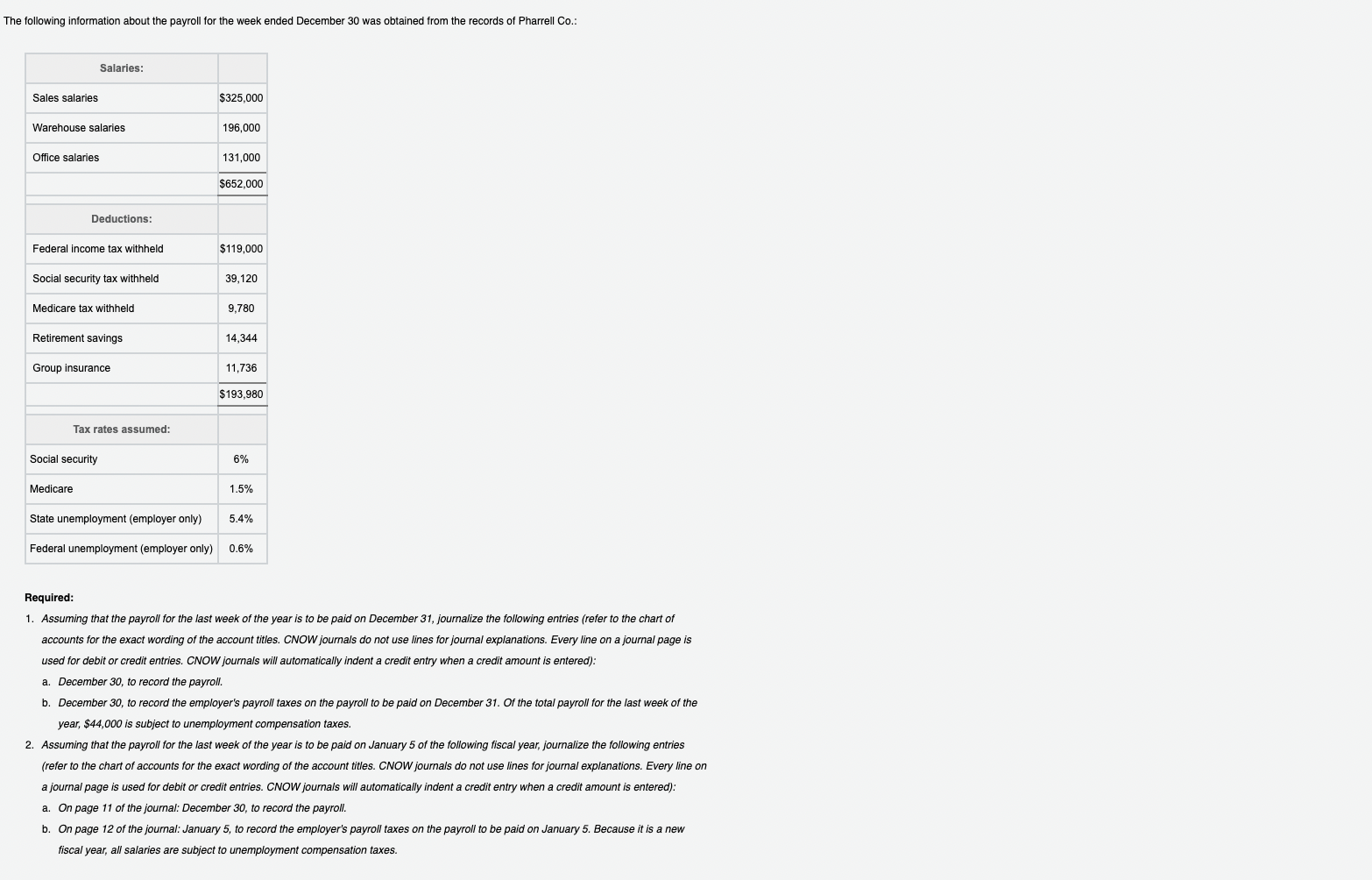

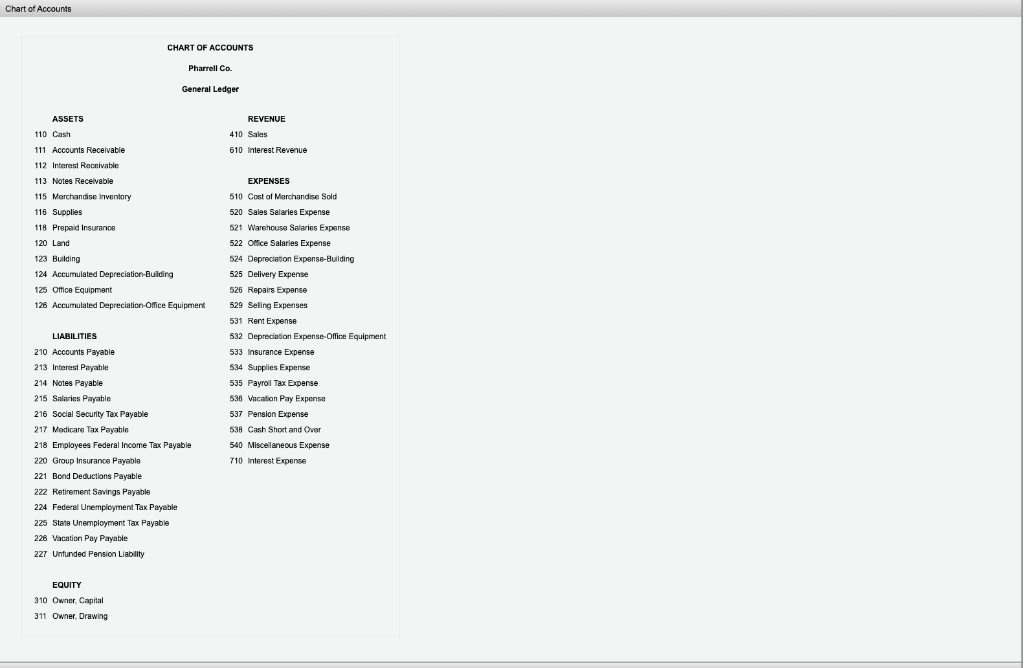

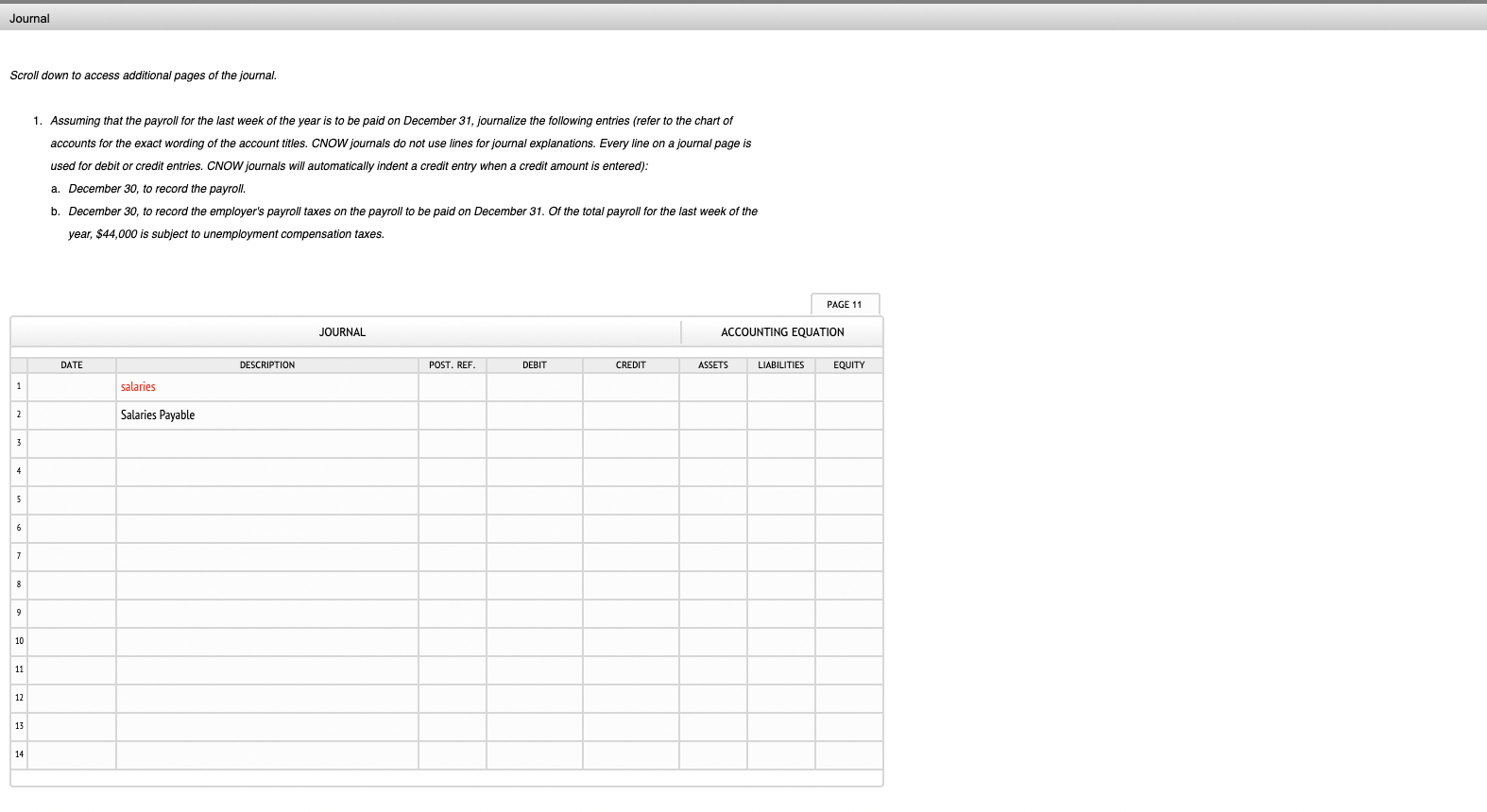

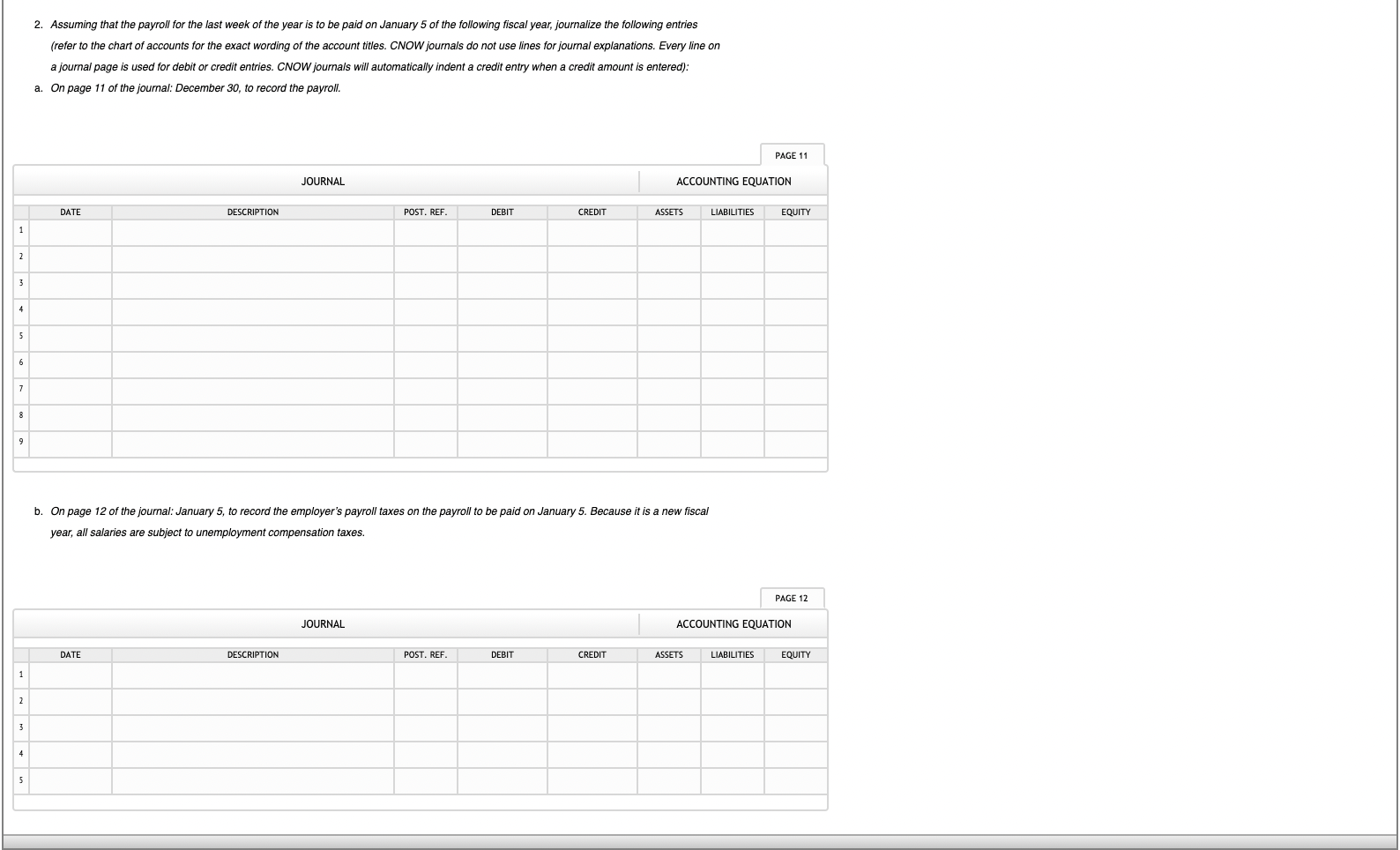

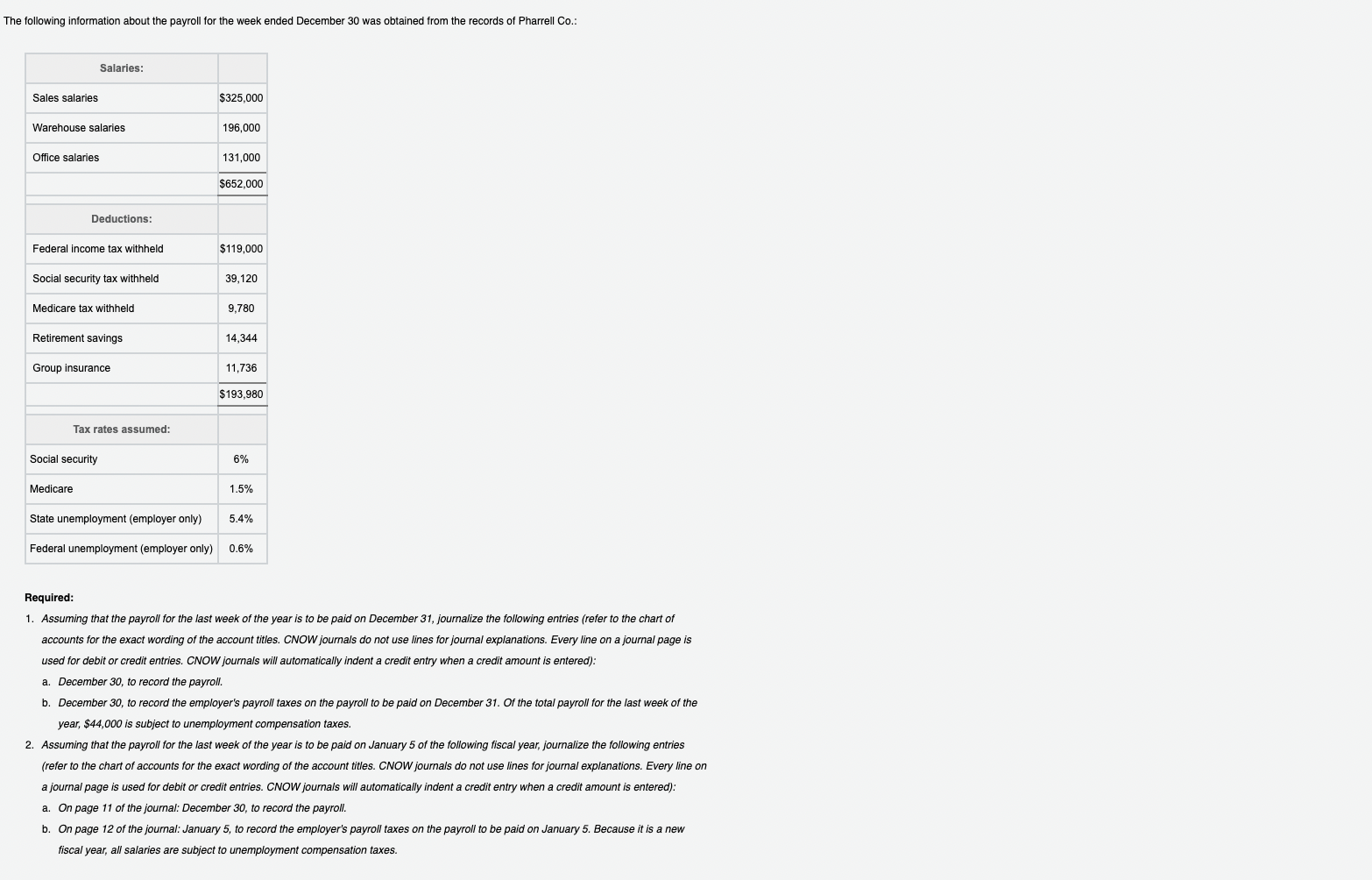

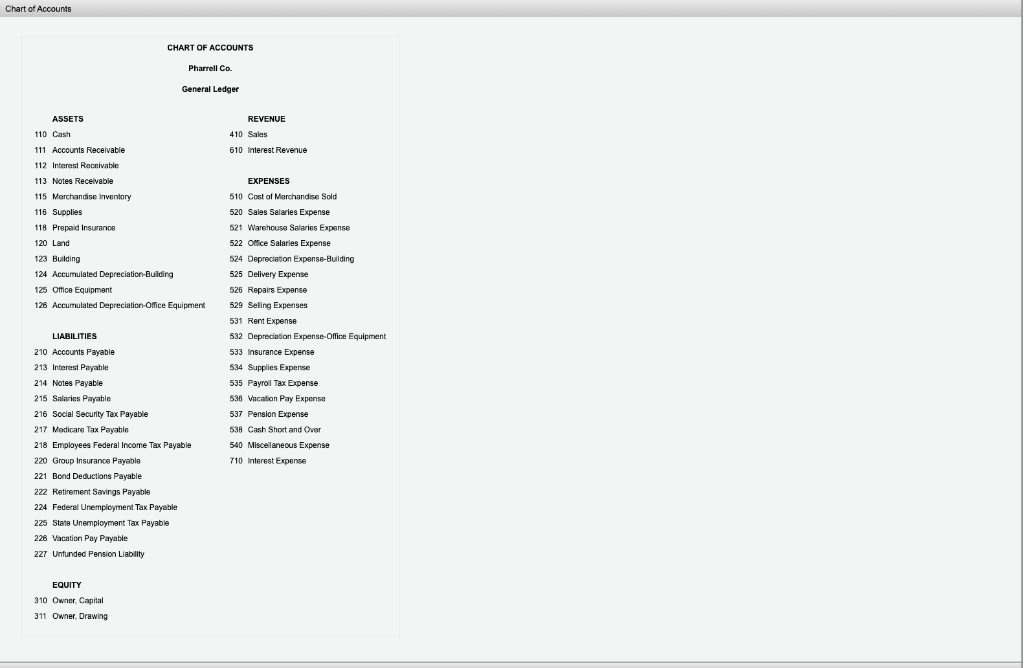

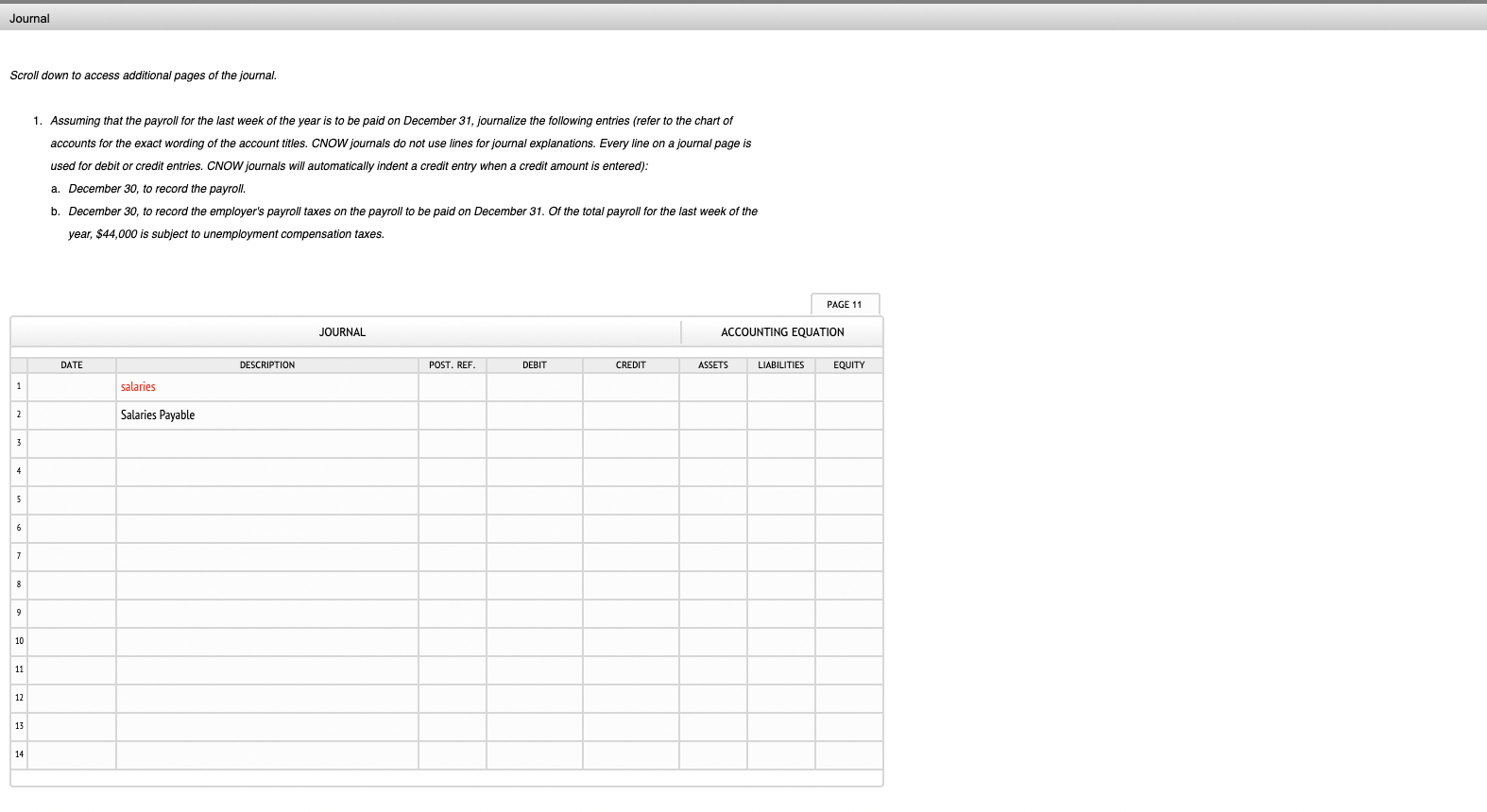

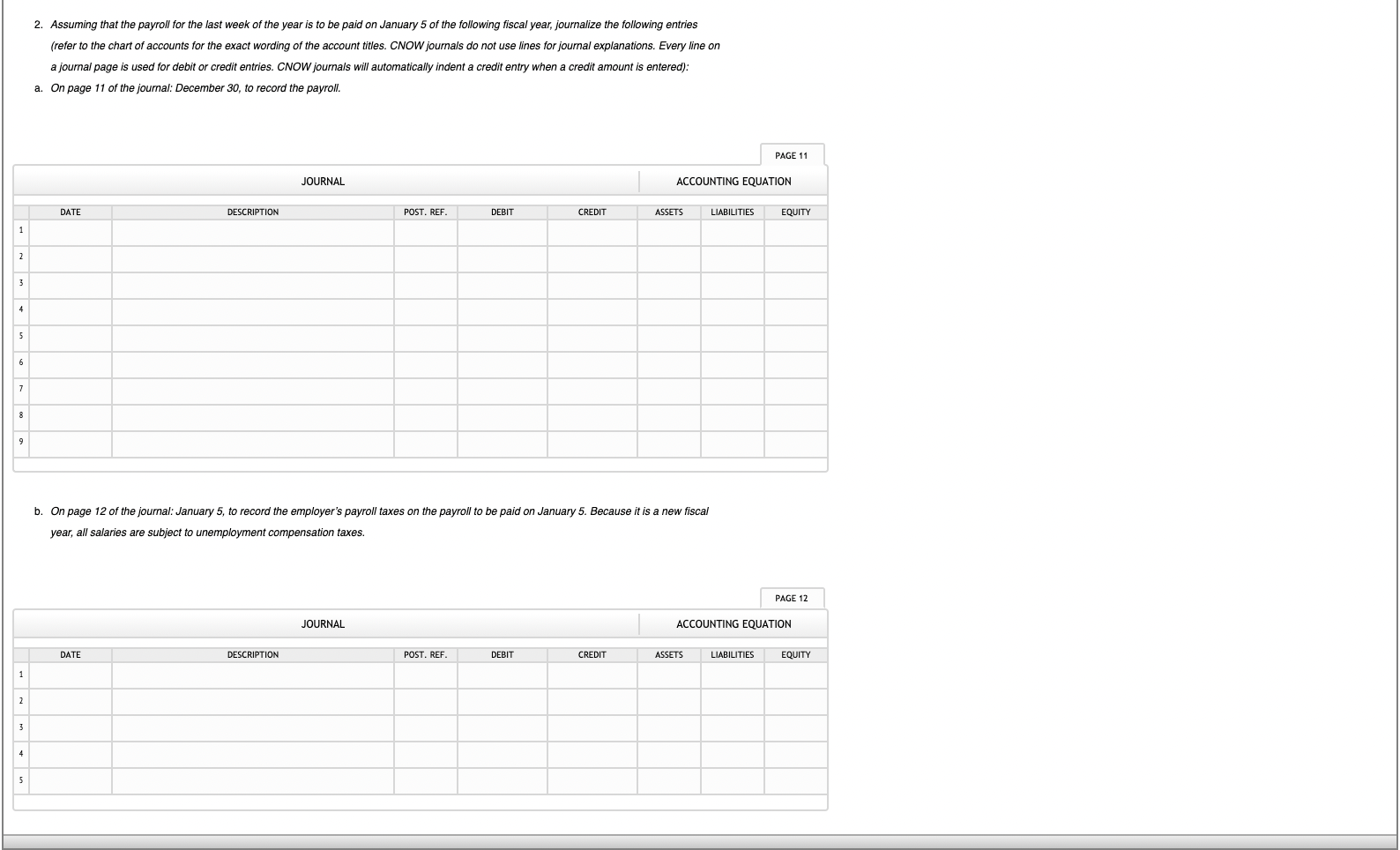

The following information about the payroll for the week ended December 30 was obtained from the records of Pharrell Co.: Salaries: Sales salaries $325,000 Warehouse salaries 196,000 