Question

The following financial statements are for Disney FY2022 and FY2021. Calculate the net working capital for FY2021. (Hint: do not include the current portion of

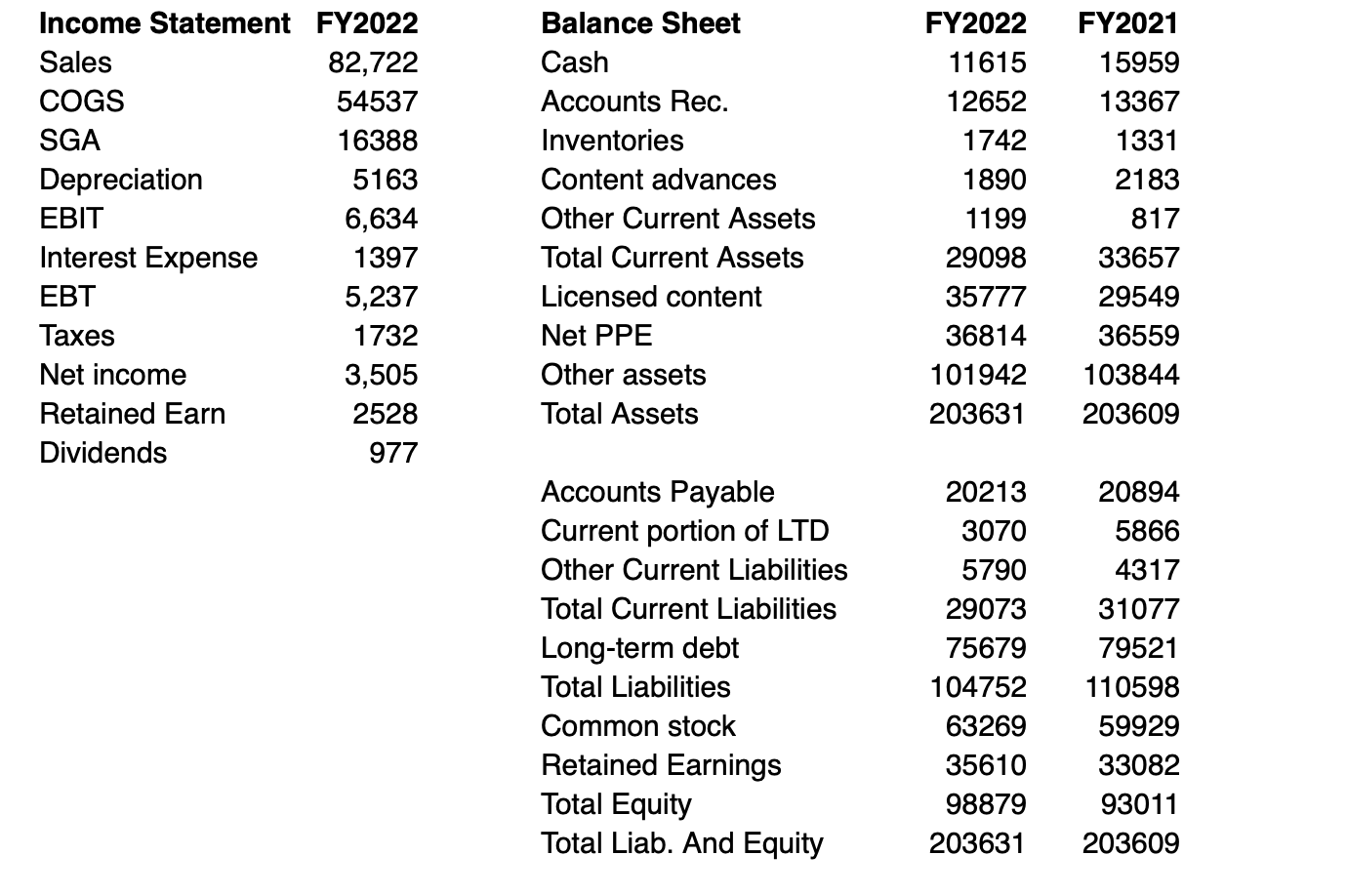

The following financial statements are for Disney FY2022 and FY2021.

Calculate the net working capital for FY2021. (Hint: do not include the current portion of LTD in the calculation).

Calculate the year-over-year change in net working capital. (Hint: do not include the current portion of LTD in the calculation).

Calculate the operating cash flows (OCF) (Hint: OCF = EBIT + depreciation - taxes).

Calculate the net capital spending (NCS).

Calculate the cash flow to the shareholders.

Calculate the cash flow to the bondholders.

Calculate the cash flow from assets (CFA).

Calculate the cash flows from operations as it would appear on the FY2021 statement of cash flows.

Calculate the cash flows from investing activities as it would appear on the FY2021 statement of cash flows. (Hint: enter a negative value).

Calculate the cash flows from financing activities as it would appear on the FY2021 statement of cash flows. (Hint: enter a negative value).

Calculate the year-over-year change in the cash account. (Hint: enter a negative value).

IncomeStatementSalesCOGSSGADepreciationEBITInterestExpenseEBTTaxesNetincomeRetainedEarnDividendsFY202282,722545371638851636,63413975,23717323,5052528977BalanceSheetCashAccountsRec.InventoriesContentadvancesOtherCurrentAssetsTotalCurrentAssetsLicensedcontentNetPPEOtherassetsTotalAssetsAccountsPayableCurrentportionofLTDOtherCurrentLiabilitiesTotalCurrentLiabilitiesLong-termdebtTotalLiabilitiesCommonstockRetainedEarningsTotalEquityTotalLiab.AndEquityFY2022116151265217421890119929098357773681410194220363120213307057902907375679104752632693561098879203631FY202115959133671331218381733657295493655910384420360920894586643173107779521110598599293308293011203609Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started