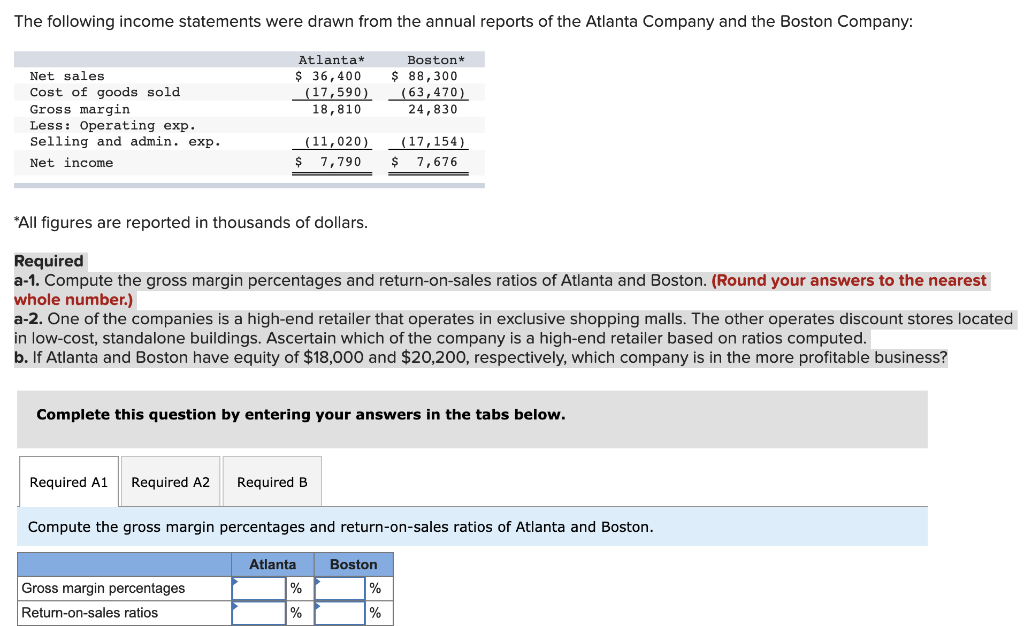

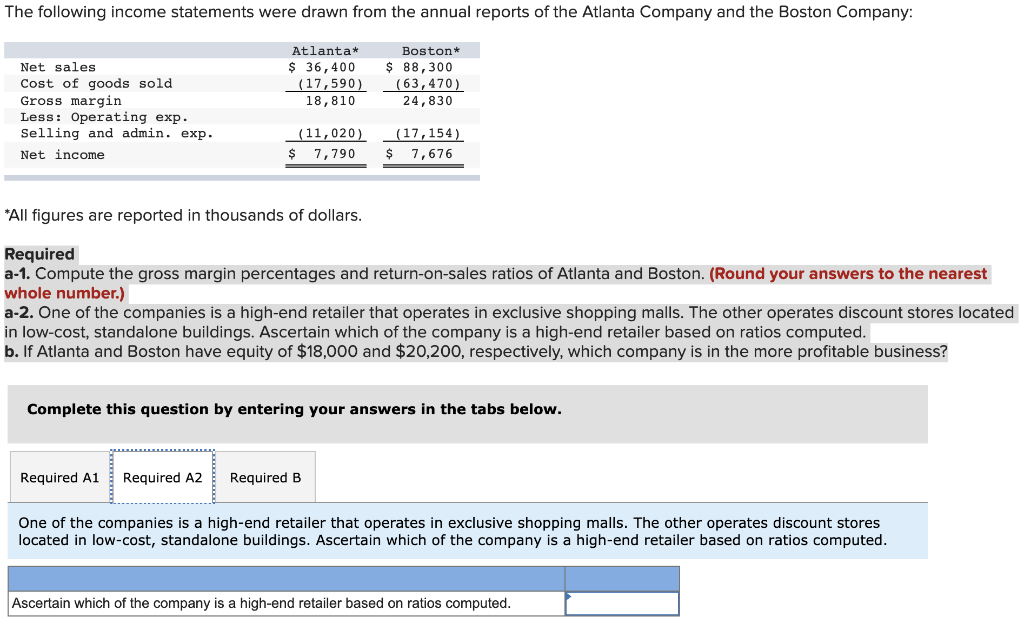

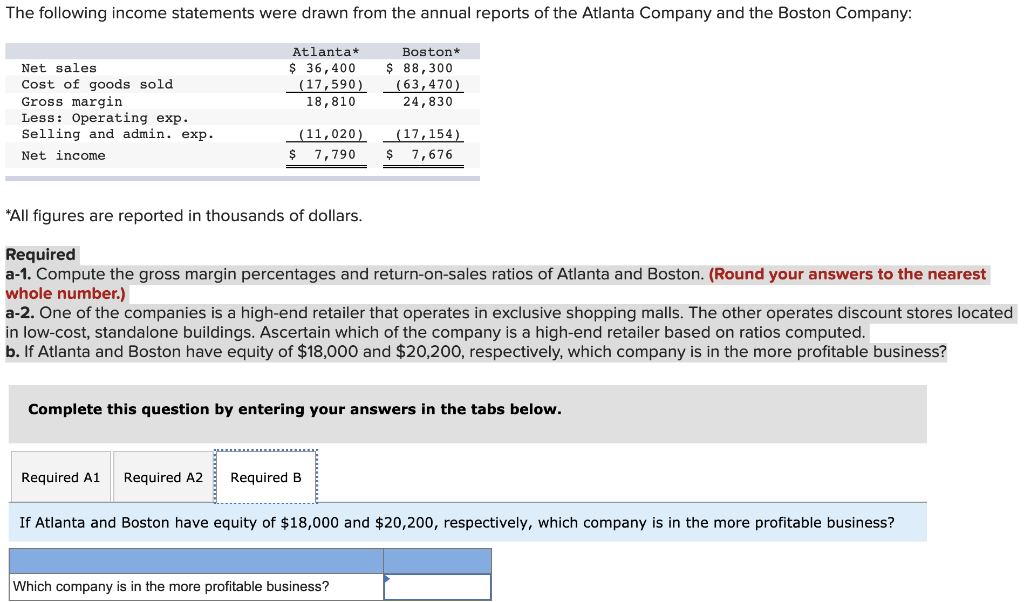

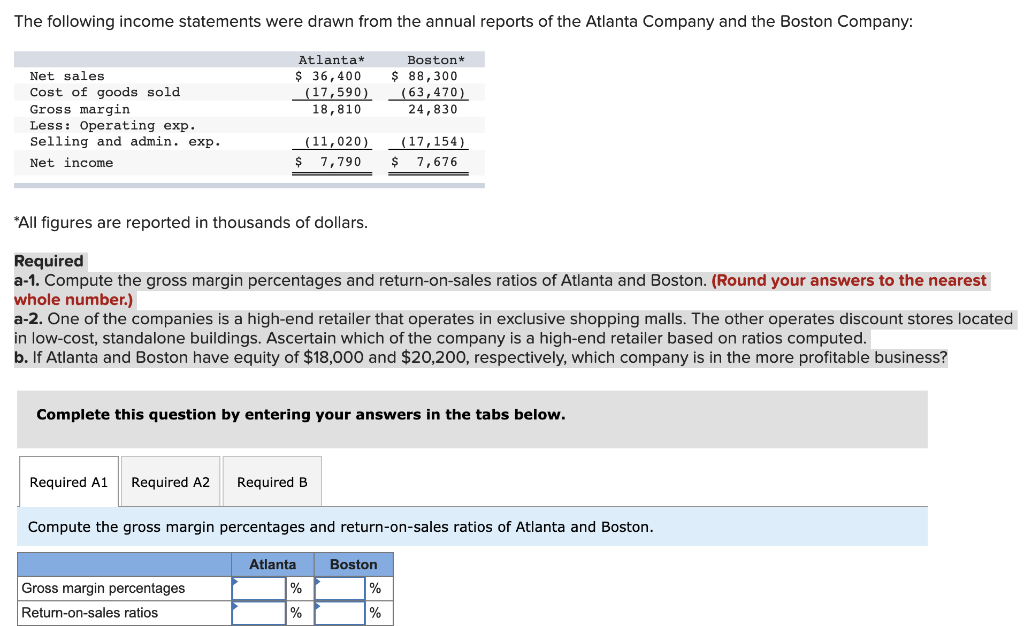

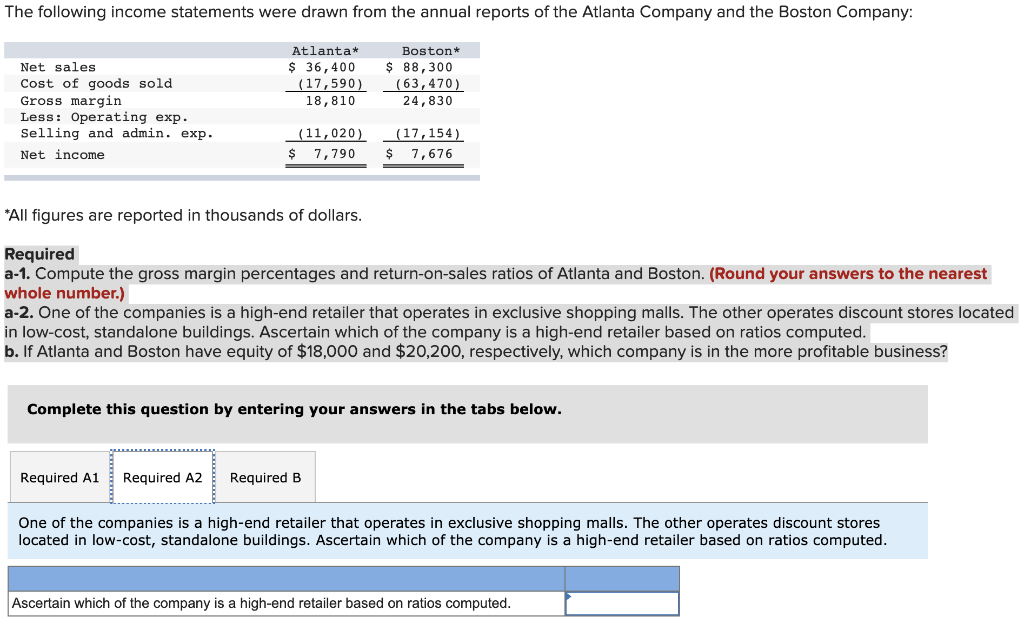

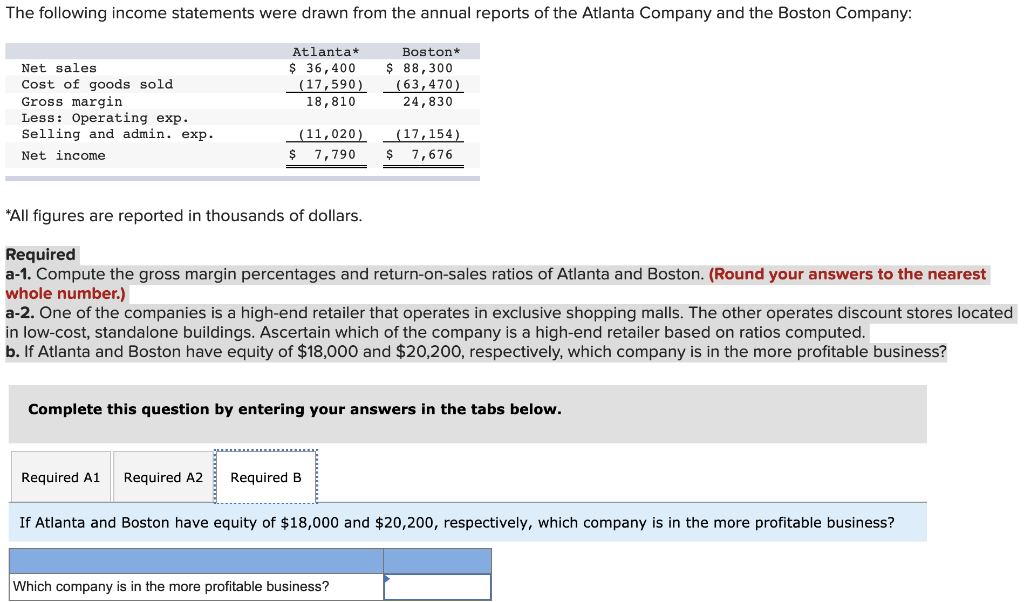

The following income statements were drawn from the annual reports of the Atlanta Company and the Boston Company: Atlanta* $ 36,400 (17,590) 18,810 Boston* $ 88,300 (63, 470) 24,830 Net sales Cost of goods sold Gross margin Less: Operating exp. Selling and admin. exp. Net income (11,020) $ 7,790 (17,154) $ 7,676 *All figures are reported in thousands of dollars. Required a-1. Compute the gross margin percentages and return-on-sales ratios of Atlanta and Boston. (Round your answers to the nearest whole number.) a-2. One of the companies is a high-end retailer that operates in exclusive shopping malls. The other operates discount stores located in low-cost, standalone