Answered step by step

Verified Expert Solution

Question

1 Approved Answer

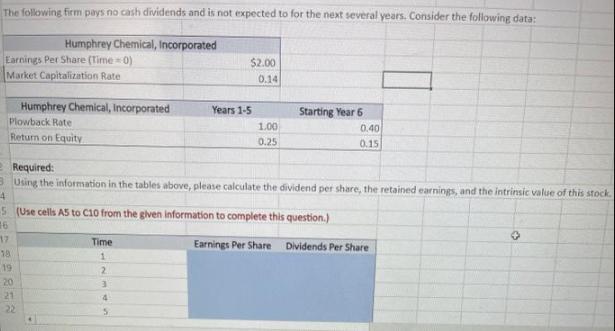

The following firm pays no cash dividends and is not expected to for the next several years. Consider the following data: Humphrey Chemical, Incorporated

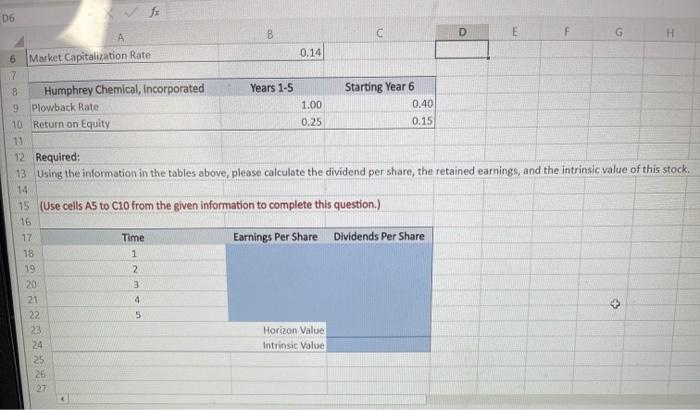

The following firm pays no cash dividends and is not expected to for the next several years. Consider the following data: Humphrey Chemical, Incorporated Earnings Per Share (Time=0) Market Capitalization Rate Humphrey Chemical, Incorporated Plowback Rate Return on Equity 17 18 19 20 21 22 Time 1 $2.00 0.14 Required: 3 Using the information in the tables above, please calculate the dividend per share, the retained earnings, and the intrinsic value of this stock. 4 5 (Use cells A5 to C10 from the given information to complete this question.) 16 2 3 4 Years 1-5 5 1.00 0.25 Starting Year 6 0.40 0.15 Earnings Per Share Dividends Per Share D6 6 7 12 13 14 A Market Capitalization Rate 8 9 Plowback Rate. 10 Return on Equity 11 Humphrey Chemical, Incorporated 18 19 20 21 22 23 24 25 26 27 fx Time 1 2 3 4 B 15 (Use cells A5 to C10 from the given information to complete this question.) 16 17 Earnings Per Share 5 Years 1-5 0.14 1.00 0.25 C Required: Using the information in the tables above, please calculate the dividend per share, the retained earnings, and the intrinsic value of this stock. Starting Year 6 Horizon Value Intrinsic Value 0.40 0.15 D Dividends Per Share E F G H

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Earnings per share in Year 1 2 given 2 Plowback rate in Years 15 is 100 given 3 This means dividen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started