Office salaries 131,000 $652,000 Deductions: Federal income tax withheld $119,000 Social security tax withheld 39,120 Medicare tax withheld 9.780 Retirement savings 14,344 Group insurance 11,736 $193,980 Tax rates assumed: Social security 6% Medicare 1.5% State unemployment (employer only) 5.4% Federal unemployment (employer only) 0.6% Required: 1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries (refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered): a. December 30, to record the payroll. b. December 30, to record the employer's payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, $44,000 is subject to unemployment compensation taxes. 2. Assuming that the payroll for the last week of the year is to be paid on January 5 of the following fiscal year, journalize the following entries to the chart of accounts for the xact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when credit amount is entered): a. On page 11 of the journal: December 30, to record the payroll. b. On page 12 of the journal: January 5, to record the employer's payroll taxes on the payroll to be paid on January 5. Because it is a new fiscal year, all salaries are subject to unemployment compensation taxes. Chart of Accounts CHART OF ACCOUNTS Pharrell Co General Ledger ASSETS REVENUE 410 Sales 610 Interest Revenue 110 Cash 111 Accounts Receivable mo 112 Interest Receivable " 113 Notes Receivable 115 Marchandise Inventory 116 Supplies 118 Prepaid Insurance 120 Land 123 Building 124 Accumulated Depreciation Building 125 Office Equipment 