buildings. Ascertain which of the company is a high-end retailer based on ratios computed. b. If Atlanta and Boston have equity of $18,000 and $20,200, respectively, which company is in the more profitable business? Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B Compute the gross margin percentages and return-on-sales ratios of Atlanta and Boston. Boston Atlanta % Gross margin percentages Return-on-sales ratios The following income statements were drawn from the annual reports of the Atlanta Company and the Boston Company: Atlanta $ 36, 400 (17,590) 18,810 Boston $ 88,300 (63,470) 24,830 Net sales Cost of goods sold Gross margin Less: Operating exp. Selling and admin. exp. Net income (11,020) $ 7,790 (17,154) $ 7,676 *All figures are reported in thousands of dollars. Required a-1. Compute the gross margin percentages and return-on-sales ratios of Atlanta and Boston. (Round your answers to the nearest whole number.) a-2. One of the companies is a high-end retailer that operates in exclusive shopping malls. The other operates discount stores located in low-cost, standalone buildings. Ascertain which of the company is a high-end retailer based on ratios computed. b. If Atlanta and Boston have equity of $18,000 and $20,200, respectively, which company is in the more profitable business? Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B One of the companies is a high-end retailer that operates in exclusive shopping malls. The other operates discount stores located in low-cost, standalone buildings. Ascertain which of the company is a high-end retailer based on ratios computed. Ascertain which of the company is a high-end retailer based on ratios computed. The following income statements were drawn from the annual reports of the Atlanta Company and the Boston Company: Atlanta* $ 36, 400 (17,590) 18,810 Boston* $ 88,300 (63,470) 2 4,830 Net sales Cost of goods sold Gross margin Less: Operating exp. Selling and admin. exp. Net income (11,020). $ 7,790 (17,154) $ 7,676 *All figures are reported in thousands of dollars. Required a-1. Compute the gross margin percentages and return-on-sales ratios of Atlanta and Boston. (Round your answers to the nearest whole number.) a-2. One of the companies is a high-end retailer that operates in exclusive shopping malls. The other operates discount stores located in low-cost, standalone buildings. Ascertain which of the company is a high-end retailer based on ratios computed. b. If Atlanta and Boston have equity of $18,000 and $20,200, respectively, which company is in the more profitable business? Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B If Atlanta and Boston have equity of $18,000 and $20,200, respectively, which company is in the more profitable business? Which company is in the more profitable business