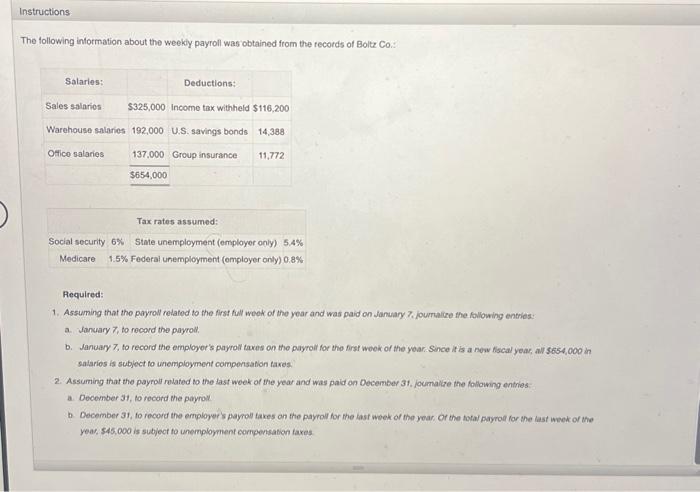

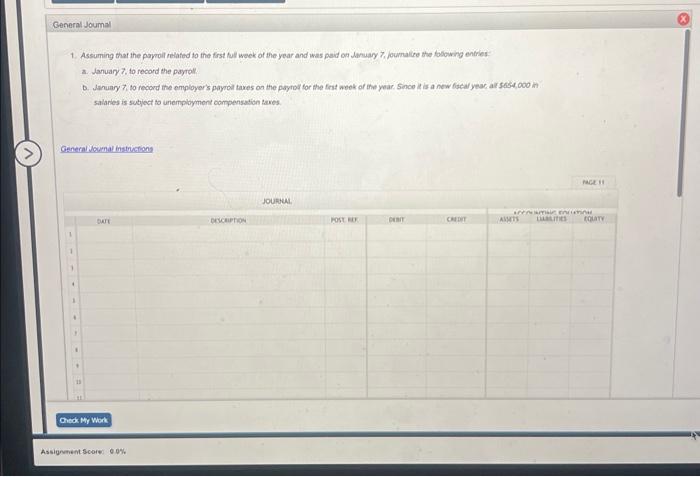

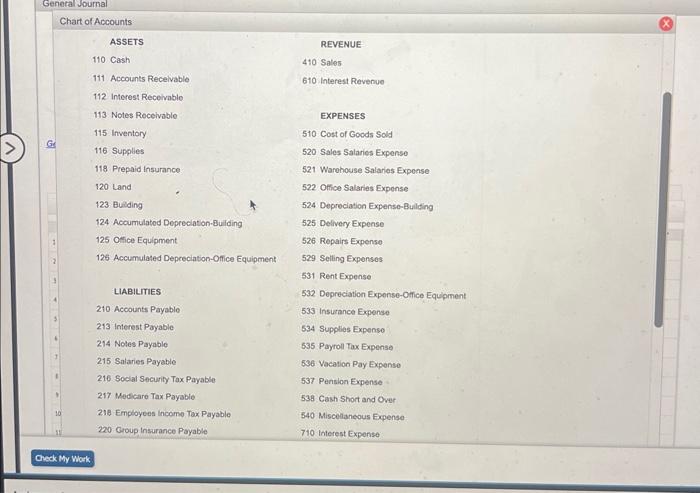

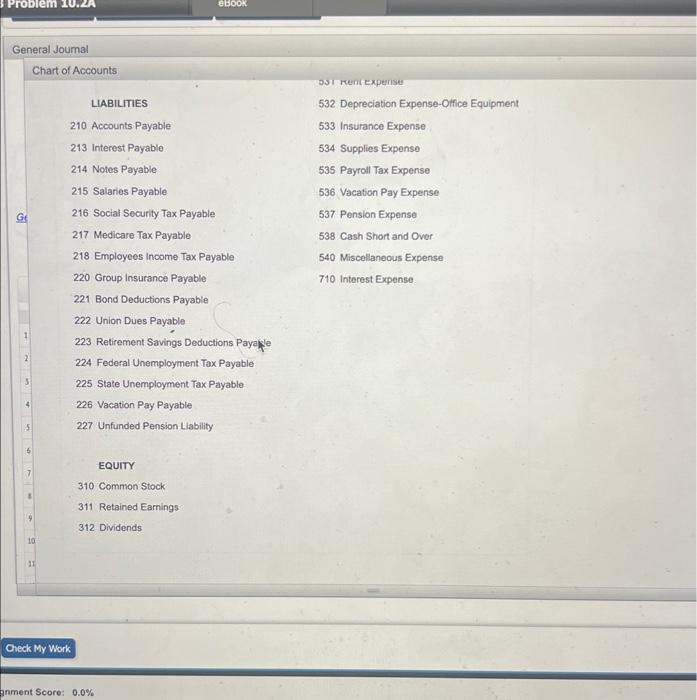

The following information about the weekly payroll was obtained from the records of Boltz Co: Required: 1. Assuming that the payroll relatod to the first full weok of the yoar and was paid on fanuary 7 . fourtalice the following entries. a. Jinuary 7 , to record the payrow. b. Januay 7, to record the employer's payroli taves on the payroil for the first woek of the yoar. Since it is a now fiscal year, all 5654,000 in salarios is subject to unemployment componsation taxes. 2. Assuming that the payroll related to the last week of the year and was paid on December 31 , foumailre the following entries a. December 31 , to rocord the payrov b. Decomber 31 , to record the emploper's payol takes on the payroll for the last week of the year. Or the total payroe for the last week of the year, 545,000 is subject to unemployment componsation taxes 3. danuary 7 , to record the paytoll salaries is subject to unemplommont oompensation Raves General sournal Chart of Accounts ASSETS 110 Cash 111 Accounts Receivablo 112 Interest Receivable 113 Notes Rocelvable 115 Inventory 116 Supplies 118 Prepaid insurance. 