Answered step by step

Verified Expert Solution

Question

1 Approved Answer

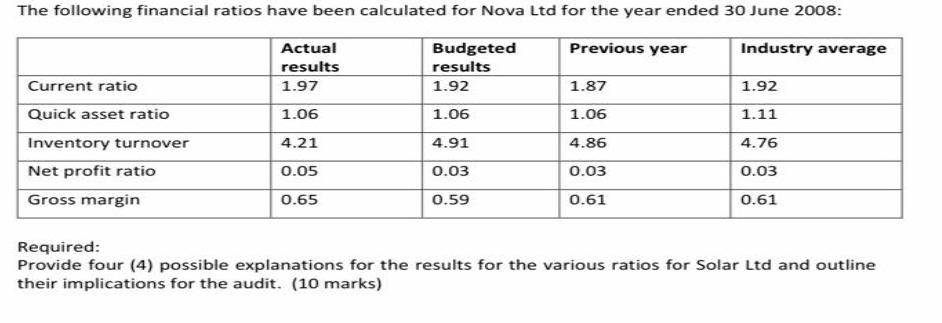

The following financial ratios have been calculated for Nova Ltd for the year ended 30 June 2008: Actual Budgeted Previous year Industry average results

The following financial ratios have been calculated for Nova Ltd for the year ended 30 June 2008: Actual Budgeted Previous year Industry average results results Current ratio 1.97 1.92 1.87 1.92 Quick asset ratio 1.06 1.06 1.06 1.11 Inventory turnover 4.21 4.91 4.86 4.76 Net profit ratio 0.05 0.03 0.03 0.03 Gross margin 0.65 0.59 0.61 0.61 Required: Provide four (4) possible explanations for the results for the various ratios for Solar Ltd and outline their implications for the audit. (10 marks) The following financial ratios have been calculated for Nova Ltd for the year ended 30 June 2008: Actual Budgeted Previous year Industry average results results Current ratio 1.97 1.92 1.87 1.92 Quick asset ratio 1.06 1.06 1.06 1.11 Inventory turnover 4.21 4.91 4.86 4.76 Net profit ratio 0.05 0.03 0.03 0.03 Gross margin 0.65 0.59 0.61 0.61 Required: Provide four (4) possible explanations for the results for the various ratios for Solar Ltd and outline their implications for the audit. (10 marks)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Current ratio current assets current liabilities Healthy ideal current ratio is 21 Here Nova companys current ratio is 1971 which is close to the idea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started