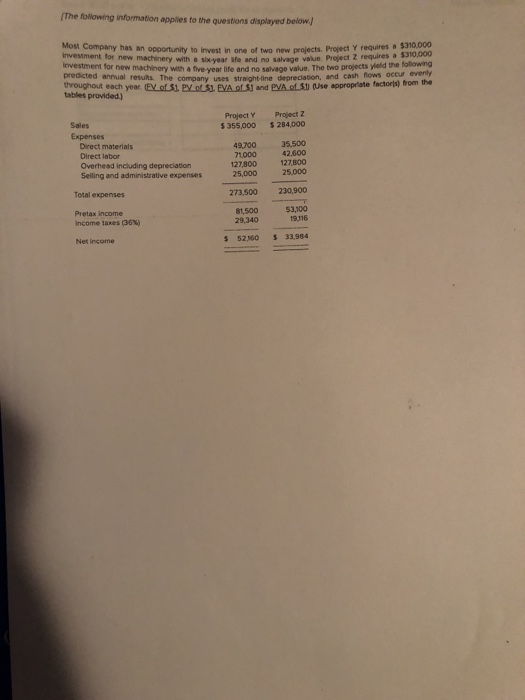

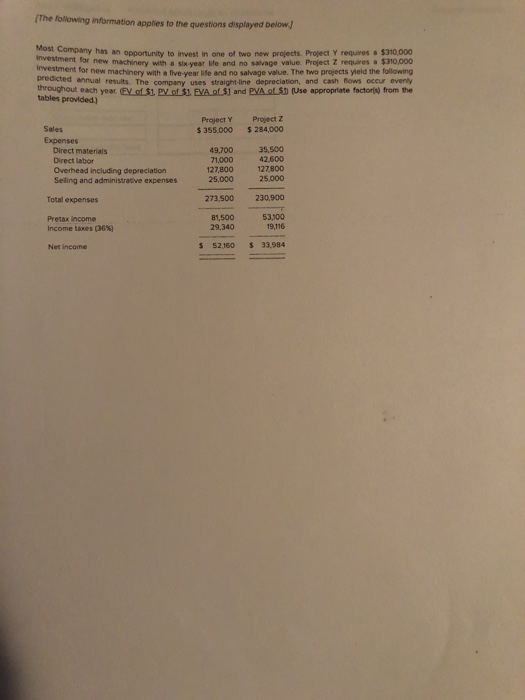

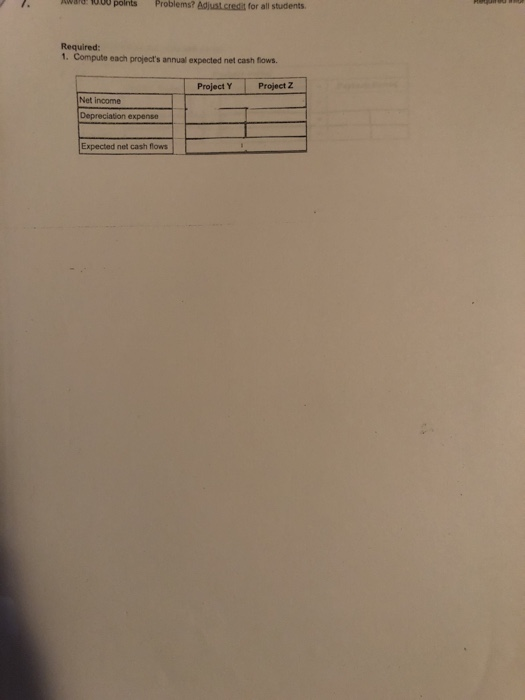

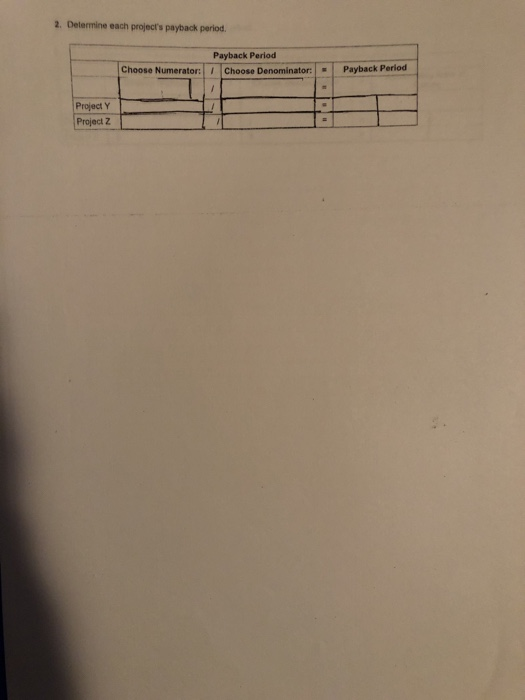

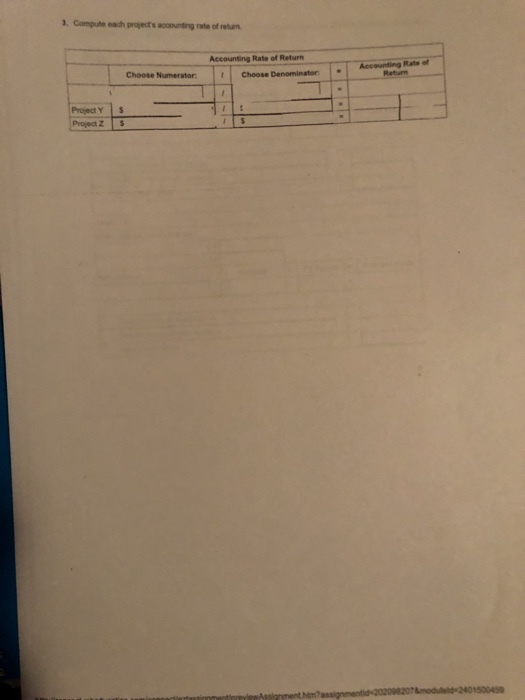

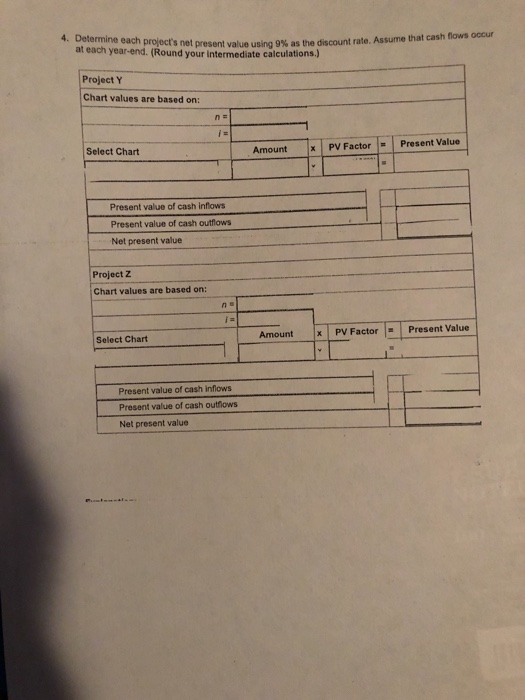

The following information appies to the questions displayed below Most Company has an opportunity to invest in one of two new projects. Project Y requires a $3100 investment for new machinery with a six-year ife $310,000 salvage value. The two projects yield the folowing company uses straight-line depreclation, and cash flows occur evenly and no salvage value. Project Z requires a new machinery with a five-year life and no salvage value. The two projects yeld predicted anrual resuts. The throughout each year EY of S1. PY o1 EVA of $1 and PVA.ot St (Use appropriate tables provided.) Project Y Project Z Sales Expenses 355,000 $ 284,000 Direct materials Direct labor Overhead including depreciatiorn 49,70035,500 42,600 71000 127,800127,800 25.000 25,000 273,500 230,900 81,500 53,00 Total expenses Pretax income Income taxes (36%) 29,340 19,116 s 52)60 $ 33,984 Net income The following information applies to the questions displayed below an opportunity to invest in one of two new projects Project Y requires$310,000 investtfo new machinery with a sixyear life and no salvage value. Project Z requires $310,000 for new machinery with a five-year life and no salvage value. The two