Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following figures relate to the current year's position in an engineering industry operating at 70% capacity level: BE Point 80 Crores. P/V ratio

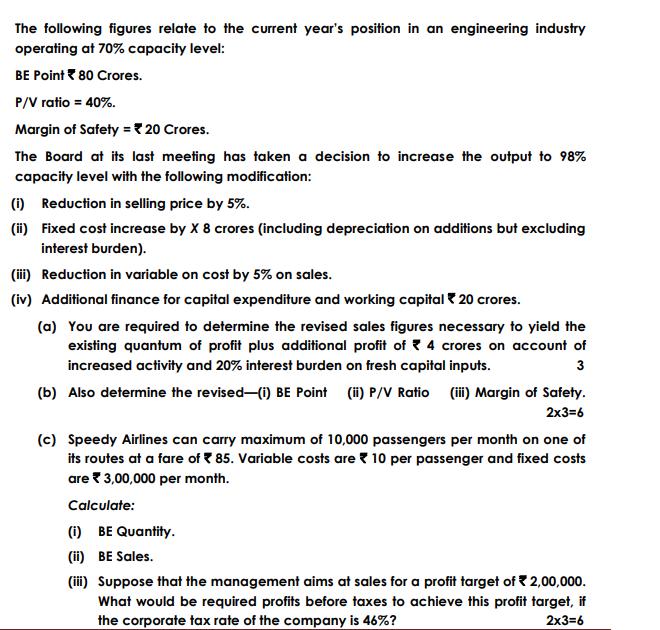

The following figures relate to the current year's position in an engineering industry operating at 70% capacity level: BE Point 80 Crores. P/V ratio = 40%. Margin of Safety = 20 Crores. The Board at its last meeting has taken a decision to increase the output to 98% capacity level with the following modification: (i) Reduction in selling price by 5%. (ii) Fixed cost increase by X 8 crores (including depreciation on additions but excluding interest burden). (iii) Reduction in variable on cost by 5% on sales. (iv) Additional finance for capital expenditure and working capital 20 crores. (a) You are required to determine the revised sales figures necessary to yield the existing quantum of profit plus additional profit of 4 crores on account of increased activity and 20% interest burden on fresh capital inputs. 3 (b) Also determine the revised-(i) BE Point (ii) P/V Ratio (iii) Margin of Safety. 2x3=6 (c) Speedy Airlines can carry maximum of 10,000 passengers per month on one of its routes at a fare of 85. Variable costs are 10 per passenger and fixed costs are 3,00,000 per month. Calculate: (i) BE Quantity. (ii) BE Sales. (iii) Suppose that the management aims at sales for a profit target of 2,00,000. What would be required profits before taxes to achieve this profit target, if the corporate tax rate of the company is 46%? 2x3=6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started