Answered step by step

Verified Expert Solution

Question

1 Approved Answer

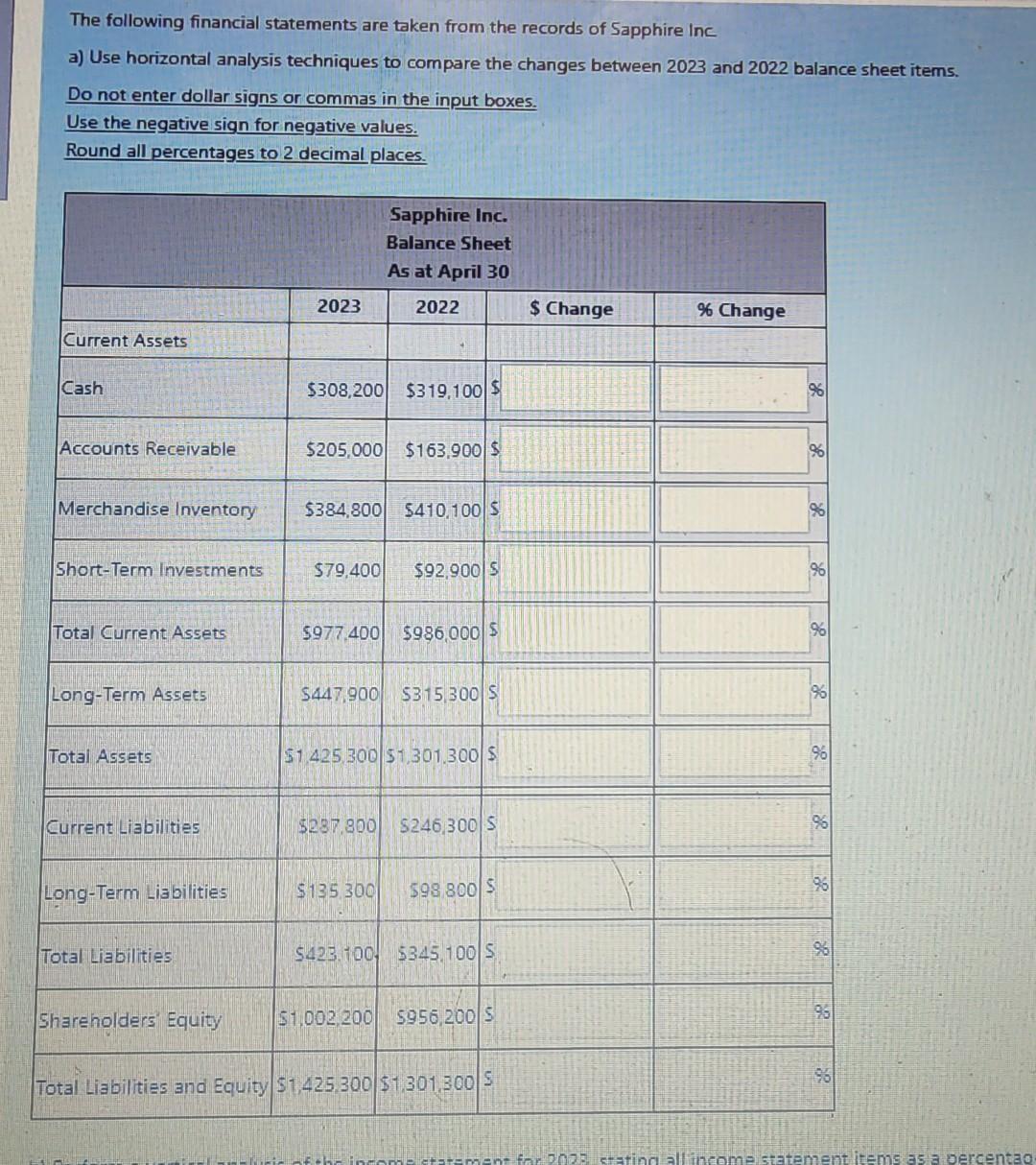

The following financial statements are taken from the records of Sapphire Inc. a) Use horizontal analysis techniques to compare the changes between 2023 and

