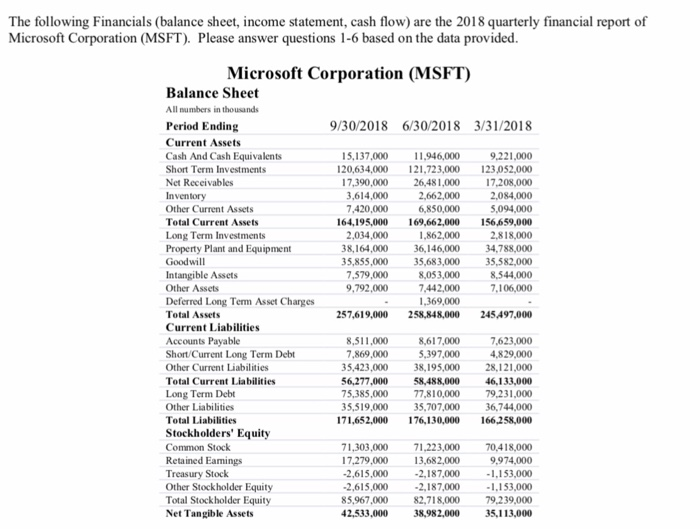

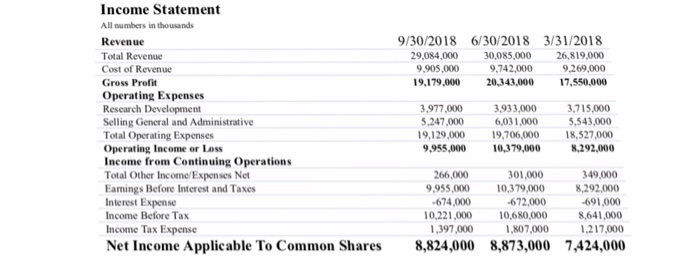

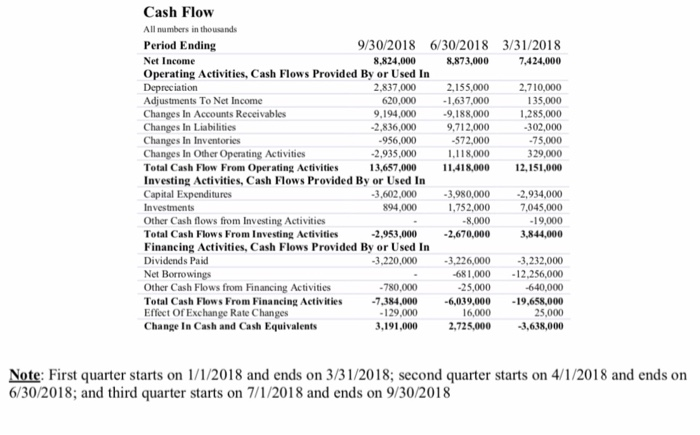

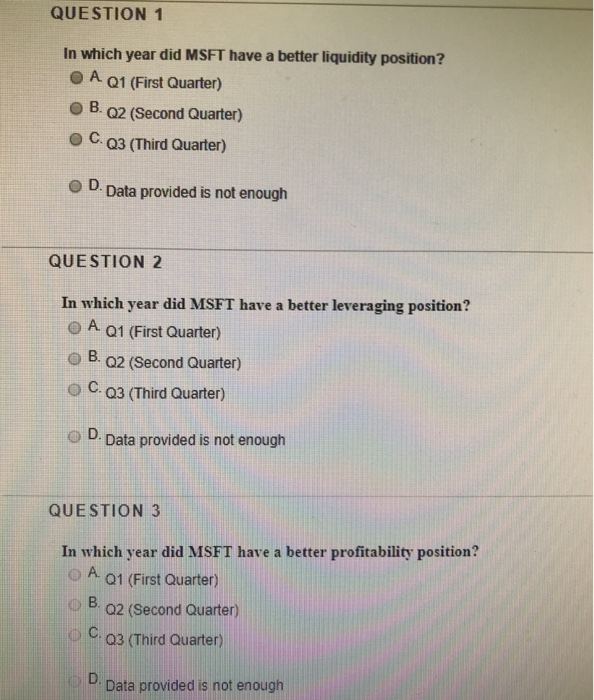

The following Financials (balance sheet, income statement, cash flow) are the 2018 quarterly financial report of Microsoft Corporation (MSFT). Please answer questions 1-6 based on the data provided. Microsoft Corporation (MSFT) Balance Sheet 9/30/2018 6/30/2018 3/31/2018 Period Ending Current Assets Cash And Cash Equivalents Short Term Investments Net Receivables Inventory Other Current Assets Total Current Assets Long Term Investments Property Plant and Equipment Goodwill Intangible Assets Other Assets Deferred Long Term Asset Charges Total Assets Current Liabilities Accounts Payable Short/Current Long Term Debt Other Current Liabilities Total Current Liabilities Long Term Debt Other Liabilities Total Liabilities Stockholders' Equity Common Stock Retained Eamings Treasury Stock Other Stock holder Equity Total Stockholder Equity Net Tangible Assets 9,221,000 20,634,000 121,723,000 123,052,000 7,390,000 26,481,000 17,208,000 2,084,000 5,094,000 164,195,000 169.662,000 156,659,000 2,818,000 8,164,000 36,146,000 34,788,000 35,855,000 35,683,000 35,582,000 15,137,000 11,946,000 3,614,000 7,420,000 2,662,000 6,850,000 2,034,000 1,862,000 7,579,000 9,792,000 8,053,000 7.442,000 1,369,000 7.106,000 257,619,000 258,848,000 245 497.000 8,311,000 7,869,000 8,617,000 5,397,000 7,623,000 4,829,000 5,423,000 38,195,000 28,121,000 56,277,000 58,488,000 46,133,000 79,231,000 5,519,000 35,707,00036,744,000 171,652,000 76,130,000 166258,000 5,385,000 778 77,810,000 1,303,000 71,223,000 70,418,000 9,974,000 1,153,000 1,153,000 85,967,000 82,718,000 79,239,000 42,533,000 38,982,000 35,113,000 7,279,000 3,682,000 2,615,000 2,187,000 2,615.000 2,187,000 Income Statement All numbers in thousands Revenue Total Revenue Cost of Revenue Gross Prefit Operating Expenses Research Development Selling General and Administrative Total Operating Expenses Operating Income or Loss Income from Continuing Operations Total Other Income/ Expenses Net Eamings Before Interest and Taxes Interest Expense Income Before Tax Income Tax Expense 9/30/2018 6/30/2018 3/31/2018 29,084,000 30,085,000 26,819,000 9,269,000 9,179,000 20,343,000 17,550,000 9,742,000 9,905,000 3,933,000 3,715,000 5,543,000 9.129,000 9,706,000 18,527,000 8,292,000 ,977,000 5,247,000 6,031,000 9,955,000 0,379,000 01,000 349,000 8,292,000 