120 Land 123 Eulding 124 Accumulatod Depreciaton-Bulding 125 Ostice Equipment 125 Accumulated Depreciation-Ofice Equipment LIABILTIES 210 Accounts Payable 213 Interest Payable 214 Notes Payable 215 Salaries Payable 216 Soclat Securily Tax Payable 217 Medicare Tax Payable 218 Employees incomo Tax Payable 220 Group Insurance Payable REVENUE 410 Sales 610 Interest Revenue EXPENSES 510 Cost of Goods Sold 520 Sales Salaries Expense 521 Warohouse Salaries Exponse 522 Office Salaries Expense 524 Depreciation Expense-Bulding 525 Delivery Expense 526 Repairs Expense 529 Selling Expenses 531 Rent Expense 532 Depreciation Expense-Orice Equlpment 533 Insurance Expense 534 Supplies Expense 535 Payrol Tax Expense 536 Vacation Pay Expenso 537 Penslon Expense 538 Cash Short and Over 540 Miscelaneous Expense 710 interest Expense General Joumal Chart of Accounts LIABILTIES 210 Accounts Payable 213 Interest Payable 214 Notes Payable 215 Salaries Payable 216 Social Security Tax Payable 217 Medicare Tax Payable 218 Employees income Tax Payable 220 Group Insurance Payable 221 Bond Deductions Payable 222 Union Dues Payable 223 Retirement Savings Deductions Payayle 224 Federal Unemployment Tax Payable. 225 State Unemployment Tax Payable 226 Vacation Pay Payable 227 Unfunded Pension Liability EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends 51 Rentexperise 532 Depreciation Expense-Office Equipment 533 Insurance Expense 534 Supplies Expense 535 Payroil Tax Expense 536 Vacation Pay Expense 537 Pension Expense 538 Cash Short and Over 540 Miscellaneous Expense 710 Interest Expense