Question

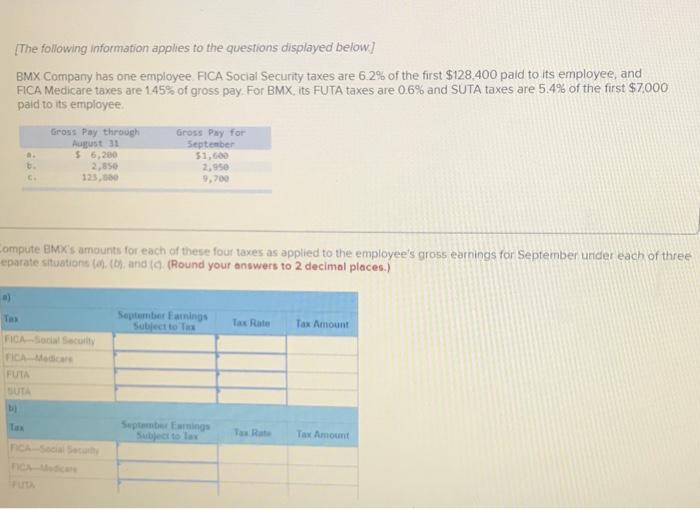

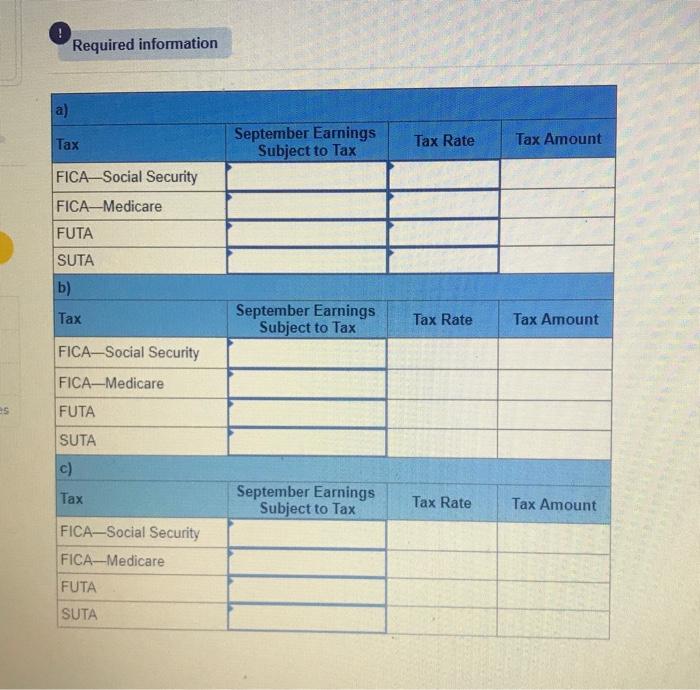

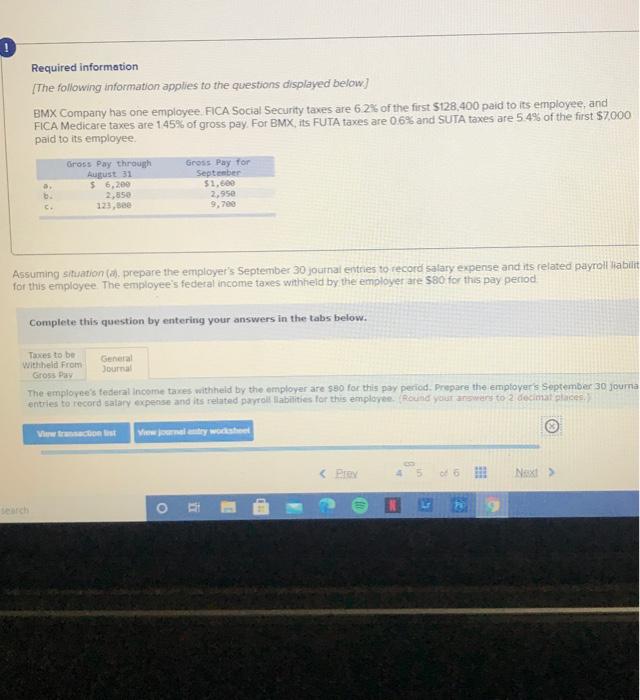

[The following information applies to the questions displayed below) BMX Company has one employee FICA Social Security taxes are 6.2% of the first $128.400 paid

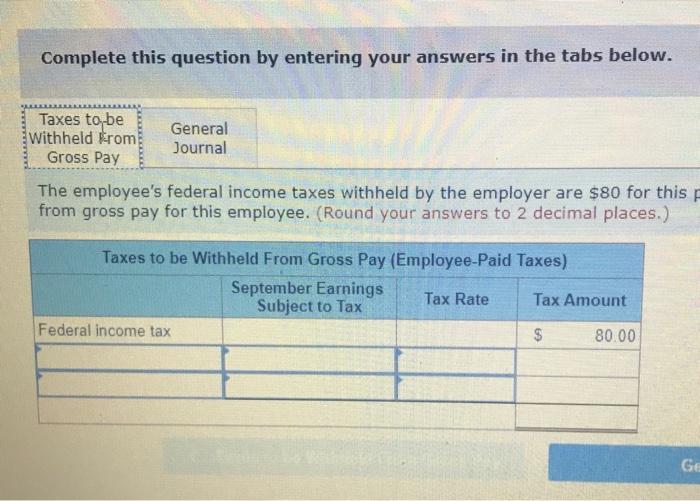

e Complete this question by entering your answers in the tabs below. Taxes to be withheld from Gross Pay General Journal The employee's federal income taxes withheld by the employer are $80 for this from gross pay for this employee. (Round your answers to 2 decimal places.) Taxes to be Withheld From Gross Pay (Employee-Paid Taxes) September Earnings Tax Rate Tax Amount Subject to Tax Federal income tax $ 80.00 Ge 5 + ion.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fblackboard.louisvil Saved U RIU Required information entries to record salary expense and its related payroll liabilities for this employee. (Round your answers to 2 de View transaction list View journal entry worksheet No Date General Journal Debit Credit e Complete this question by entering your answers in the tabs below. Taxes to be withheld from Gross Pay General Journal The employee's federal income taxes withheld by the employer are $80 for this from gross pay for this employee. (Round your answers to 2 decimal places.) Taxes to be Withheld From Gross Pay (Employee-Paid Taxes) September Earnings Tax Rate Tax Amount Subject to Tax Federal income tax $ 80.00 Ge 5 + ion.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fblackboard.louisvil Saved U RIU Required information entries to record salary expense and its related payroll liabilities for this employee. (Round your answers to 2 de View transaction list View journal entry worksheet No Date General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started