Answered step by step

Verified Expert Solution

Question

1 Approved Answer

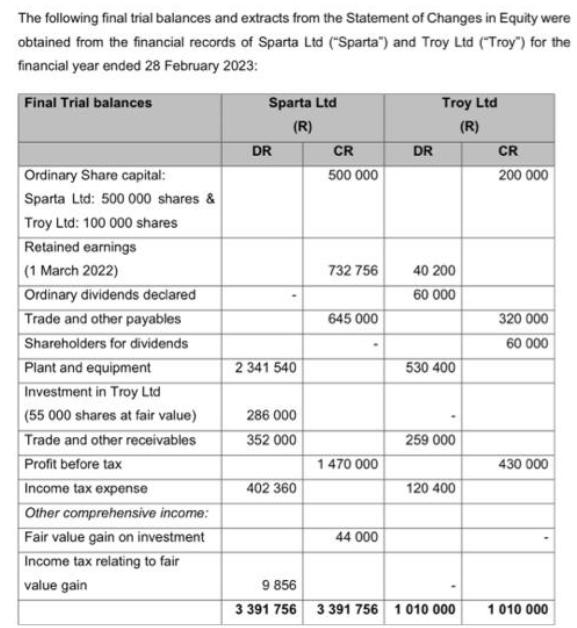

The following final trial balances and extracts from the Statement of Changes in Equity were obtained from the financial records of Sparta Ltd (Sparta)

