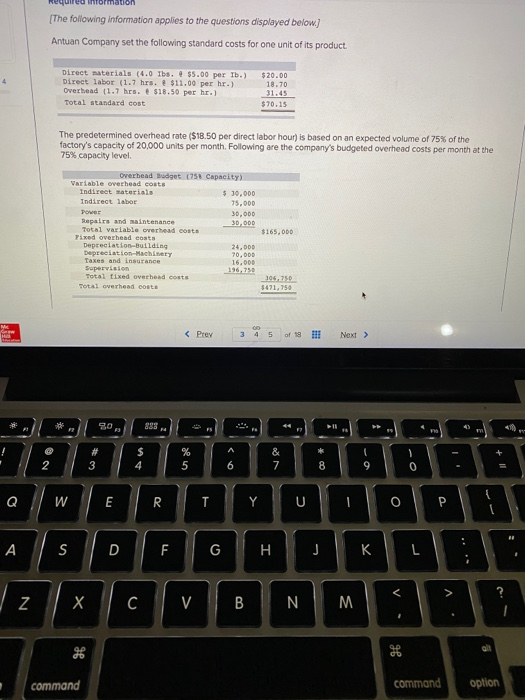

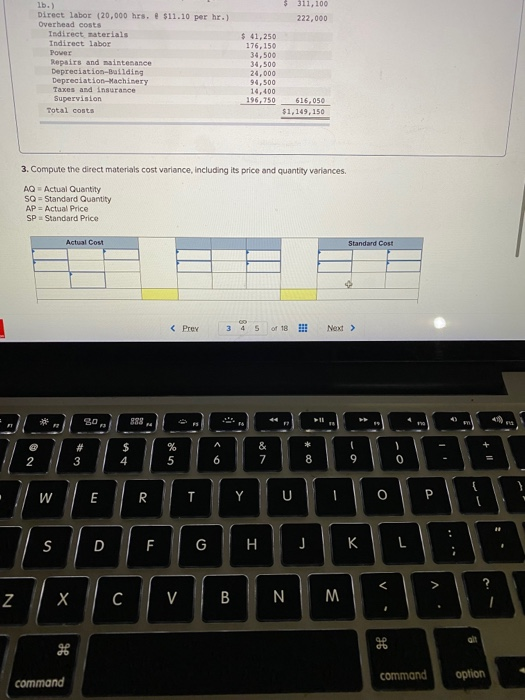

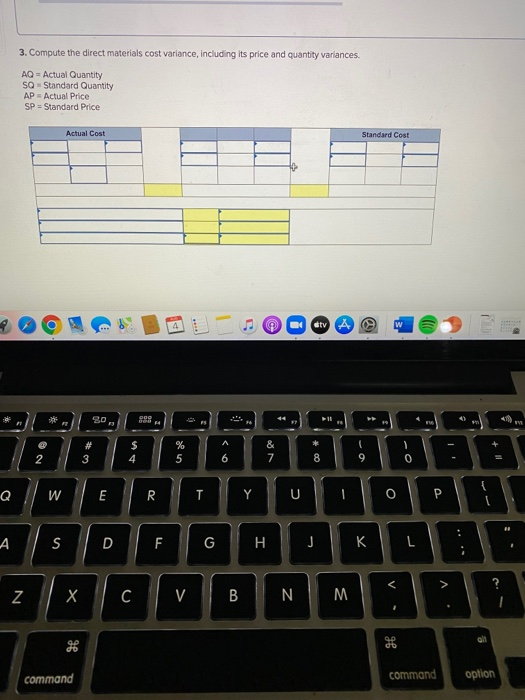

[The following information applies to the questions displayed below) Antuan Company set the following standard costs for one unit of its product. 4 Direct materials (4.0 Ibs. $5.00 per tb.) Direct labor (1.7 hrs. $11.00 per hr.) Overhead (1.7 hrs. . $18.50 per hr.) Total standard cost $20.00 18.70 31.45 $70.15 The predetermined overhead rate ($18.50 per direct labor hour) is based on an expected volume of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level Overhead Budget (758 Capacity) Variable overhead costs Indirect materials $ 30.000 Indirect labor 75,000 Power 30.0DD Repairs and maintenance 30.000 Total variable owerhead costs Fixed overhead coats Depreciation-Balding 24.000 Depreciation-Machinery 70,000 Taxes and insurance 16.000 Supervision 196.750 Total fixed over bead costs Total overhead coate $165,000 105.750 3471,750 M Saw Hill 888 1 ! * % 5 & 7 2 3 4 6 8 9 0 W E R T Y U 0 P A S D F G H J K L > V N X C V B N. M 9 Qil command command option $ 311,100 222.000 1b.) Direct labor (20,000 hrs. $11.10 per hr.) Overhead costs Indirect materials Indirect labor Power Repairs and maintenance Depreciation-Building Depreciation-Machinery Taxes and insurance Supervision Total costs $ 41,250 176,150 34,500 34,500 24,000 94,500 14,400 196,750 616.050 $1,149, 150 3. Compute the direct materials cost variance, including its price and quantity variances. AQ - Actual Quantity SO = Standard Quantity AP = Actual Price SP Standard Price Actual Cost Standard Cost 90 998 I A $ 4 % 5 00* 2 3 6 7 9 0 W o E R Y U P S DI FIG . J L K N X C V B N M CO command option command 3. Compute the direct materials cost variance, including its price and quantity variances. AQ - Actual Quantity SQ Standard Quantity AP Actual Price SP = Standard Price Actual Cost Standard Cost tv A W 30 009 os 11 1 8 $ 4 % 5 & 7 2 3 6 8 9 0 Q u W E R T Y 0 P 3 A S D F H. J K L N C V B N. M QP db command command option [The following information applies to the questions displayed below) Antuan Company set the following standard costs for one unit of its product. 