Answered step by step

Verified Expert Solution

Question

1 Approved Answer

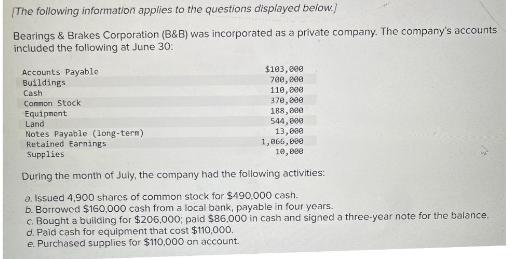

[The following information applies to the questions displayed below.) Bearings & Brakes Corporation (B&B) was incorporated as a private company. The company's accounts included

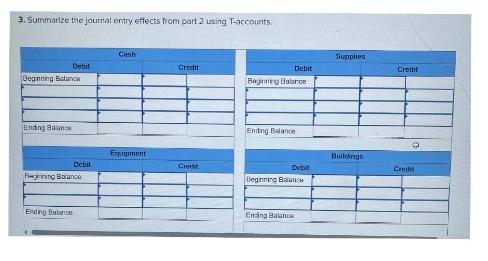

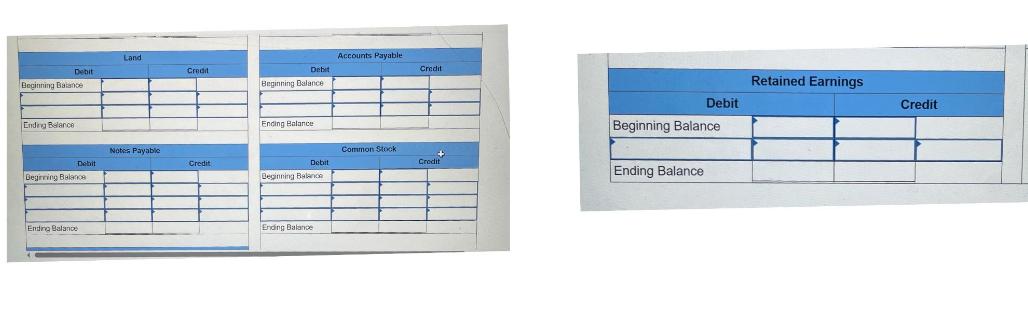

[The following information applies to the questions displayed below.) Bearings & Brakes Corporation (B&B) was incorporated as a private company. The company's accounts included the following at June 30: Accounts Payable Buildings Cash Common Stock Equipment. Land Notes Payable (long-term) Retained Earnings Supplies $103,000 700,000 110,000 370,000 d. Paid cash for equipment that cost $110,000. e. Purchased supplies for $110,000 on account. 188,000 544,000 13,000 1,066,000 10,000 During the month of July, the company had the following activities: a. Issued 4,900 shares of common stock for $490.000 cash. b. Borrowed $160,000 cash from a local bank, payable in four years. c. Bought a building for $206,000; paid $86,000 in cash and signed a three-year note for the balance. 3. Summarize the journal entry effects from part 2 using T-accounts. Debit Beginning Balance Ending Balance Debit Reginning Balance Ending Balance Cash Equipment Credit Credit Debit Beginning Balance Ending Balance Ending Balanc Debit Beginning Balance Supplies Buildings Credit Credit Debit Beginning Balance Ending Balance Debit Beginning Balance Ending Balance Land Notes Payable Credit Credit Debit Beginning Balance Ending Balance Debit Beginning Balance Ending Balance Accounts Payable Common Stock Credit Credit Debit Beginning Balance Ending Balance Retained Earnings Credit

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The images provided contain pieces of accounting information and the task is to summarize the journal entry effects on Taccounts based on the activiti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started