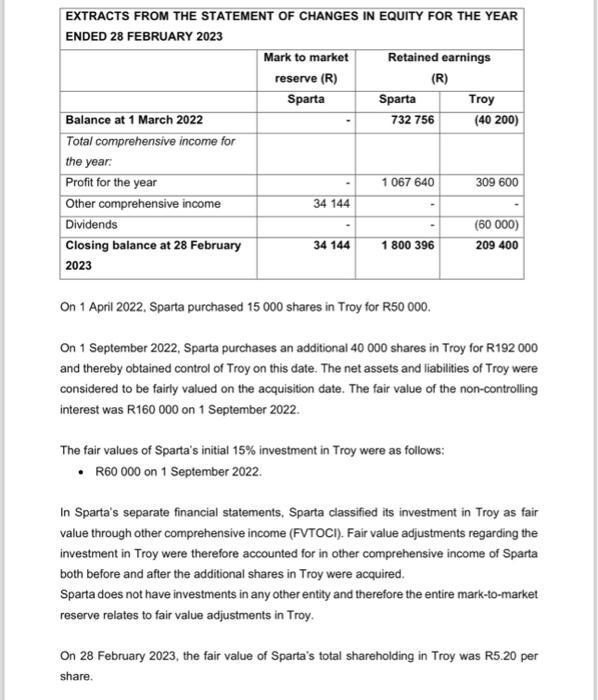

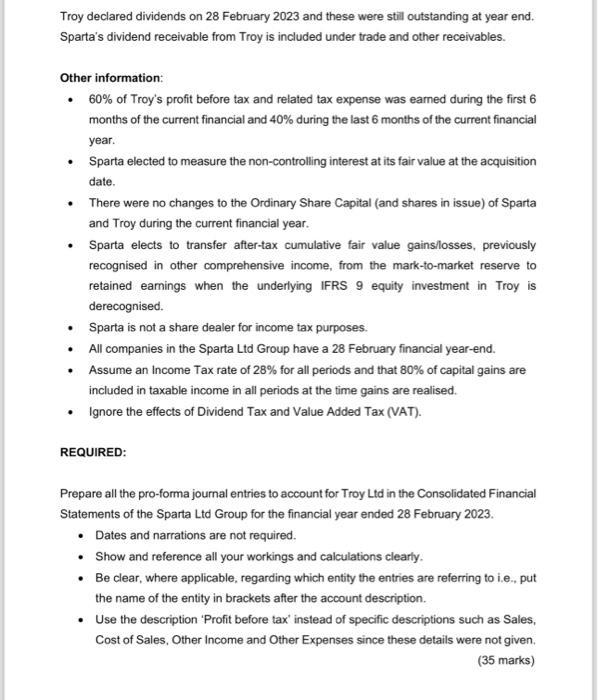

The following final trial balances and extracts from the Statement of Changes in Equity were obtained from the financial records of Sparta Ltd ("Sparta") and Troy Ltd ("Troy") for the financial year ended 28 February 2023: Final Trial balances Ordinary Share capital: Sparta Ltd: 500 000 shares & Troy Ltd: 100 000 shares Retained earnings (1 March 2022) Ordinary dividends declared Trade and other payables Shareholders for dividends Plant and equipment Investment in Troy Ltd (55 000 shares at fair value) Trade and other receivables Profit before tax Income tax expense Other comprehensive income: Fair value gain on investment Income tax relating to fair value gain Sparta Ltd (R) DR 2 341 540 286 000 352 000 402 360 CR 500 000 732 756 645 000 1 470 000 44 000 DR Troy Ltd (R) 40 200 60 000 530 400 259 000 120 400 9 856 3 391 756 3 391 756 1010 000 CR 200 000 320 000 60 000 430 000 1 010 000 EXTRACTS FROM THE STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 28 FEBRUARY 2023 Balance at 1 March 2022 Total comprehensive income for the year: Profit for the year Other comprehensive income Dividends Closing balance at 28 February 2023 Mark to market reserve (R) Sparta 34 144 34 144 Retained earnings Sparta (R) 732 756 1 067 640 1 800 396 On 1 April 2022, Sparta purchased 15 000 shares in Troy for R50 000. Troy The fair values of Sparta's initial 15% investment in Troy were as follows: R60 000 on 1 September 2022. (40 200) 309 600 (60 000) 209 400 On 1 September 2022, Sparta purchases an additional 40 000 shares in Troy for R192 000 and thereby obtained control of Troy on this date. The net assets and liabilities of Troy were considered to be fairly valued on the acquisition date. The fair value of the non-controlling interest was R160 000 on 1 September 2022. In Sparta's separate financial statements, Sparta classified its investment in Troy as fair value through other comprehensive income (FVTOCI). Fair value adjustments regarding the investment in Troy were therefore accounted for in other comprehensive income of Sparta both before and after the additional shares in Troy were acquired. Sparta does not have investments in any other entity and therefore the entire mark-to-market reserve relates to fair value adjustments in Troy. On 28 February 2023, the fair value of Sparta's total shareholding in Troy was R5.20 per share. Troy declared dividends on 28 February 2023 and these were still outstanding at year end. Sparta's dividend receivable from Troy is included under trade and other receivables. Other information: 60% of Troy's profit before tax and related tax expense was earned during the first 6 months of the current financial and 40% during the last 6 months of the current financial year. Sparta elected to measure the non-controlling interest at its fair value at the acquisition date. . There were no changes to the Ordinary Share Capital (and shares in issue) of Sparta and Troy during the current financial year. Sparta elects to transfer after-tax cumulative fair value gains/losses, previously recognised in other comprehensive income, from the mark-to-market reserve to retained earnings when the underlying IFRS 9 equity investment in Troy is derecognised. Sparta is not a share dealer for income tax purposes. All companies in the Sparta Ltd Group have a 28 February financial year-end. Assume an Income Tax rate of 28% for all periods and that 80% of capital gains are included in taxable income in all periods at the time gains are realised. Ignore the effects of Dividend Tax and Value Added Tax (VAT). REQUIRED: Prepare all the pro-forma journal entries to account for Troy Ltd in the Consolidated Financial Statements of the Sparta Ltd Group for the financial year ended 28 February 2023. Dates and narrations are not required. Show and reference all your workings and calculations clearly. Be clear, where applicable, regarding which entity the entries are referring to i.e., put the name of the entity in brackets after the account description. Use the description 'Profit before tax' instead of specific descriptions such as Sales, Cost of Sales, Other Income and Other Expenses since these details were not given. (35 marks)

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To provide a comprehensive analysis I will summarize the key information and transactions and calculate relevant financial figures 1 Sparta Ltd and Tr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started