Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following income statement and balance sheets for Laser World are provided: LASER WORLD Income Statement For the year-ended December 31, 2021 Sales revenue $

The following income statement and balance sheets for Laser World are provided:

| LASER WORLD | ||||

| Income Statement | ||||

| For the year-ended December 31, 2021 | ||||

| Sales revenue | $ | 2,260,000 | ||

| Cost of goods sold | 1,570,000 | |||

| Gross profit | 690,000 | |||

| Expenses: | ||||

| Operating expenses | 345,000 | |||

| Depreciation expense | 65,000 | |||

| Loss on sale of land | 4,900 | |||

| Interest expense | 24,000 | |||

| Income tax expense | 51,000 | |||

| Total expenses | 489,900 | |||

| Net income | $ | 200,100 | ||

| LASER WORLD | ||||||||

| Balance Sheet | ||||||||

| December 31 | ||||||||

| 2021 | 2020 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash | $ | 124,000 | $ | 105,000 | ||||

| Accounts receivable | 98,000 | 76,000 | ||||||

| Inventory | 140,000 | 120,000 | ||||||

| Prepaid rent | 16,000 | 16,000 | ||||||

| Long-term assets: | ||||||||

| Land | 340,000 | 280,000 | ||||||

| Equipment | 330,000 | 280,000 | ||||||

| Accumulated depreciation | (77,000 | ) | (47,000 | ) | ||||

| Total assets | $ | 971,000 | $ | 830,000 | ||||

| Liabilities and Stockholders' Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 51,000 | $ | 58,000 | ||||

| Interest payable | 8,900 | 7,900 | ||||||

| Income tax payable | 15,800 | 12,400 | ||||||

| Long-term liabilities: | ||||||||

| Notes payable | 380,000 | 280,000 | ||||||

| Stockholders' equity: | ||||||||

| Common stock | 130,000 | 130,000 | ||||||

| Retained earnings | 385,300 | 341,700 | ||||||

| Total liabilities and equity | $ | 971,000 | $ | 830,000 | ||||

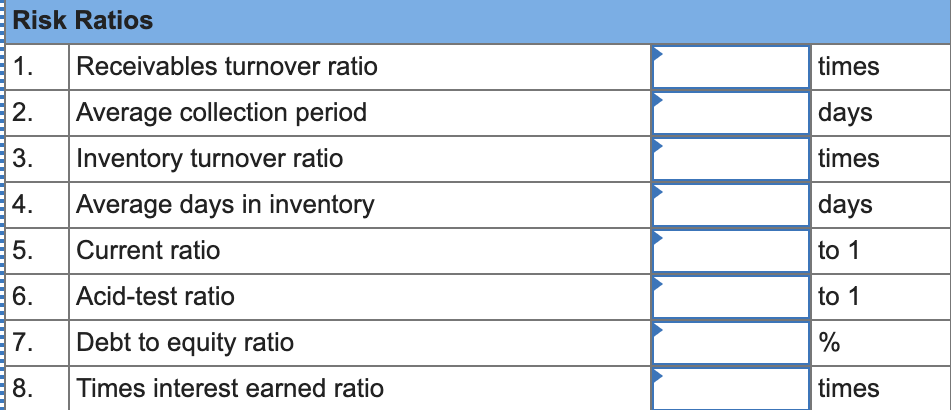

Assuming that all sales were on account, calculate the following risk ratios for 2021: (Assume 365 days in a year. Round your intermediate calculations and final answers to 1 decimal place.)

Risk Ratios 1. Receivables turnover ratio times 2. days 3. times Average collection period Inventory turnover ratio Average days in inventory Current ratio 4. days 5. to 1 6. Acid-test ratio to 1 7. 1 Debt to equity ratio % 8. Times interest earned ratio times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started