Answered step by step

Verified Expert Solution

Question

1 Approved Answer

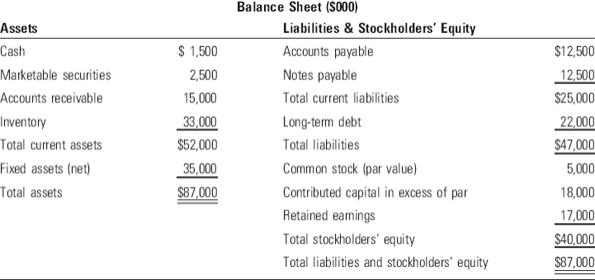

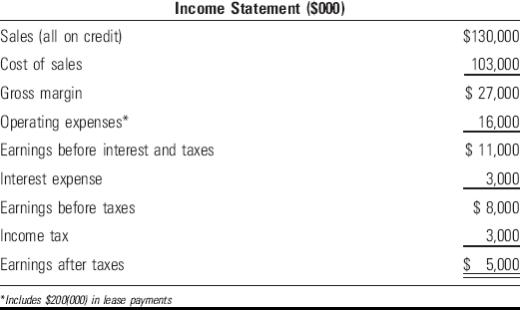

The following financial data for the Freemont Corporation . 5.Calculate the following market-based ratios and interpret each ratio: Price-to-earnings ratio Market price-to-book value ratio Assets

The following financial data for the Freemont Corporation

.

.

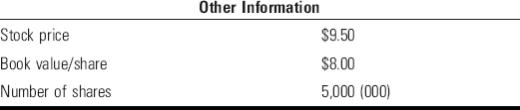

5.Calculate the following market-based ratios and interpret each ratio:

Price-to-earnings ratio

Market price-to-book value ratio

Assets Cash Marketable securities Accounts receivable Inventory Total current assets Fixed assets (net) Total assets $ 1,500 2,500 15,000 33,000 $52,000 35,000 $87,000 Balance Sheet (S000) Liabilities & Stockholders' Equity Accounts payable Notes payable Total current liabilities Long-term debt Total liabilities Common stock (par value) Contributed capital in excess of par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $12,500 12,500 $25,000 22,000 $47,000 5,000 18,000 17,000 $40,000 $87,000

Step by Step Solution

★★★★★

3.31 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

5 Pricetoearnings ratio Current share priceEarning per sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started