Question

The following financial statements and additional information are reported. Comparative Balance Sheets At December 31 Year 2 Year 1 Assets Cash $ 102,100 $ 53,000

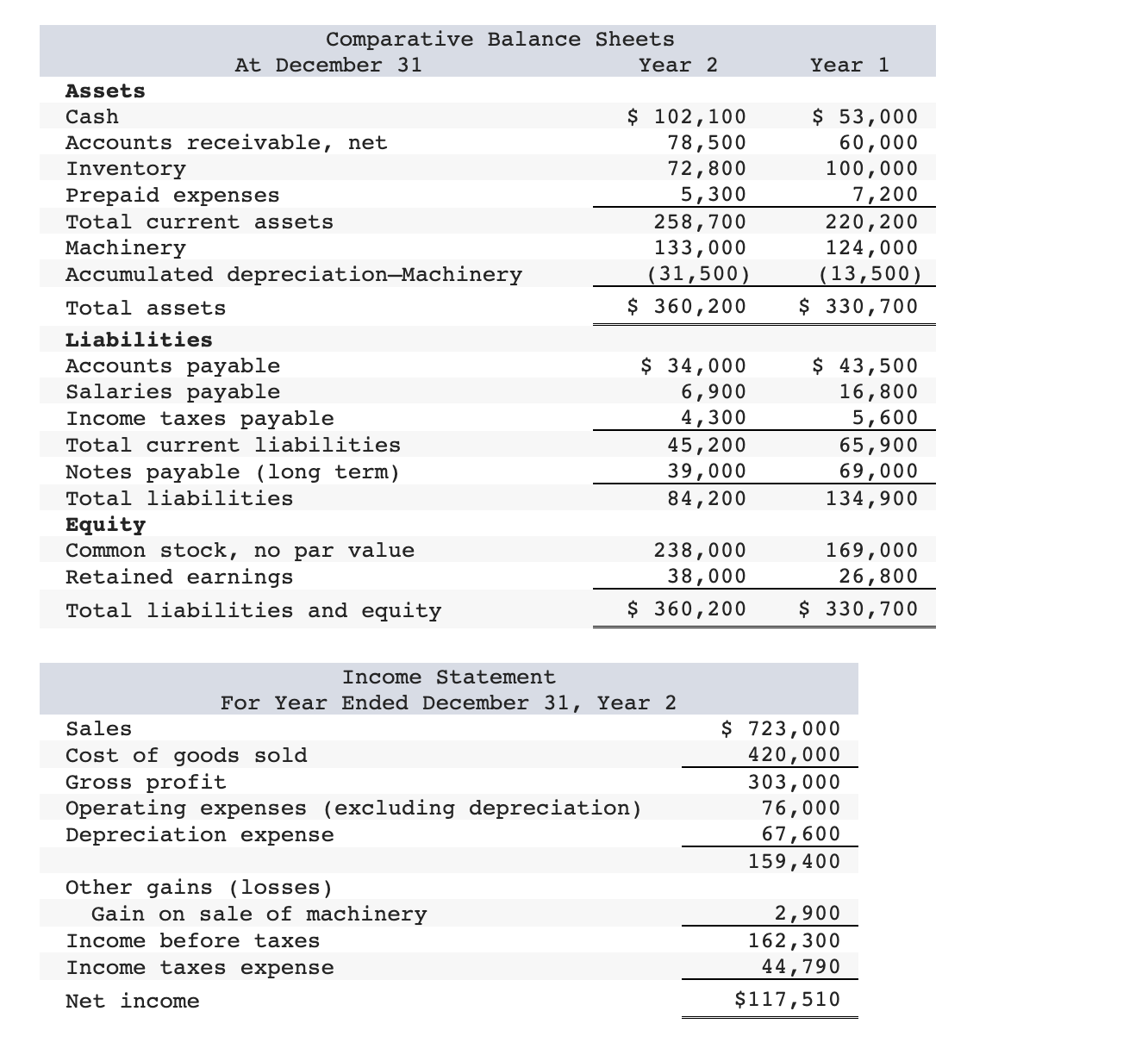

The following financial statements and additional information are reported. Comparative Balance Sheets At December 31 Year 2 Year 1 Assets Cash $ 102,100 $ 53,000 Accounts receivable, net 78,500 60,000 Inventory 72,800 100,000 Prepaid expenses 5,300 7,200 Total current assets 258,700 220,200 Machinery 133,000 124,000 Accumulated depreciationMachinery (31,500) (13,500) Total assets $ 360,200 $ 330,700 Liabilities Accounts payable $ 34,000 $ 43,500 Salaries payable 6,900 16,800 Income taxes payable 4,300 5,600 Total current liabilities 45,200 65,900 Notes payable (long term) 39,000 69,000 Total liabilities 84,200 134,900 Equity Common stock, no par value 238,000 169,000 Retained earnings 38,000 26,800 Total liabilities and equity $ 360,200 $ 330,700

The following financial statements and additional information are reported. Comparative Balance Sheets At December 31 Year 2 Year 1 Assets Cash $ 102,100 $ 53,000 Accounts receivable, net 78,500 60,000 Inventory 72,800 100,000 Prepaid expenses 5,300 7,200 Total current assets 258,700 220,200 Machinery 133,000 124,000 Accumulated depreciationMachinery (31,500) (13,500) Total assets $ 360,200 $ 330,700 Liabilities Accounts payable $ 34,000 $ 43,500 Salaries payable 6,900 16,800 Income taxes payable 4,300 5,600 Total current liabilities 45,200 65,900 Notes payable (long term) 39,000 69,000 Total liabilities 84,200 134,900 Equity Common stock, no par value 238,000 169,000 Retained earnings 38,000 26,800 Total liabilities and equity $ 360,200 $ 330,700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started