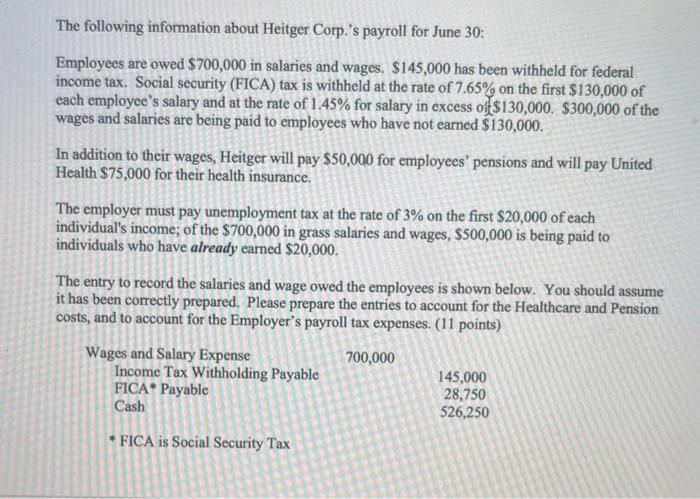

The following information about Heitger Corp.'s payroll for June 30: Employees are owed $700,000 in salaries and wages. $145,000 has been withheld for federal income tax. Social security (FICA) tax is withheld at the rate of 7.65% on the first $130,000 of each employee's salary and at the rate of 1.45% for salary in excess off$130,000. $300,000 of the wages and salaries are being paid to employees who have not earned $130,000. In addition to their wages, Heitger will pay $50,000 for employees' pensions and will pay United Health $75,000 for their health insurance. The employer must pay unemployment tax at the rate of 3% on the first $20,000 of each individual's income; of the $700,000 in grass salaries and wages, $500,000 is being paid to individuals who have already earned $20,000. The entry to record the salaries and wage owed the employees is shown below. You should assume it has been correctly prepared. Please prepare the entries to account for the Healthcare and Pension costs, and to account for the Employer's payroll tax expenses. (11 points) Wages and Salary Expense 700,000 Income Tax Withholding Payable 145,000 FICA* Payable 28,750 Cash 526,250 * FICA is Social Security Tax The following information about Heitger Corp.'s payroll for June 30: Employees are owed $700,000 in salaries and wages. $145,000 has been withheld for federal income tax. Social security (FICA) tax is withheld at the rate of 7.65% on the first $130,000 of each employee's salary and at the rate of 1.45% for salary in excess off$130,000. $300,000 of the wages and salaries are being paid to employees who have not earned $130,000. In addition to their wages, Heitger will pay $50,000 for employees' pensions and will pay United Health $75,000 for their health insurance. The employer must pay unemployment tax at the rate of 3% on the first $20,000 of each individual's income; of the $700,000 in grass salaries and wages, $500,000 is being paid to individuals who have already earned $20,000. The entry to record the salaries and wage owed the employees is shown below. You should assume it has been correctly prepared. Please prepare the entries to account for the Healthcare and Pension costs, and to account for the Employer's payroll tax expenses. (11 points) Wages and Salary Expense 700,000 Income Tax Withholding Payable 145,000 FICA* Payable 28,750 Cash 526,250 * FICA is Social Security Tax