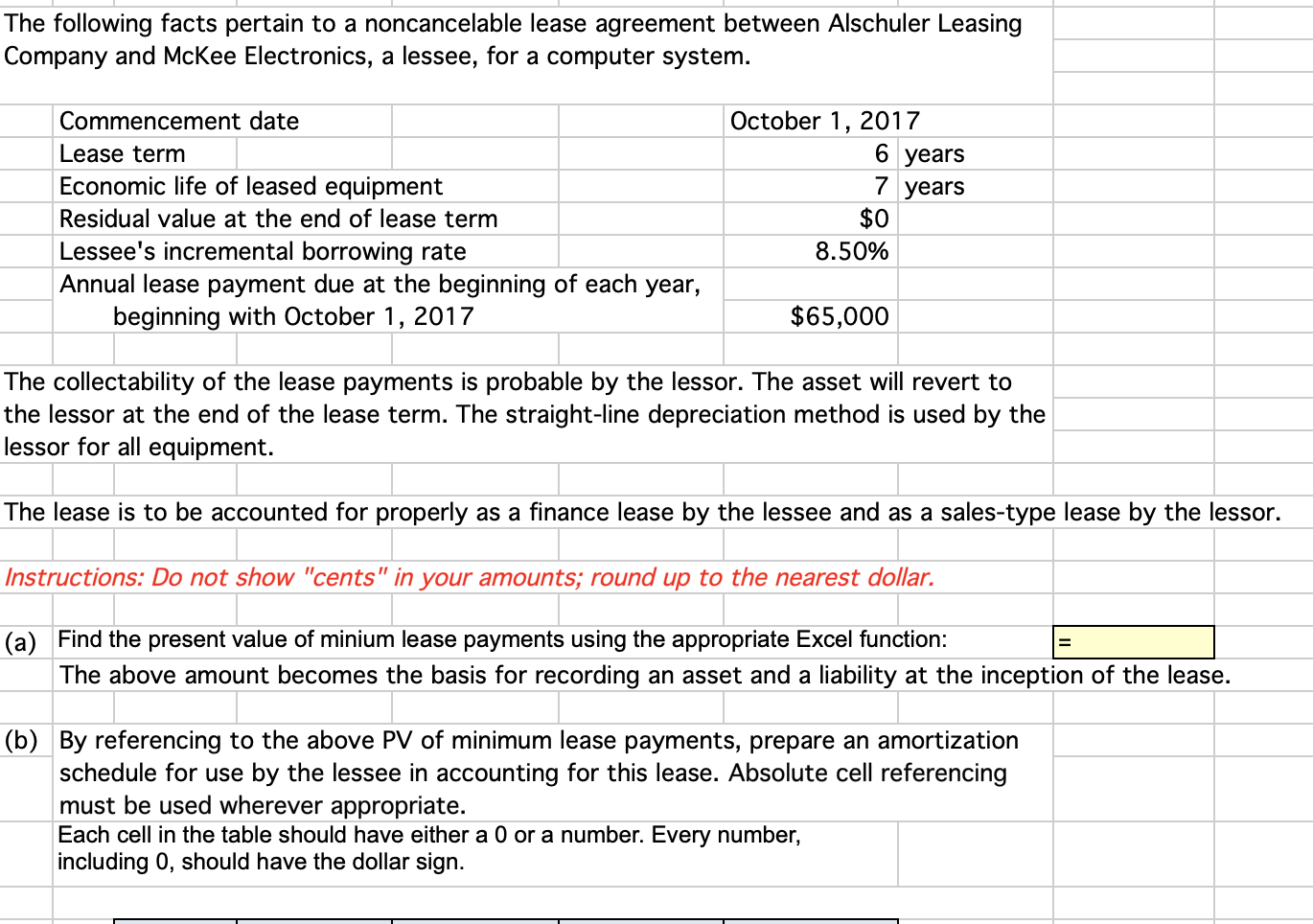

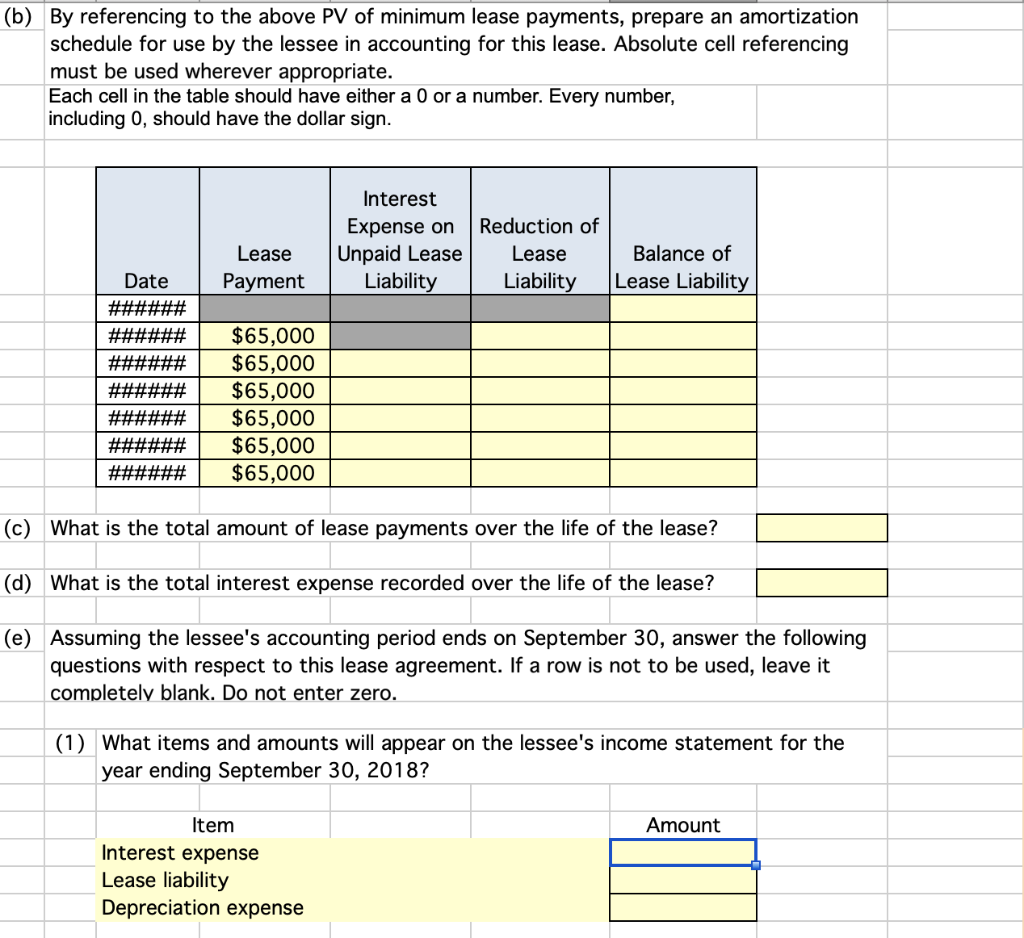

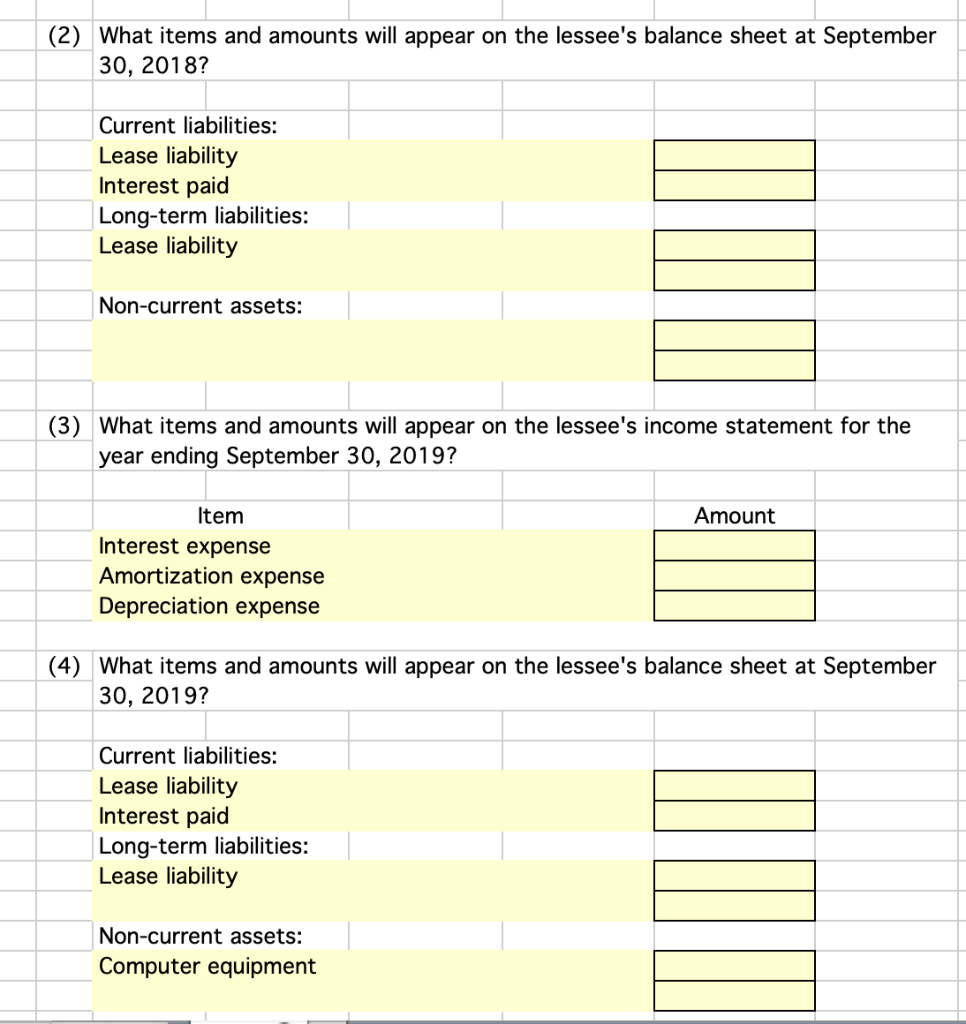

The following facts pertain to a noncancelable lease agreement between Alschuler Leasing Company and McKee Electronics, a lessee, for a computer system. Commencement date Lease term Economic life of leased equipment Residual value at the end of lease term Lessee's incremental borrowing rate Annual lease payment due at the beginning of each year, beginning with October 1, 2017 October 1, 2017 6 years 7 years $0 8.50% $65,000 The collectability of the lease payments is probable by the lessor. The asset will revert to the lessor at the end of the lease term. The straight-line depreciation method is used by the lessor for all equipment. The lease is to be accounted for properly as a finance lease by the lessee and as a sales-type lease by the lessor. Instructions: Do not show "cents" in your amounts; round up to the nearest dollar. (a) Find the present value of minium lease payments using the appropriate Excel function: