Answered step by step

Verified Expert Solution

Question

1 Approved Answer

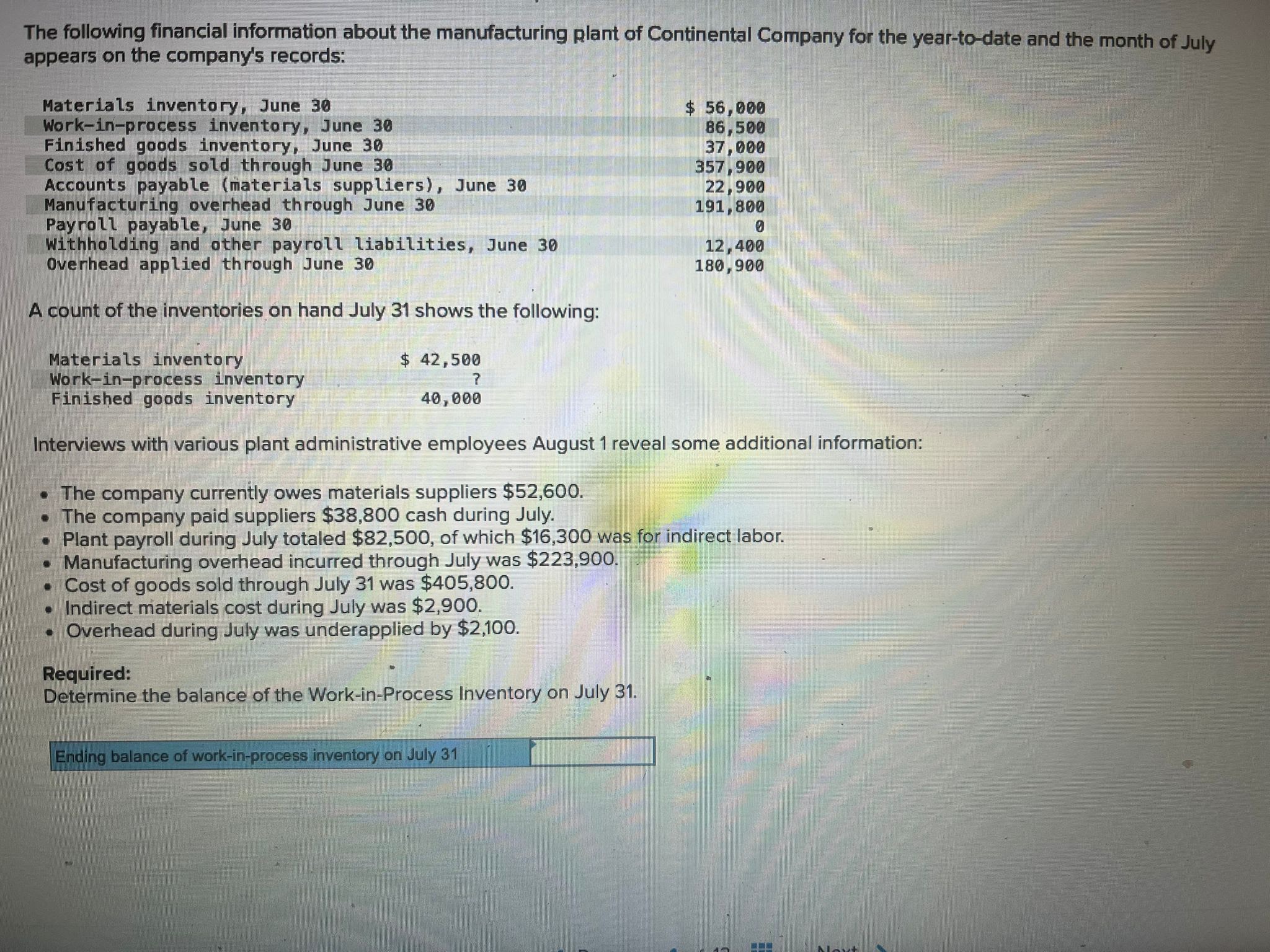

The following financial information about the manufacturing plant of Continental Company for the year-to-date and the month of July appears on the company's records:

The following financial information about the manufacturing plant of Continental Company for the year-to-date and the month of July appears on the company's records: Materials inventory, June 30 Work-in-process inventory, June 30 $ 56,000 86,500 Finished goods inventory, June 30 37,000 Cost of goods sold through June 30 357,900 Accounts payable (materials suppliers), June 30 Manufacturing overhead through June 30 22,900 191,800 Payroll payable, June 30 Withholding and other payroll liabilities, June 30 Overhead applied through June 30 12,400 180,900 A count of the inventories on hand July 31 shows the following: Materials inventory $ 42,500 Work-in-process inventory ? 40,000 Finished goods inventory Interviews with various plant administrative employees August 1 reveal some additional information: . The company currently owes materials suppliers $52,600. The company paid suppliers $38,800 cash during July. Plant payroll during July totaled $82,500, of which $16,300 was for indirect labor. Manufacturing overhead incurred through July was $223,900. . Cost of goods sold through July 31 was $405,800. Indirect materials cost during July was $2,900. Overhead during July was underapplied by $2,100. Required: Determine the balance of the Work-in-Process Inventory on July 31. Ending balance of work-in-process inventory on July 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the balance of the WorkinProcess Inventory on July 31 we need to calculate the changes ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started