Answered step by step

Verified Expert Solution

Question

1 Approved Answer

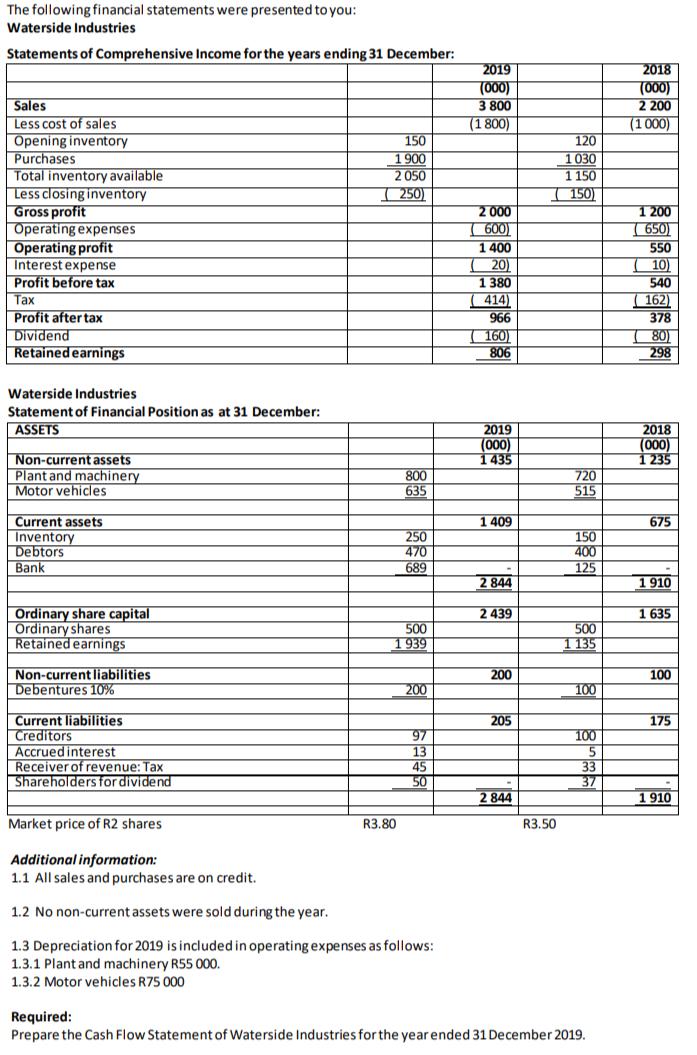

The following financial statements were presented to you: Waterside Industries Statements of Comprehensive Income for the years ending 31 December: Sales Less cost of

The following financial statements were presented to you: Waterside Industries Statements of Comprehensive Income for the years ending 31 December: Sales Less cost of sales 150 Opening inventory Purchases 1900 Total inventory available 2050 250) Less closing inventory Gross profit Operating expenses Operating profit Interest expense Profit before tax Tax Profit after tax Dividend Retained earnings Waterside Industries Statement of Financial Position as at 31 December: ASSETS Non-current assets Plant and machinery Motor vehicles Current assets Inventory Debtors Bank Ordinary share capital Ordinary shares. Retained earnings Non-current liabilities Debentures 10% Current liabilities Creditors Accrued interest Receiver of revenue: Tax Shareholders for dividend Market price of R2 shares R3.80 R3.50 Additional information: 1.1 All sales and purchases are on credit. 1.2 No non-current assets were sold during the year. 1.3 Depreciation for 2019 is included in operating expenses as follows: 1.3.1 Plant and machinery R55 000. 1.3.2 Motor vehicles R75 000 Required: Prepare the Cash Flow Statement of Waterside Industries for the year ended 31 December 2019. 800 635 250 470 689 500 1939 200 97 13 45 50 2019 (000) 3 800 (1800) 2 000 600) 1400 (20) 1380 (414) 966 160) 806 2019 (000) 1435 1409 2 844 2 439 200 205 2 844 120 1030 1150 150) | | 720 515 150 400 125 500 1135 100 100 5 33 37 2018 (000) 2 200 (1000) 1 200 (650) 550 (10) 540 (162) 378 (80) 298 2018 (000) 1 235 675 1910 1 635 100 175 1910

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation Cash Flow Statement For the Year Ending 12312019 Cash at Beginning of Year 125 Op...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started