Answered step by step

Verified Expert Solution

Question

1 Approved Answer

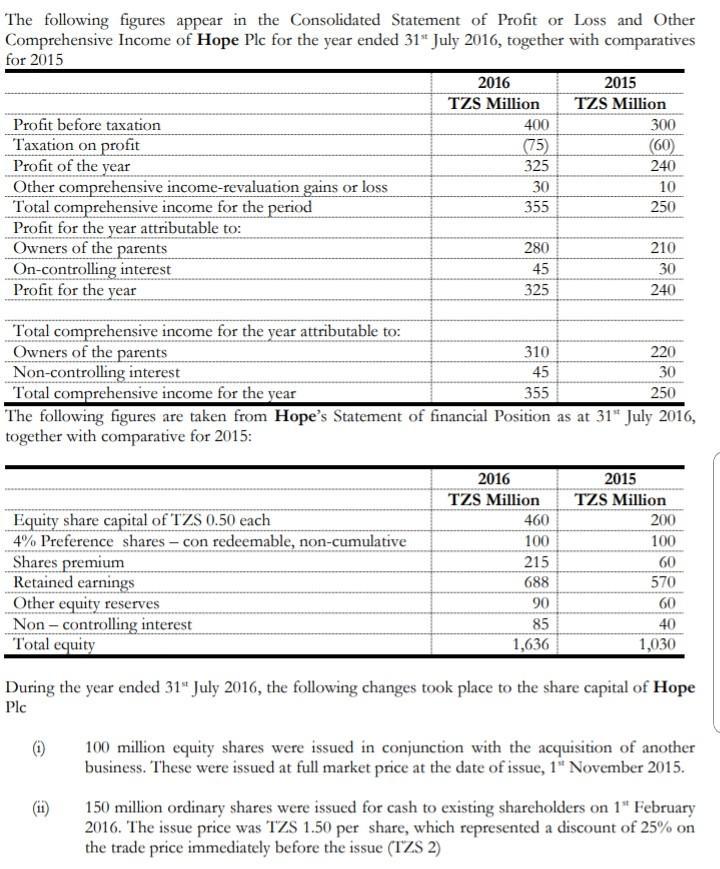

The following figures appear in the Consolidated Statement of Profit or Loss and Other Comprehensive Income of Hope Plc for the year ended 31

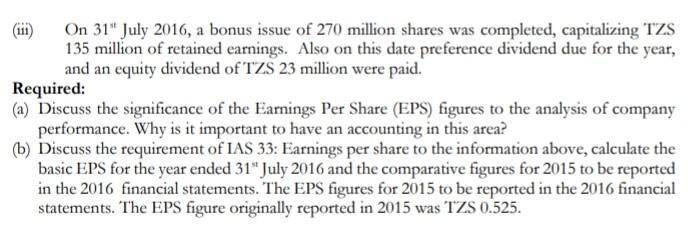

The following figures appear in the Consolidated Statement of Profit or Loss and Other Comprehensive Income of Hope Plc for the year ended 31 July 2016, together with comparatives for 2015 Profit before taxation Taxation on profit Profit of the year Other comprehensive income-revaluation gains or loss Total comprehensive income for the period Profit for the year attributable to: Owners of the parents On-controlling interest Profit for the year Total comprehensive income for the year attributable to: Owners of the parents Non-controlling interest Equity share capital of TZS 0.50 each 4% Preference shares- con redeemable, non-cumulative Shares premium Retained earnings Other equity reserves Non-controlling interest Total equity 2016 TZS Million (1) 400 (75) 325 (ii) 30 355 280 45 325 310 45 355 Total comprehensive income for the year The following figures are taken from Hope's Statement of financial Position as at 31" July 2016, together with comparative for 2015: 2016 TZS Million 2015 TZS Million 460 100 215 688 90 85 1,636 300 (60) 240 10 250 210 30 240 220 30 250 2015 TZS Million 200 100 60 570 60 During the year ended 31 July 2016, the following changes took place to the share capital of Hope Plc 40 1,030 100 million equity shares were issued in conjunction with the acquisition of another business. These were issued at full market price at the date of issue, 1" November 2015. 150 million ordinary shares were issued for cash to existing shareholders on 1 February 2016. The issue price was TZS 1.50 per share, which represented a discount of 25% on the trade price immediately before the issue (TZS 2) On 31 July 2016, a bonus issue of 270 million shares was completed, capitalizing TZS 135 million of retained earnings. Also on this date preference dividend due for the year, and an equity dividend of TZS 23 million were paid. Required: (a) Discuss the significance of the Earnings Per Share (EPS) figures to the analysis of company performance. Why is it important to have an accounting in this area? (b) Discuss the requirement of IAS 33: Earnings per share to the information above, calculate the basic EPS for the year ended 31 July 2016 and the comparative figures for 2015 to be reported in the 2016 financial statements. The EPS figures for 2015 to be reported in the 2016 financial statements. The EPS figure originally reported in 2015 was TZS 0.525.

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a Earnings Per Share EPS is a measure of the profitability of a company calculated by dividing the net income available to the common shareholders by the total number of outstanding common shares It i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started