Answered step by step

Verified Expert Solution

Question

1 Approved Answer

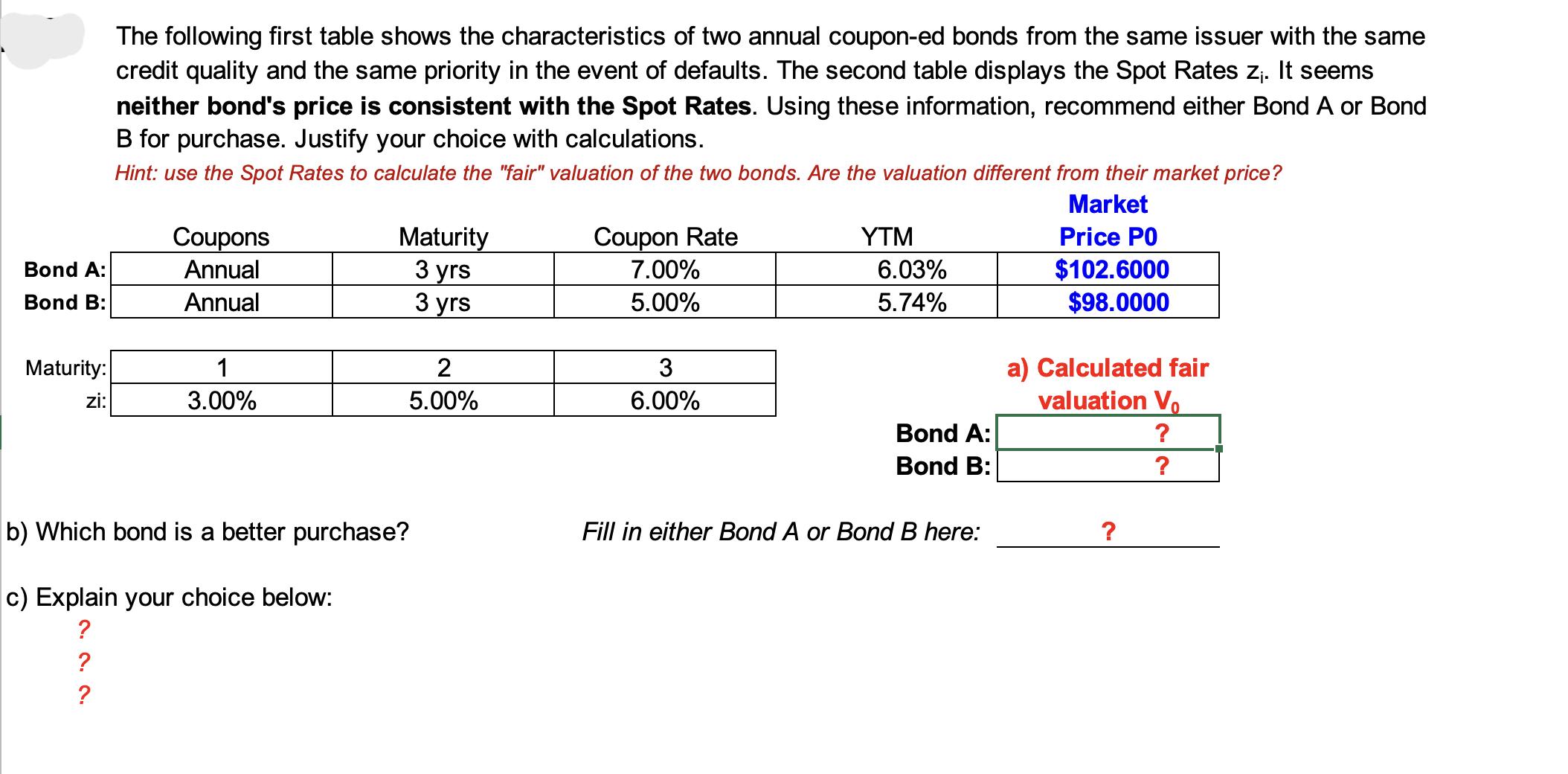

The following first table shows the characteristics of two annual coupon-ed bonds from the same issuer with the same credit quality and the same

The following first table shows the characteristics of two annual coupon-ed bonds from the same issuer with the same credit quality and the same priority in the event of defaults. The second table displays the Spot Rates Zi. It seems neither bond's price is consistent with the Spot Rates. Using these information, recommend either Bond A or Bond B for purchase. Justify your choice with calculations. Hint: use the Spot Rates to calculate the "fair" valuation of the two bonds. Are the valuation different from their market price? Coupon Rate 7.00% 5.00% Bond A: Coupons Annual Maturity 3 yrs Bond B: Annual 3 yrs Maturity: zi: 1 3.00% 2 3 5.00% 6.00% YTM 6.03% 5.74% Market Price PO $102.6000 $98.0000 a) Calculated fair valuation Vo Bond A: Bond B: b) Which bond is a better purchase? Fill in either Bond A or Bond B here: ? c) Explain your choice below: ? 2.2. ? ? ? ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started