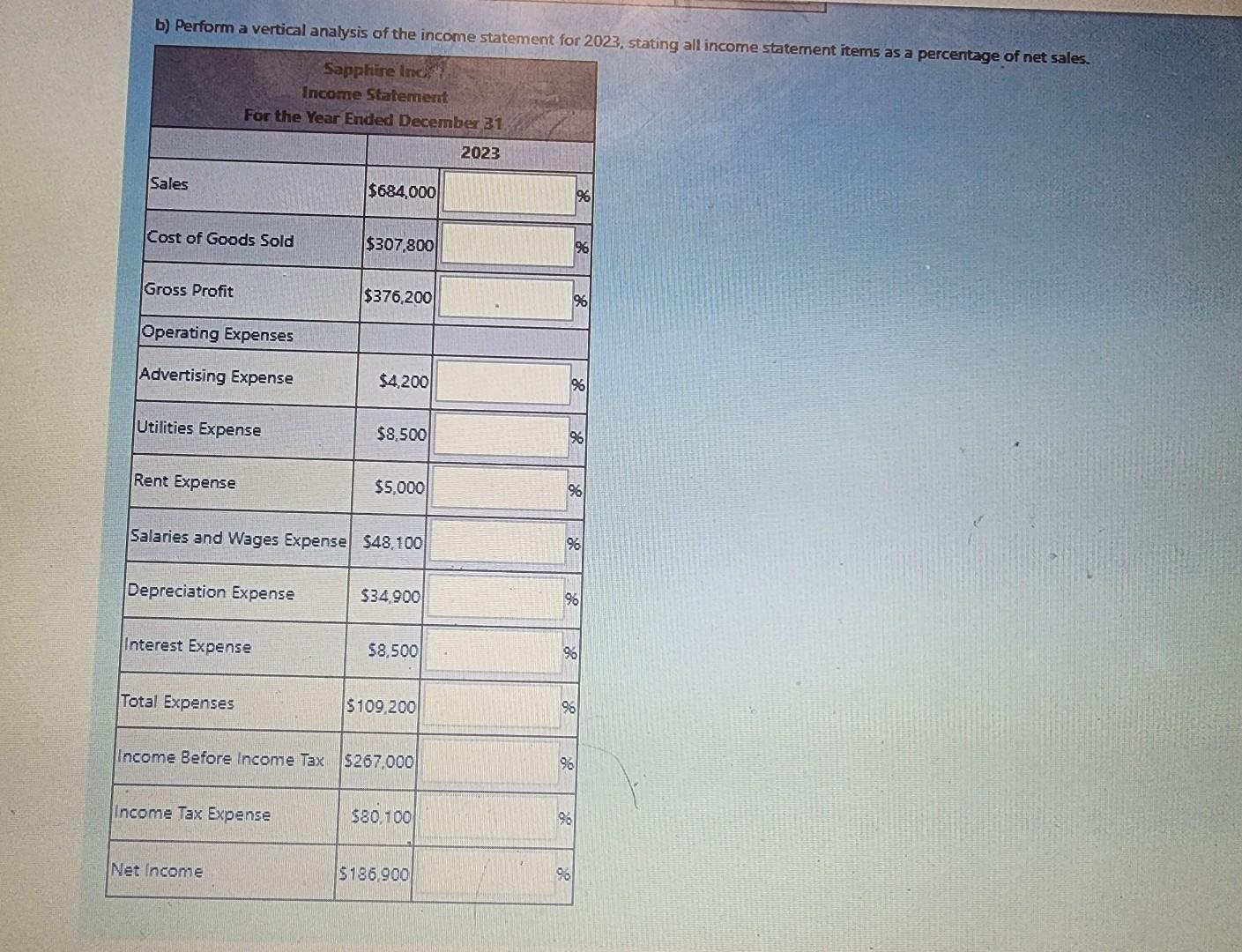

The following financial statements are taken from the records of Sapphire Inc. a) Use horizontal analysis techniques to compare the changes between 2023 and 2022 balance sheet items. Do not enter dollar signs or commas in the input boxes. Use the negative sign for negative values. Round all percentages to 2 decimal places. Current Assets Cash Accounts Receivable Merchandise Inventory Short-Term Investments Total Current Assets Long-Term Assets Total Assets Current Liabilities Long-Term Liabilities Total Liabilities 2023 $308,200 $319,100 $ $205,000 $163,900 $ Sapphire Inc. Balance Sheet As at April 30 2022 $384,800 $410,100 S $79,400 $92,900 S $977,400 $447,900 $986,000 $ $135.300 $315,300 S $1,425,300 $1,301,300 $ $287,800 $246,300 S $98,800 $ $423.100 $345.100 S Shareholders Equity $1,002,200 $956,200 S Total Liabilities and Equity $1,425,300 $1,301,300 S $ Change % Change 96 96 95 96 for 2025 seating all income statement items as a percentag b) Perform a vertical analysis of the income statement for 2023, stating all income statement items as a percentage of net sales. Sapphire Inc. Income Statement For the Year Ended December 31 2023 Sales Cost of Goods Sold Gross Profit Operating Expenses Advertising Expense Utilities Expense Rent Expense Depreciation Expense Interest Expense Total Expenses $684,000 Income Tax Expense $307,800 Salaries and Wages Expense $48,100 Net Income $376,200 $4,200 $8,500 $5,000 $34,900 $8,500 Income Before Income Tax $267,000 $109,200 $80,100 $136,900 196 96 %6 96 96 1% 96 96 96 96 96 96

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SAPPHIRE INC Horizontal Analysis of Balance Sheet as at April 30 showing comparison of 2023 and 2022 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started