Answered step by step

Verified Expert Solution

Question

1 Approved Answer

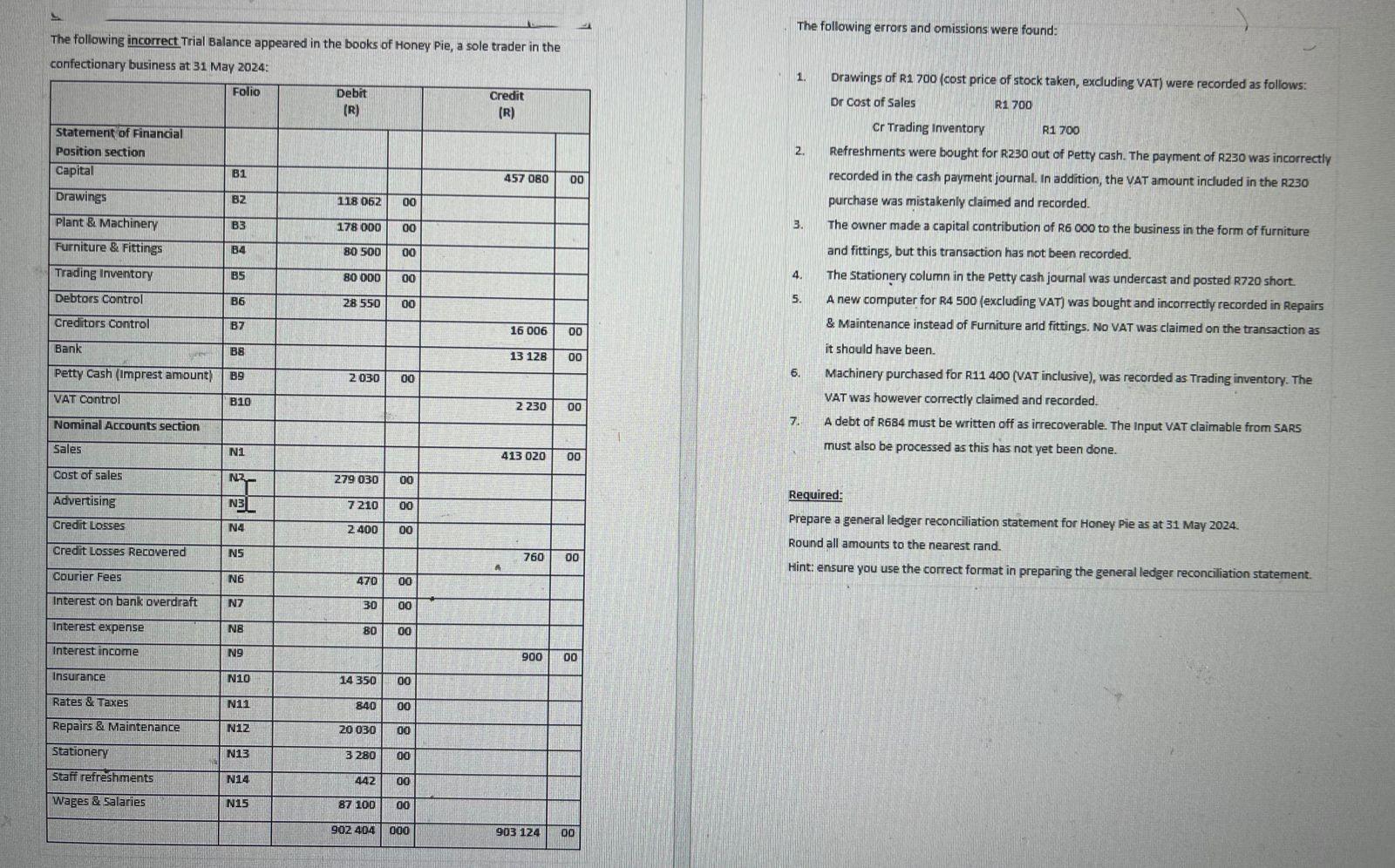

The following incorrect Trial Balance appeared in the books of Honey Pie, a sole trader in the confectionary business at 31 May 2024: 1.

The following incorrect Trial Balance appeared in the books of Honey Pie, a sole trader in the confectionary business at 31 May 2024: 1. Folio Debit (R) Credit (R) R1 700 The following errors and omissions were found: Drawings of R1 700 (cost price of stock taken, excluding VAT) were recorded as follows: Dr Cost of Sales R1 700 Statement of Financial 2. Position section Capital B1 457 080 00 Drawings B2 118 062 Plant & Machinery B3 178 000 Furniture & Fittings B4 80 500 Trading Inventory B5 80 000 Debtors Control B6 28 550 88888 Cr Trading Inventory Refreshments were bought for R230 out of Petty cash. The payment of R230 was incorrectly recorded in the cash payment journal. In addition, the VAT amount included in the R230 purchase was mistakenly claimed and recorded. 3. The owner made a capital contribution of R6 000 to the business in the form of furniture and fittings, but this transaction has not been recorded. 4. The Stationery column in the Petty cash journal was undercast and posted R720 short. 5. A new computer for R4 500 (excluding VAT) was bought and incorrectly recorded in Repairs Creditors Control B7 16 006 00 Bank B8 13 128 00 6. Petty Cash (Imprest amount) B9 2030 00 VAT Control B10 2 230 00 7. Nominal Accounts section & Maintenance instead of Furniture and fittings. No VAT was claimed on the transaction as it should have been. Machinery purchased for R11 400 (VAT inclusive), was recorded as Trading inventory. The VAT was however correctly claimed and recorded. A debt of R684 must be written off as irrecoverable. The Input VAT claimable from SARS must also be processed as this has not yet been done. Sales N1 413 020 00 Cost of sales N2 279 030 Advertising N3 7210 Credit Losses N4 2.400 888 Credit Losses Recovered N5 760 00 A Required: Prepare a general ledger reconciliation statement for Honey Pie as at 31 May 2024. Round all amounts to the nearest rand. Hint: ensure you use the correct format in preparing the general ledger reconciliation statement. Courier Fees N6 470 00 Interest on bank overdraft N7 30 00 Interest expense N8 80 00 Interest income N9 900 00 Insurance N10 14 350 00 Rates & Taxes N11 840 00 Repairs & Maintenance N1Z 20 030 00 Stationery N13 3 280 00 Staff refreshments N14 442 00 Wages & Salaries N15 87 100 00 902 404 000 903 124 00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Honey Pie General Ledger Reconciliation Statement As at 31 May 202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started