691,000 8,641,000 1,217,000 266,000 674,000 1,397,000 8,824,000 9,955,000 0,379,000 672,000 0,221,000 0,680,000 1,807,000 Net Income Applicable To Common Shares 8,873,000 7,424,000 Cash Flow All numbers in thousands Period Ending Net Income Operating Activities, Cash Flows Provided By or Used In Depreciation Adjustments To Net Income Changes In Accounts Receivables Changes In Liabilities Changes In Inventories Changes In Other Operating Activities Total Cash Flow From Operating Activities Investing Activities, Cash Flows Provided By or Used In Capital Expenditures Investments Other Cash flows from Investing Activities Total Cash Flows From Investing Activities Financing Activities, Cash Flows Provided By or Used In Dividends Paid Net Borrowings Other Cash Flows from Financing Activities Total Cash Flows From Financing Activities Effect Of Exchange Rate Changes Change In Cash and Cash Equivalents 9/30/2018 6/30/2018 3/31/2018 7,424,000 8,873,000 8,824,000 2,837,000 620,000 2.1550002,710,000 135,000 1,637,00 9.194,000 9,188,000 285,000 9,712.000 572,000 1,118,000 13,657,000 11,418,000 12,151,000 2,836,00 956,000 2,935,000 302,000 75,000 329,000 3,602.000 894,000 ,980,000 2,934,000 7,045,000 19,000 3,844,000 1,752,000 -8,000 2,953,0002,670,000 3,220,0003,226,000 3,232,000 681,00012.256,000 640,000 780,000 25,000 7.384,000 6,039,00019,658,000 129,000 3,191,000 25,000 2,725,000 3,638,000 16,000 Note: First quarter starts on 1/1/2018 and ends on 3/31/2018; second quarter starts on 4/1/2018 and ends on 6/30/2018; and third quarter starts on 7/1/2018 and ends on 9/30/2018 QUESTION 1 In which year did MSFT have a better liquidity position? O A Q1 (First Quarter) O B. 02 (Second Quarter) o c. Q3 (Third Quarter) D. Data provided is not enough QUESTION 2 In which year did MSFT have a better leveraging position? O A Q1 (First Quarter) B. Q2 (Second Quarter) c-Q3 (Third Quarter) o D. Data provided is not enough QUESTION 3 In which year did MSFT have a better profitability position? O A a1 (First Quarter) B. Q2 (Second Quarter) 03 (Third Quarter) D. Data provided is not enough QUESTION 4 In which year did MSFT have a better "total asset management efficiency" position? O A 01 (First Quarter) O B. 02 (Second Quarter) o c-Q3 (Third Quarter) O D. Data provided is not enough QUESTION 5 In which year did MSFT have a better cash flow position? O A o1 (First Quarter) B. Q2 (Second Quarter) o C a3 (Third Quarter) O D. Data provided is not enough