4 Direct materials (4.0 Ibs. $5.00 per tb.) Direct labor (1.7 hrs. $11.00 per hr.) Overhead (1.7 hrs. . $18.50 per hr.) Total standard cost $20.00 18.70 31.45 $70.15 The predetermined overhead rate ($18.50 per direct labor hour) is based on an expected volume of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level Overhead Budget (758 Capacity) Variable overhead costs Indirect materials $ 30.000 Indirect labor 75,000 Power 30.0DD Repairs and maintenance 30.000 Total variable owerhead costs Fixed overhead coats Depreciation-Balding 24.000 Depreciation-Machinery 70,000 Taxes and insurance 16.000 Supervision 196.750 Total fixed over bead costs Total overhead coate $165,000 105.750 3471,750 M Saw Hill 888 1 ! * % 5 & 7 2 3 4 6 8 9 0 W E R T Y U 0 P A S D F G H J K L > V N X C V B N. M 9 Qil command command option $ 311,100 222.000 1b.) Direct labor (20,000 hrs. $11.10 per hr.) Overhead costs Indirect materials Indirect labor Power Repairs and maintenance Depreciation-Building Depreciation-Machinery Taxes and insurance Supervision Total costs $ 41,250 176,150 34,500 34,500 24,000 94,500 14,400 196,750 616.050 $1,149, 150 3. Compute the direct materials cost variance, including its price and quantity variances. AQ - Actual Quantity SO = Standard Quantity AP = Actual Price SP Standard Price Actual Cost Standard Cost 90 998 I A $ 4 % 5 00* 2 3 6 7 9 0 W o E R Y U P S DI FIG . J L K N X C V B N M CO command option command 3. Compute the direct materials cost variance, including its price and quantity variances. AQ - Actual Quantity SQ Standard Quantity AP Actual Price SP = Standard Price Actual Cost Standard Cost tv A W 30 009 os 11 1 8 $ 4 % 5 & 7 2 3 6 8 9 0 Q u W E R T Y 0 P 3 A S D F H. J K L N C V B N. M QP db command command option