The above amount becomes the basis for recording an asset and a liability at the inception of the lease. (b) By referencing to the above PV of minimum lease payments, prepare an amortization schedule for use by the lessee in accounting for this lease. Absolute cell referencing must be used wherever appropriate. Each cell in the table should have either a 0 or a number. Every number, including 0, should have the dollar sign. (b) By referencing to the above PV of minimum lease payments, prepare an amortization schedule for use by the lessee in accounting for this lease. Absolute cell referencing must be used wherever appropriate. Each cell in the table should have either a 0 or a number. Every number, including O, should have the dollar sign. Interest Expense on Unpaid Lease Liability Lease Payment Reduction of Lease Balance of Liability Lease Liability Date ###### ###### ###### ###### ###### ###### ###### $65,000 $65,000 $65,000 $65,000 $65,000 $65,000 (c) What is the total amount of lease payments over the life of the lease? (d) What is the total interest expense recorded over the life of the lease? (e) Assuming the lessee's accounting period ends on September 30, answer the following questions with respect to this lease agreement. If a row is not to be used, leave it completely blank. Do not enter zero. (1) What items and amounts will appear on the lessee's income statement for the year ending September 30, 2018? Amount Item Interest expense Lease liability Depreciation expense (2) What items and amounts will appear on the lessee's balance sheet at September 30, 2018? Current liabilities: Lease liability Interest paid Long-term liabilities: Lease liability Non-current assets: (3) What items and amounts will appear on the lessee's income statement for the year ending September 30, 2019? Amount Item Interest expense Amortization expense Depreciation expense (4) What items and amounts will appear on the lessee's balance sheet at September 30, 2019? Current liabilities: Lease liability Interest paid Long-term liabilities: Lease liability Non-current assets: Computer equipment