projects yield the following annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. EY of S1. PV of $1. EVA o $1 and PVA of S1 (Use appropriate factoris) from the predicted tables provided.) Project Y $ 355,000 Project Z $ 284,000 Sales Expenses 49700 42600 Direct materials Direct labor Overhead including depreciation Seling and administrative expenses 71,00035,500 127,800 127800 25,000 25,000 Total expenses 273,500 230,900 Pretax income Income taxes 06%) 81,500 29,340 53,100 9,116 Net income s 52160 33.984 ird: 1000 polnts Problems? Adjust credit for all students Required: 1 Compute each project's annual expected net cash ftows. Project YProject Z Net income Depreciation expense Expected net cash flows 2. Delermine each project's payback period. Payback Period Choose Numerator: ! Choose Denominator: 1-1 Payback Period Project Y Project Z . Compute each projects accounting rate of relum Accounting Rate of Return Choose Numerator Project Z 4. Determine each project's net present value using 9% as the discount rate. Assume that cash flows occur at each year-end. (Round your intermediate calculations .) Project Y Chart values are based on: Select Chart Amount xPV FactorPresent Value Present value of cash inflows Present value of cash outflows Net present value Project Z Chart values are based on: Amount |x | PV Factor |= | Present Value Select Chart Present value of cash inflows Present value of cash outfiows Net present value