Question

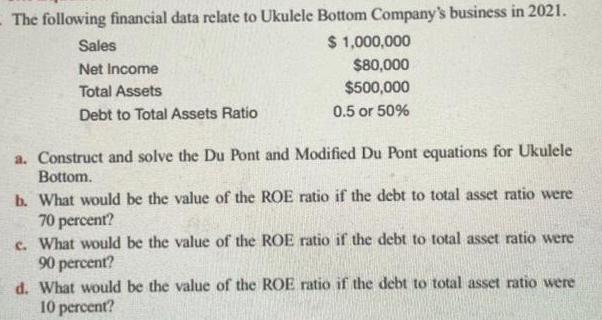

- The following financial data relate to Ukulele Bottom Company's business in 2021. $ 1,000,000 $80,000 $500,000 0.5 or 50% Sales Net Income Total

- The following financial data relate to Ukulele Bottom Company's business in 2021. $ 1,000,000 $80,000 $500,000 0.5 or 50% Sales Net Income Total Assets Debt to Total Assets Ratio a. Construct and solve the Du Pont and Modified Du Pont equations for Ukulele Bottom. b. What would be the value of the ROE ratio if the debt to total asset ratio were 70 percent? c. What would be the value of the ROE ratio if the debt to total asset ratio were 90 percent? d. What would be the value of the ROE ratio if the debt to total asset ratio were 10 percent?

Step by Step Solution

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Du Pont and Modified Du Pont equations for Ukulele Bottom Company well first find t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Theory And Practice

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

3rd Canadian Edition

017658305X, 978-0176583057

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App