128 Accumulated Depreciation Office Equipment EXPENSES 510 Cost of Marchandise Sold 520 Sales Salaries Expense 521 Warehouse Salaries Expanse . 522 Office Salaries Expense 524 Depreciation Expense-Building SE 525 Delivery Expense 526 Repairs Expense 529 Seling Expenses 531 Rent Expense 532 Depreciation Expense-Office Equipment 533 Insurance Expense 534 Supplies Expense 535 Payroll Tax Expense 536 Vacation Pay Expense 537 Pension Expense 538 Cash Short and Over 540 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 213 Interest Payable 214 Notes Payable ce 215 Salaries Payable 216 Social Security Tax Payable 217 Medicare Tax Payable 218 Employees Federal Income Tax Payable 220 Group Insurance Payable 221 Bond Deductions Payable 222 Retirement Savings Payable 224 Federal Unemployment Tax Payable 225 State Unemployment Tax Payable 226 Vacation Pay Payable 227 Unfunded Pension Liability EQUITY 310 Owner, Capital 311 Owner. Drawing Journal Scroll down to access additional pages of the journal. 1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries (refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered): a. December 30, to record the payroll. b. December 30, to record the employer's payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, $44,000 is subject to unemployment compensation taxes. PAGE 11 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 salaries 2 Salaries Payable 5 7 8 9 10 11 12 13 14 2. Assuming that the payroll for the last week of the year is to be paid on January 5 of the following fiscal year, journalize the following entries (refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered): a. On page 11 of the journal: December 30, to record the payroll. PAGE 11 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 1 2 4 5 6 8 b. On page 12 of the journal: January 5, to record the employer's payroll taxes on the payroll to be paid on January 5. Because it is a new fiscal year, all salaries are subject to unemployment compensation taxes. PAGE 12 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 3 5