The following facts pertain to a non-cancelable lease agreement between Novak Leasing Company and Splish Company, a lessee. Inception date: May 1, 2017 Annual

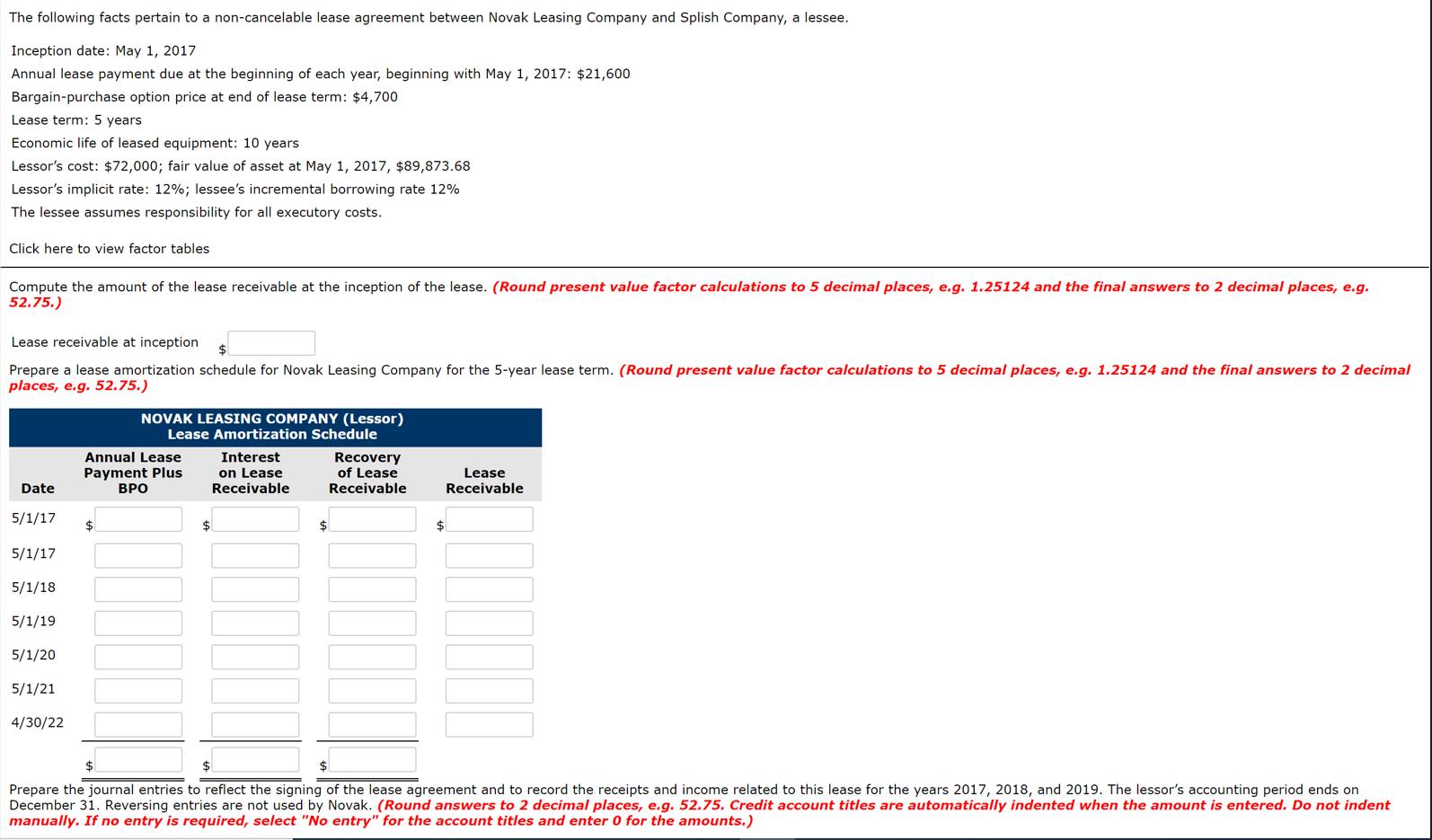

The following facts pertain to a non-cancelable lease agreement between Novak Leasing Company and Splish Company, a lessee. Inception date: May 1, 2017 Annual lease payment due at the beginning of each year, beginning with May 1, 2017: $21,600 Bargain-purchase option price at end of lease term: $4,700 Lease term: 5 years Economic life of leased equipment: 10 years Lessor's cost: $72,000; fair value of asset at May 1, 2017, $89,873.68 Lessor's implicit rate: 12%; lessee's incremental borrowing rate 12% The lessee assumes responsibility for all executory costs. Click here to view factor tables Compute the amount of the lease receivable at the inception of the lease. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 2 decimal places, e.g. 52.75.) Lease receivable at inception Prepare a lease amortization schedule for Novak Leasing Company for the 5-year lease term. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 2 decimal places, e.g. 52.75.) Date 5/1/17 5/1/17 5/1/18 5/1/19 5/1/20 5/1/21 4/30/22 NOVAK LEASING COMPANY (Lessor) Lease Amortization Schedule Interest on Lease Receivable Annual Lease Payment Plus $ $ $ Recovery of Lease Receivable $ Lease Receivable $ Prepare the journal entries to reflect the signing of the lease agreement and to record the receipts and income related to this lease for the years 2017, 2018, and 2019. The lessor's accounting period ends on December 31. Reversing entries are not used by Novak. (Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.)

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To compute the amount of the lease receivable at the inception of the leasewe first need to calculate the present value of the lease paymentsWe will u...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started